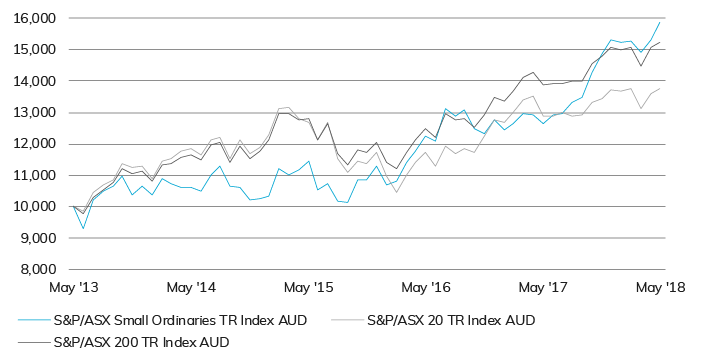

Australia’s small cap shares have continued their extraordinary run of outperformance, returning 4.1% over the past three months to May, and an incredible 25.4% over the past year. Meanwhile, in a tale of two markets, Australia’s largest shares have proved the laggards, with structural headwinds, regulatory risks, and declining public trust dragging the top of the market down.

Small cap shares have continued to present significant opportunities through 2018, with themes such as technological disruption, Chinese demand, and the commodity rally all driving valuations higher. The beneficiaries have been previously ‘beaten-up’ mining services stalwarts such as Monadelphous (MND) and NRW Holdings (NWH), as well as consumer staple market darlings like organic infant formula producer Bellamy’s (BAL).

Small versus large cap performance over five years to 31 May 2018

Source: Lonsec, Bloomberg

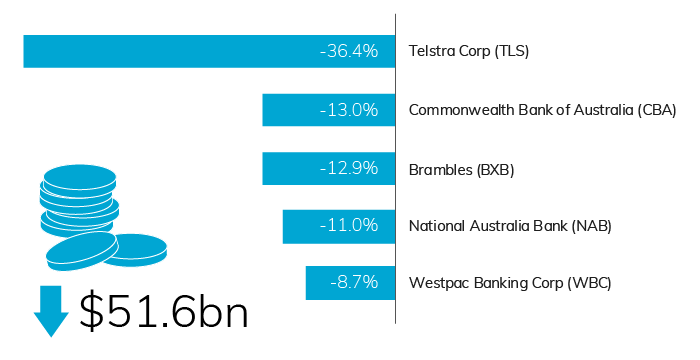

The S&P/ASX 20, which encompasses Australia’s top 20 biggest stocks by market cap, is underperforming the broader market, returning 6.9% over the past year, compared to 9.6% for the ASX 200. In particular, recent poor performance from the banks, as well as problem stocks like Telstra (TLS), Brambles (BXB), and AMP (AMP) have all been a drag. The sheer size of these stocks has had a big impact on the market, with the five worst performing stocks within the top 20 wiping $51.6 billion from the S&P/ASX 200 Index over the past year.

Australia’s biggest losers (% return over year to 31 May 2018)

Source: Lonsec, Bloomberg

In terms of Australia’s major banks, Lonsec currently views valuation support at ‘fair value’, while earnings are likely to exhibit low growth at best, due to weaker consumer sentiment and the increased regulatory risk in the wake of the Royal Commission into Financial Services. However, despite the recent pain, it is possible the worst may be over for now, and investors will be looking for long-term value opportunities among the big four.

Release ends

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2018 Lonsec Research Pty Ltd, ABN 11 151 658 561 AFSL 421 445. All rights reserved. Read our Privacy Policy here.