Exchange Traded Funds (ETFs) have become a popular way for investors to gain exposure not only to passive indices but to a range of market factors.

Smart beta ETFs, which follow rule-based strategies to provide factor exposure, are increasingly recommended by financial advisers because they provide a relatively cheap and effective way of meeting specific investment objectives or creating greater diversification.

But while the smart beta concept might seem easily commoditised, there can be significant differences in investment outcomes even among those investment products that appear to offer something very similar.

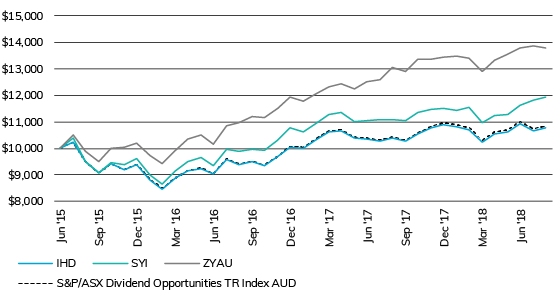

For example, the below chart shows the performance of three well-known dividend-focused ETFs, each of which seeks to generate above market income. Over the past three years, these ETFs have exhibited markedly different performance despite sharing the same income objective.

Growth of $10,000 over three years

Source: Lonsec

IHD: iShares S&P/ASX Dividend Opportunities ETF

SYI: SPDR MSCI Australia Select High Dividend Yield Fund

ZYAU: ETFS S&P/ASX 300 High Yield Plus ETF

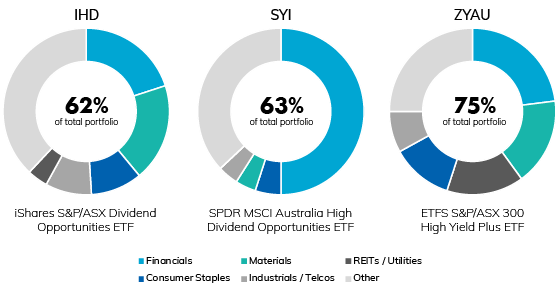

In order to understand these diverging results, investors need to get under the hood to see how individual ETFs determine their index construction rules. Differences in how fund managers determine things like the quality, liquidity, and weights of certain stocks can result in funds with very different allocations. The chart below shows the sector breakdown of each fund’s top 10 stock holdings, revealing very different compositions.

Top 10 holdings—sector breakdown

Source: Lonsec

IHD and ZYAU holdings as at 15 August 2018. SYI holding as at 31 July 2018

Both the ETFS and iShares products have similar exposure to Financials and Materials, but the ETFS fund has a greater allocation to defensive REITs and Utilities, while the iShares fund has diversified more across other sectors. Its top 10 holdings represent only 62% of its total portfolio value, compared to 75% for the ETFS fund. Meanwhile, the SPDR fund’s top 10 holdings are dominated by Financials, with smaller allocations across Consumer Staples and Materials, and no exposure to REITs or Utilities.

What this means is that financial advisers need to do more than simply ‘read the packet’ when selecting investment products. Financial advisers should have a thorough understanding of how individual smart beta products operate to ensure they deliver outcomes in line with their clients’ investment objectives.