For some time, we have flagged that volatility in markets has been subdued, underpinned by a wave of liquidity being pumped into global economies by central banks in the form of Quantitative Easing (QE). We have seen bond yields trade at historic lows and the subsequent low interest rate environment has led to increasing debt levels among both corporates and households.

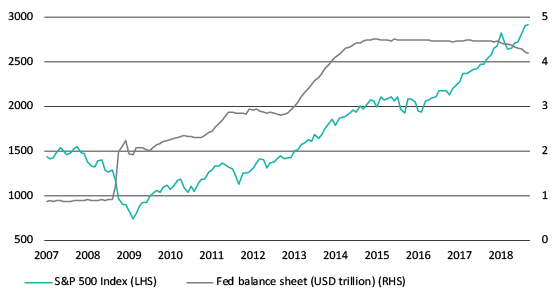

With central banks unwinding their QE programs and interest rates in the US going up, from an equities perspective the focus will increasingly be on future earnings growth, which to date has been trading above nominal GDP, partly due to low wage growth. The unwinding of the Fed’s balance sheet—which began around a year ago—has been a catalyst for rising yields, as has the prospect of growth with inflation.

US equity market performance and size of Fed balance sheet

Source: Lonsec, Bloomberg

An important factor recently has been uncertainty regarding the so-called ‘neutral’ Fed funds rate. The FOMC has for some time suggested that the neutral rate—meaning the rate that is consistent with full employment and inflation at target—would rise to around 2.9% over coming years. Markets had also implicitly priced in a peak of around 2.9% for the Fed funds rate by mid-2019.

However, Fed Chair Jay Powell surprised markets by commenting that there would be less emphasis on the neutral rate going forward, given that the funds rate is likely converging on the neutral level and that the actual neutral rate cannot be calculated with a high degree of accuracy. New York Fed President John Williams—considered the expert on the neutral policy concept and its measurement—noted that, going forward, the Fed would determine proximity to the neutral rate by observing changes in growth and inflation data. Sensible enough, but hardly the kind of solid forward guidance that markets have become accustomed to.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2018 Lonsec Research Pty Ltd, ABN 11 151 658 561 AFSL 421 445. All rights reserved. Read our Privacy Policy here.