We are in the business of educating our clients on the importance of retirement planning. But research has shown that a one-size-fits-all approach to communication isn’t the most effective tactic. And while it’s impossible to customise messages person by person, it turns out that it’s quite easy to customise them by one big factor: gender. It’s widely accepted that there are differing preferences in communication styles and learning techniques between most men and most women. The question is: How can you adjust your message in a way that’s enlightening, not alienating for your female participants?

The risks of not being prepared

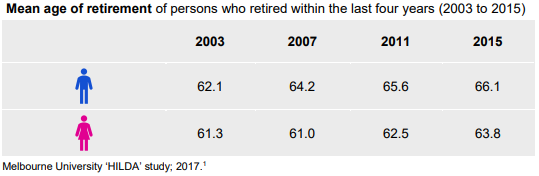

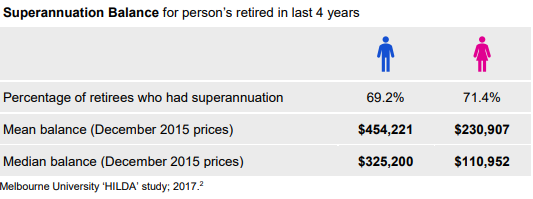

Before I answer that question, I want to reinforce why this topic is so important. Women have longer average lifespans than men, and retire earlier, with much less Superannuation than men, yet tend to underestimate how much they need to save for retirement.

Avoiding labels

At this point, you may be thinking that I’m going to suggest a series of women-branded workshops or educational flyers stamped in pink.

But I’m not.

When Invesco Consulting began the process of creating a workshop for women, we tested numerous options for titles with specific references to women, and one of the first things we heard from women is that they do not want to be singled out by their gender. In fact, any title that included a gender reference — such as “What Women Know About Money” or “The Female Financial Advantage” — consistently scored in the bottom 20% of engagement.

Why? Because women often view these approaches as carrying a subtle suggestion of inferiority, as if the “women’s version” was created for those who don’t qualify for the regular workshop. We found that a better approach is to create educational workshops and materials with the preferences of women in mind, but which doesn’t highlight them as “special” or “different.” In other words, simply work to meet the needs of your women participants — without labeling them.

Three key principles

This is the approach Invesco Consulting took when creating our investor education workshop “Your Prosperity Picture” (notice the lack of women-specific labels in the title). We found that there are three key principles that resonate with many women investors, and we incorporated these in our program:

Principle 1: Provide experience before explanation

Principle 2: Align life goals with financial goals

Principle 3: Be positive

Principle 1: Provide experience before explanation.

According to the Public Administration & Policy – APAC Journal, 3 women tend to be “Relational Learners” while men are usually more “Independent Learners.” We found that beginning a workshop with an interactive activity (instead of just launching into a presentation) can be a great way to tap into that learning preference for many women. But what kind of activity? In a column I wrote — “What will retirement look like?” — I discussed the power of visualisation exercises. Science has shown that if you visualise a particular goal that requires financial resources, such as traveling or pursing a hobby, it helps condition the brain to look for information and resources that might help in achieving that goal. Walking investors through a visualisation exercise that focuses on their goals can be a great way to begin a financial workshop.

Principle 2: Align life goals with financial goals.

One study has shown that women who feel their financial advisors have successfully helped them align their investment goals with their life goals are 41% more likely to be satisfied. In “Your Prosperity Picture” workshops, we do this by walking investors through the process of creating a visual financial plan that illustrates their short-term and long-term goals, and organises them by the amount of financial resources that will be necessary to make those goals happen.

Once investors are talking and thinking about their vision for their retirement, the next logical step is to connect that vision with your retirement plan benefits. You’ve set the stage to talk about practical strategies geared toward making their goals happen.

Principle 3: Be positive.

I started this column with some sobering statistics about women’s retirement age and retirement superannuation balance. I did that to set the stage for you, the Financial Advisor, but I would not include these in an investor workshop. Our research has clearly shown that negative spin doesn’t sit well with most women investors, and trying to scare them into action can backfire. In fact, the principle of being positive is so powerful that it transcends gender. It’s proven to be one of the most important and consistent language trends that Invesco Consulting has seen since we began doing our language research in 2009.

What does this mean for Financial Advisors? Rather than focusing on the possibility of negative outcomes and how to avoid them, focus on achieving what’s possible. Position your retirement plan as a way to help investors reach their goals, rather than taking a gloom-and-doom approach.

Bottom line

In general, women and men have different learning styles and communication preferences, but women don’t want to be singled out. A workshop designed for these needs won’t include “women” in the title, but will follow three key principles: providing experience before explanation, aligning life goals with financial goals, and maintaining a positive message.

Important information

This document has been prepared by Invesco Australia Ltd (Invesco) ABN 48 001 693 232, Australian Financial Services Licence number 239916, who can be contacted on freecall 1800 813 500, by email to info@au.invesco.com, or by writing to GPO Box 231, Melbourne, Victoria, 3001. You can also visit our website at www.invesco.com.au

This document contains general information only and does not take into account your individual objectives, taxation position, financial situation or needs. You should assess whether the information is appropriate for you

and consider obtaining independent taxation, legal, financial or other professional advice before making an investment decision. A Product Disclosure Statement (PDS) for any Invesco fund referred to in this document is available from Invesco. You should read the PDS and consider whether a fund is appropriate for you before making a decision to invest.

Invesco is authorised under its licence to provide financial product advice, deal in financial products and operate registered managed investment schemes. If you invest in an Invesco Fund, Invesco may receive fees in relation

to that investment. Details are in the PDS. Invesco’s employees and directors do not receive commissions but are remunerated on a salary basis. Neither Invesco nor any related corporation has any relationship with other product issuers that could influence us in providing the information contained in this document.

Investments in the Invesco funds are subject to investment risks including possible delays in repayment and loss of income and principal invested. Neither Invesco nor any other member of the Invesco Ltd Group guarantee the return of capital, distribution of income, or the performance of any of the Funds. Any investments in the Funds do not represent deposits in, or other liabilities of, any other member of the Invesco Ltd Group.

Invesco has taken all due care in the preparation of this document. To the maximum extent permitted by law, Invesco, its related bodies corporate, directors or employees are not liable and take no responsibility for the accuracy or completeness of this document and disclaim all liability for any loss or damage of any kind (whether foreseeable or not) that may arise from any person acting on any statements contained in this document. This document has been prepared only for those persons to whom Invesco has provided it. It should not be relied upon by anyone else.

©Copyright of this document is owned by Invesco. You may only reproduce, circulate and use this document (or any part of it) with the consent of Invesco.