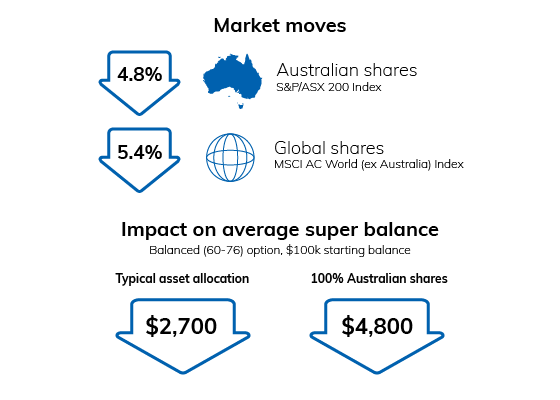

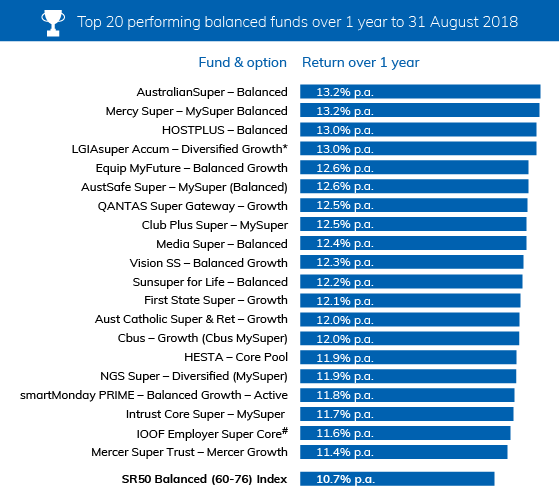

Australia’s superannuation funds have faced their first test of the financial year, with a major market selloff in October likely to put a dent in account balances. According to preliminary estimates from SuperRatings, over the period 28 September to 11 October, a typical balanced option account with a $100,000 balance will have lost $2,700. For members with pure Australian share exposure, this amount rises to $4,800.

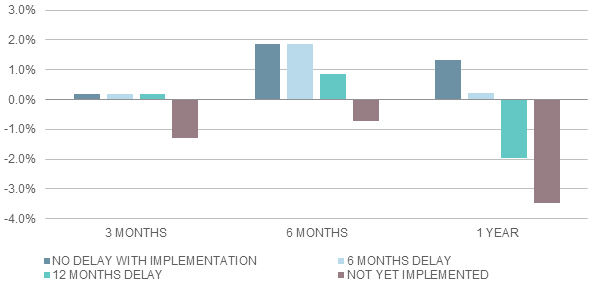

Impact of fall in share price index over the period 28 September to 11 October 2018

Source: SuperRatings, FE

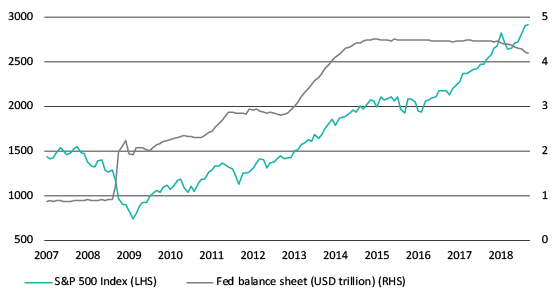

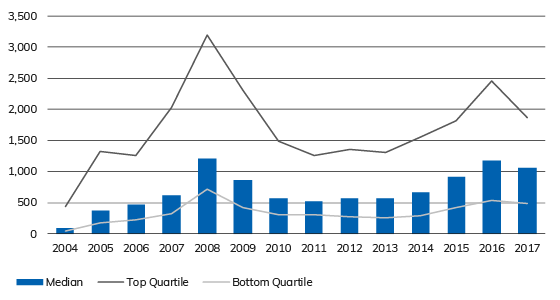

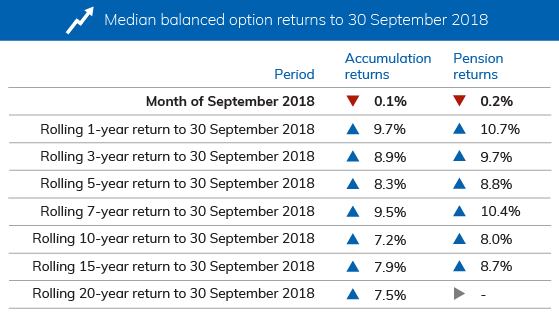

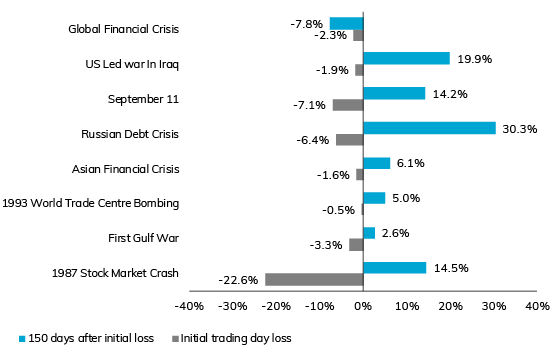

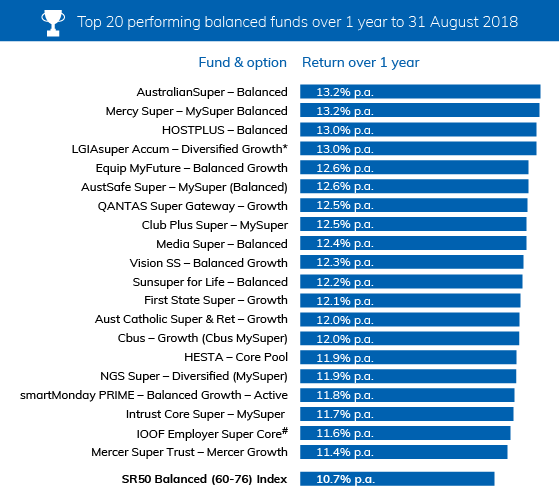

October’s market jitters come on the back of lacklustre returns in the previous month, which saw super fund performance flat to slightly negative. According to SuperRatings, the median balanced option returned -0.1% in September as Australian shares came under pressure. However, while super funds may have taken a hit through the month, the data shows that superannuation has held up well over the past year, with the median balanced option delivering 9.7%.

Interim results only. Median Balanced Option refers to ‘Balanced’ options with exposure to growth style assets of between 60% and 76%. Approximately 60% to 70% of Australians in our major funds are invested in their fund’s default investment option, which in most cases is the balanced investment option. Returns are net of investment fees, tax and implicit asset-based administration fees

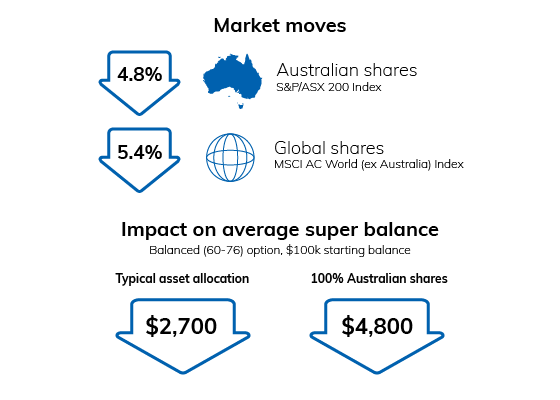

“The market pullback is another timely reminder to members that good times should not be taken for granted,” said SuperRatings Executive Director Kirby Rappell. “We do not believe that recent selling will translate into a bear market for shares, but it certainly presents a clear message to super funds and other investment managers to be wary of holding too much risk.”

“These sort of market moves will inevitably impact superannuation account balances in the short term. However, over longer periods, as well as over the past 12 months, super returns are holding up well. The challenge for super funds in this environment will be to maintain discipline and stick to their long-term investment strategy.”

When there is a market drop, the balance of your superannuation can fall. However, it isn’t expected to affect most members directly as they cannot access their super. However, this is more challenging for those members nearing or in retirement. For most members, it is important to keep a long term view as volatility is unavoidable. Therefore, timing markets is a fraught exercise and one to be extremely cautious of.

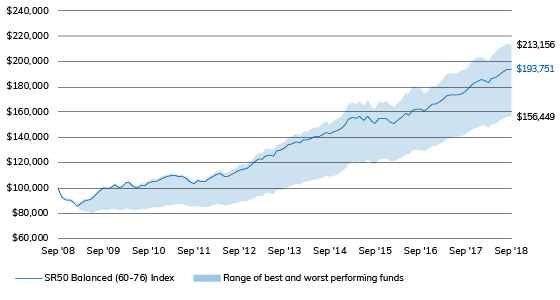

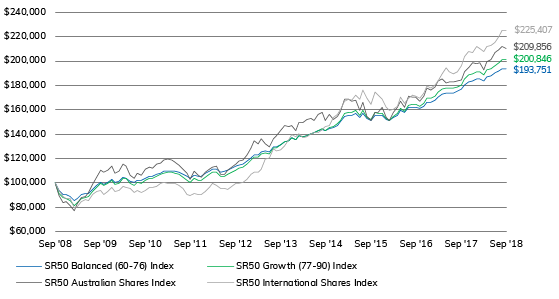

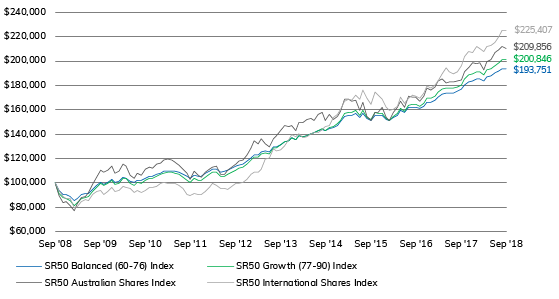

Growth in $100,000 invested for 10 years to 30 September 2018

Select index

SR50 Balanced (60-76) Index

SR50 Growth (77-90) Index

SR50 Australian Shares Index

SR50 International Shares Index

SR50 Cash Index

Source: SuperRatings

Interim results only

Source: SuperRatings

Interim results

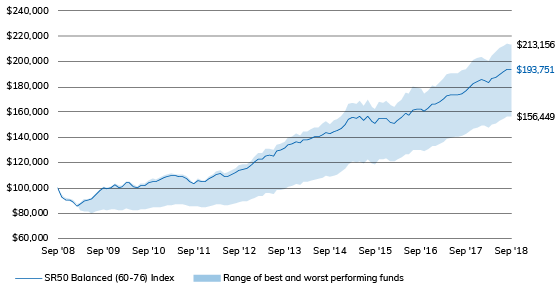

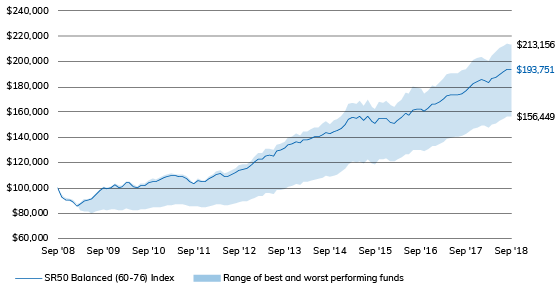

When considered over the longer term, the recent selling will not significantly diminish the stellar performance achieved by super funds over recent years. An investment of $100,000 in the median balanced fund 10 years ago would now be worth around $193,751 as at the end of September 2018. In the best performing balanced fund over that period, the same $100,000 investment would have doubled in value to $213,156.

Best and worst performing balanced options to 30 September 2018

Source: SuperRatings

Interim results

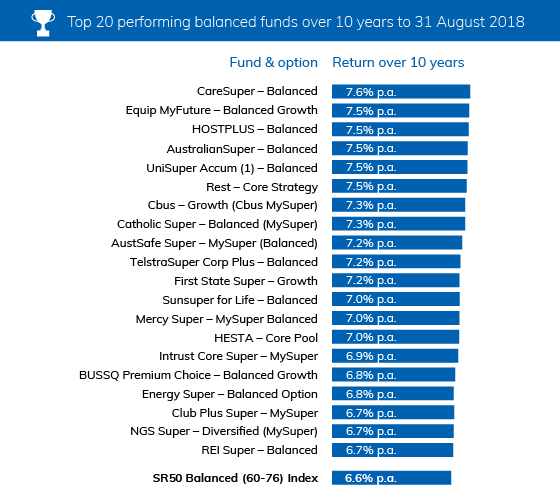

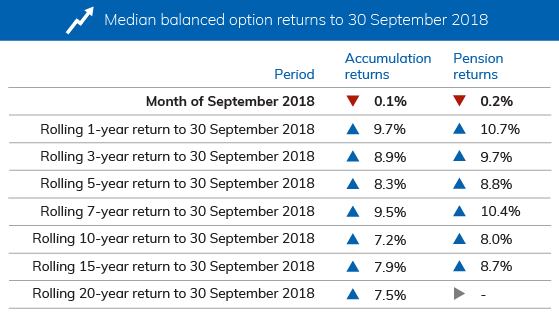

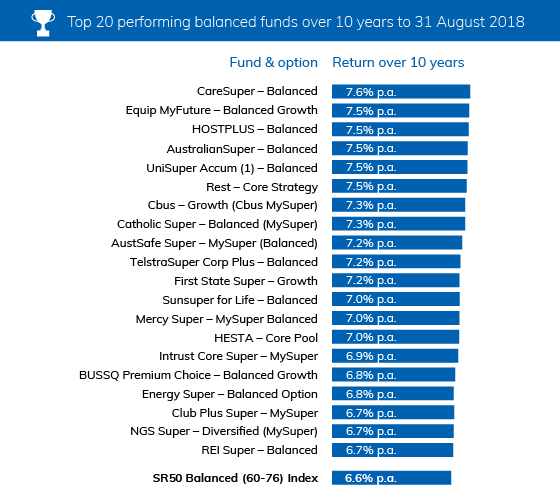

A comparison of balanced option returns shows that CareSuper remains ahead of the pack with an annual return of 7.6% over the past decade, followed closely by Equip MyFuture and HOSTPLUS. While the global financial crisis, continues to cast a shadow over long-term returns, Australia’s top performing funds have nevertheless delivered some impressive results.

Source: SuperRatings

Source: SuperRatings

*Interim results

# IOOF Employer Super Core – IOOF MultiMix Balanced Growth Trust

Release ends

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the merits of the superannuation or pension financial product(s) alone, without taking into account the objectives, financial situation or particular needs (‘financial circumstances’) of any particular person. Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If SuperRatings advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Product Disclosure Statement for each superannuation or pension financial product before making any decision about whether to acquire a financial product. SuperRatings research process relies upon the participation of the superannuation fund or product issuer(s). Should the superannuation fund or product issuer(s) no longer be an active participant in SuperRatings research process, SuperRatings reserves the right to withdraw the rating and document at any time and discontinue future coverage of the superannuation and pension financial product(s). Copyright © 2018 SuperRatings Pty Ltd (ABN 95 100 192 283 AFSL No. 311880 (SuperRatings)). This media release is subject to the copyright of SuperRatings. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth.), no part of this media release may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of SuperRatings. This media release may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to SuperRatings copyrighted material, applies to such third party content.

// GLOBAL PARAMETERS

var chartHeight = 376;

var chartWidth = 700;

var startAmt = 100000;

var numAxes = 9;

var dateNum = 10;

// DATA

// SR50 Balanced (60-76) Index

var balancedPrices = [

100000,

93352.9,

90449.62481,

90338.1908722341,

88669.7348250148,

85423.9791817451,

87337.4763154162,

90005.6362168522,

90914.6931426424,

91396.5410162984,

94705.0958010884,

97655.1595352923,

100145.366103442,

99093.1387417934,

100391.258859311,

102592.337209801,

100366.083492349,

101206.047245096,

104141.022615204,

104055.418694614,

101429.892370112,

100179.667516758,

102184.1624841,

101782.885278025,

104062.821908253,

105455.078402564,

105268.001093478,

107042.714323912,

108102.437195719,

109280.753761153,

109652.30832394,

109811.30417101,

109531.285345374,

108808.378862095,

107304.320641084,

105333.998705472,

103425.767984924,

106297.798136097,

105222.914801345,

105108.221824212,

107509.839584673,

109439.641205218,

111072.371212359,

111405.588325996,

108960.90409577,

109234.069082338,

110408.335324973,

112219.032024303,

113877.180441494,

114846.389124231,

115459.094610209,

117670.829026562,

120684.849641249,

123038.204209253,

122809.722264036,

125288.513698214,

126153.004442731,

125390.787989888,

129204.298025025,

129774.088979315,

131505.14555221,

133828.315453536,

134878.867729846,

136821.123425156,

135663.479899855,

138501.69556284,

138010.014543592,

139007.274908684,

140471.994564397,

140724.844154613,

142441.687253299,

143675.802031662,

142817.626466127,

144567.999296096,

145646.332002845,

147346.024697318,

150189.360935903,

154641.424162126,

155570.973762764,

155103.016273686,

156605.188986296,

153441.764168773,

157001.613097489,

152421.091035369,

150902.367284293,

155411.631823482,

154909.030606165,

155160.60287187,

151661.731277109,

150911.005707287,

153491.28208287,

155594.41962997,

159149.752118515,

157558.25459733,

161735.754159723,

162199.774038407,

162272.763936725,

161039.490930806,

162917.37243455,

166420.095941892,

166237.033836356,

168065.641208556,

170569.819262564,

172943.81000706,

173762.698947444,

173797.451487233,

173884.350212977,

174922.265899398,

176557.789085557,

180563.53220433,

182827.618334641,

183906.301282815,

185451.114213591,

185092.266307587,

183759.601990173,

186736.507542413,

187423.884626677,

189935.364680675,

191929.686009822,

193906.561775723,

193751.436526302

];

// SR50 Growth (77-90) Index

var growthPrices = [

100000,

91467.9,

87758.876655,

87399.0652607145,

85267.3146599404,

81293.8577967872,

83676.6620626689,

86973.522547938,

88265.0793577749,

89103.5976116738,

93041.9766261098,

96428.7045753001,

99234.7798784414,

97715.6938680622,

99147.2287832293,

101814.289237498,

98983.8519966957,

99960.5256643471,

103639.073008795,

103421.430955477,

99863.7337306082,

98116.1183903226,

100500.340067207,

99706.3873806765,

102383.503881848,

103987.853387676,

103748.681324885,

105737.232299839,

106889.768131907,

108204.512279929,

108496.664463085,

108540.06312887,

107975.6548006,

106939.088514514,

104933.980604867,

102296.150200422,

100011.058797245,

103564.951771605,

102045.653929116,

101802.887318418,

104521.02440982,

106726.418024867,

108617.716878686,

108834.952312443,

105492.957431785,

105762.386445066,

107065.590570842,

109014.184319231,

110758.411268339,

111815.821820718,

112491.972095268,

114955.546284154,

118580.324569586,

121165.375645203,

120807.93778705,

123655.743304504,

124635.962381679,

123676.26547134,

128294.213547774,

128862.043736937,

130885.048961563,

133555.103960379,

134789.954451596,

136919.635731932,

135303.984030295,

138668.994113128,

137934.048444329,

139037.520831883,

140658.281212221,

140735.643266887,

142826.83419019,

144131.98580102,

143087.893695877,

144975.938453194,

146237.664045553,

148297.421543634,

151518.441539562,

157068.259016273,

158041.925153915,

157520.544842832,

159372.828929639,

155456.082285864,

159762.215765183,

153920.670107944,

151996.661731595,

157386.159363274,

156794.859562546,

157026.131980401,

152516.184443792,

151326.55820513,

154306.93476898,

156808.558795455,

161078.612660014,

158775.188498976,

163828.050097767,

164174.054939574,

164131.698033399,

162359.075694639,

164891.877275475,

169483.95116572,

169009.396102456,

171189.617312177,

174082.721844753,

176799.456801862,

177555.981677517,

177413.936892175,

177344.745456787,

178490.392512438,

180457.535128318,

185340.35511382,

188141.2185603,

189495.835333934,

191211.530627048,

190663.900803332,

188528.465114334,

192449.857188713,

193315.881546062,

196058.260641674,

198626.62385608,

201228.632628595,

200846.2982266

];

// SR50 Australian Shares Index

var australianPrices = [

100000,

89359.3,

83774.34375,

84226.6414319062,

80857.57577463,

77173.0577617316,

83237.9340251106,

87672.1020085623,

88969.649118289,

92056.8959426936,

98325.970556391,

104473.9001914,

110428.91250231,

108662.049902273,

110107.255165973,

114069.795064886,

108012.688946941,

109683.753257639,

115407.051502622,

113883.678422788,

106217.484726079,

103428.213577172,

107741.170083341,

106362.083106274,

111143.058741901,

113134.186639262,

112071.404089973,

115746.113358679,

116000.754808068,

118448.370734518,

119230.129981366,

118802.809195513,

116709.028486251,

114736.645904833,

110891.017744041,

108268.445174395,

102696.95098572,

109405.629308862,

105838.786982135,

104485.003057846,

109042.32543622,

111495.777758535,

112911.662640291,

113885.751553889,

107054.314746929,

107050.996063172,

110412.397339555,

113269.318120716,

115421.43516501,

118237.487340166,

118828.674776867,

122536.129429905,

128295.32751311,

134378.578762472,

132147.894355015,

136548.419237037,

132260.798872994,

129472.476711153,

135745.547680286,

139056.24584266,

142540.439138494,

147322.243250273,

145849.02081777,

147103.322396803,

143165.660662885,

149364.733769588,

149853.75390795,

152094.067528874,

152978.038249351,

150882.239125335,

156404.529077323,

157556.761243035,

150740.6981949,

155941.252282624,

152073.909226015,

154735.202637471,

158713.135226875,

168546.842372397,

168955.56846515,

166568.226282737,

167489.681710533,

159450.176988428,

165869.481663805,

154747.932918247,

151457.991864405,

157788.935924337,

157773.157030744,

161565.865952606,

153767.727866538,

151318.207961624,

157493.655346746,

161568.488691532,

166770.9940274,

162042.369262747,

171246.375836871,

169874.007380914,

170458.713714319,

166964.310083176,

171024.882104398,

177344.251498156,

175960.96633647,

178723.553507953,

183960.153625736,

185555.272117825,

181942.139859146,

182749.962960121,

182836.220942638,

183787.517800203,

184289.441511315,

191295.573209251,

194534.207263683,

198409.523206583,

197973.022255529,

198581.789298964,

192763.342872505,

199413.678201606,

201418.383908567,

207078.240496398,

209418.224614007,

211847.476019529,

209856.109744946

];

// SR50 International Shares Index

var internationalPrices = [

100000,

93420,

88496.766,

87348.07797732,

86710.4370080856,

79669.549523029,

80383.0700085573,

84940.7900780425,

86558.9121290292,

85772.6975301612,

90237.8526181863,

92584.0367862592,

93537.6523651577,

90601.411919763,

92726.0150292814,

95934.3351492946,

93065.8985283307,

93531.2280209723,

97057.355317363,

96556.2481918594,

95543.6628170714,

92462.3796912208,

93843.0279447701,

91891.0929635189,

93865.4649869331,

95887.9841610065,

95917.9012120648,

97008.1999951423,

99763.2328750043,

100461.575505129,

99718.1598463914,

99215.9791934049,

99357.2627477764,

97915.7875798316,

95213.3118426283,

90156.0567841071,

89191.3869765171,

91125.234628942,

90670.9753343167,

90689.1095293835,

92865.6481580887,

96039.7031464841,

99469.0888664387,

98216.1762230771,

95601.1705311376,

95004.5236258528,

94401.2449008286,

97402.5436799607,

99744.7826478327,

99413.5302246592,

100384.402760833,

102699.869394915,

106848.944118469,

108302.08975848,

108714.93732464,

111483.689348424,

119515.420263841,

120519.349794058,

127468.133945134,

125951.263151187,

127238.611011855,

130068.397720759,

135390.146213503,

139779.765534038,

137484.302224438,

140586.085566923,

137050.345514915,

137528.377120071,

140168.646904022,

141154.733334992,

141112.386914992,

143250.239576754,

146444.719919315,

146991.837392934,

153224.291298394,

155744.064768796,

159950.867702266,

167122.584757433,

168369.152117138,

167873.81007161,

172252.294785898,

168454.476190458,

175904.375399981,

169079.109730086,

164700.806183626,

174132.397849731,

171711.086857631,

168259.694011792,

161788.762699487,

159631.794915177,

160208.384958411,

162796.551417414,

170106.279372607,

165286.998371702,

169819.829015047,

171894.178226466,

170734.408205972,

169197.798532119,

173614.030271605,

179075.58043589,

177660.883350446,

180414.627042378,

183644.048866437,

189796.124503462,

194412.345843635,

191244.202255768,

189720.9421848,

191208.733813414,

195984.363149137,

203295.363832053,

208052.475345723,

206887.381483787,

211449.455132886,

209779.004437336,

207932.949198287,

212091.608182253,

212510.277016805,

215082.501409816,

219835.824690973,

224979.982988742,

225407.444956421

];

// SR50 Cash Index

var cashPrices = [

100000,

100570,

100966.54751,

101295.39555524,

101623.086159861,

101856.819258029,

102056.254910136,

102274.349126879,

102496.284464484,

102726.798608245,

102963.070245044,

103189.588999583,

103437.244013182,

103664.805950011,

103923.967964886,

104204.562678391,

104506.755910159,

104799.374826707,

105101.825822457,

105417.551707228,

105744.34611752,

106097.637977899,

106468.979710821,

106830.974241838,

107188.110188729,

107572.379563755,

107938.125654272,

108335.553832931,

108736.395382113,

109095.225486874,

109487.968298627,

109871.176187672,

110266.712421947,

110663.672586666,

111050.99544072,

111450.112718334,

111833.055305634,

112235.654304734,

112606.03196394,

112985.176473562,

113360.287259455,

113700.368121233,

114077.853343395,

114454.310259429,

114832.009483285,

115135.165988321,

115453.860127776,

115775.514582092,

116091.813287931,

116405.261183808,

116685.215836955,

116989.414194642,

117273.815460549,

117529.706925884,

117793.67864764,

118076.501270073,

118348.077222994,

118596.608185162,

118869.380383988,

119118.649474653,

119359.030909293,

119597.748971112,

119833.834927581,

120064.994395156,

120299.601394204,

120520.11056356,

120756.209460154,

120985.646258128,

121223.262067379,

121465.708591514,

121708.640008697,

121942.442306153,

122171.572155247,

122410.661921954,

122641.406019677,

122897.726558258,

123155.443090851,

123379.093375504,

123606.604423689,

123813.769092703,

124021.652411009,

124215.002167118,

124411.758730551,

124610.81754452,

124796.238441026,

124995.912422532,

125181.656348391,

125377.315277264,

125579.047377545,

125767.415948611,

125972.03953436,

126186.192001568,

126399.446666051,

126589.04583605,

126788.296994196,

126983.677759864,

127155.613659551,

127333.631518674,

127504.131251278,

127682.509530898,

127861.265044242,

128027.484688799,

128206.723167363,

128381.725344487,

128570.061335567,

128746.716599842,

128915.503545305,

129083.093699914,

129250.901721723,

129431.852984134,

129596.619732983,

129763.410582579,

129948.323442659,

130104.26143079,

130273.39697065,

130456.407583428,

130647.134851315,

130826.252073196,

131035.574076514,

131232.127437628,

131415.852416041

];

// Dates

var dates = [“Sep 2008″,”Oct 2008″,”Nov 2008″,”Dec 2008″,”Jan 2009″,”Feb 2009″,”Mar 2009″,”Apr 2009″,”May 2009″,”Jun 2009″,”Jul 2009″,”Aug 2009″,”Sep 2009″,”Oct 2009″,”Nov 2009″,”Dec 2009″,”Jan 2010″,”Feb 2010″,”Mar 2010″,”Apr 2010″,”May 2010″,”Jun 2010″,”Jul 2010″,”Aug 2010″,”Sep 2010″,”Oct 2010″,”Nov 2010″,”Dec 2010″,”Jan 2011″,”Feb 2011″,”Mar 2011″,”Apr 2011″,”May 2011″,”Jun 2011″,”Jul 2011″,”Aug 2011″,”Sep 2011″,”Oct 2011″,”Nov 2011″,”Dec 2011″,”Jan 2012″,”Feb 2012″,”Mar 2012″,”Apr 2012″,”May 2012″,”Jun 2012″,”Jul 2012″,”Aug 2012″,”Sep 2012″,”Oct 2012″,”Nov 2012″,”Dec 2012″,”Jan 2013″,”Feb 2013″,”Mar 2013″,”Apr 2013″,”May 2013″,”Jun 2013″,”Jul 2013″,”Aug 2013″,”Sep 2013″,”Oct 2013″,”Nov 2013″,”Dec 2013″,”Jan 2014″,”Feb 2014″,”Mar 2014″,”Apr 2014″,”May 2014″,”Jun 2014″,”Jul 2014″,”Aug 2014″,”Sep 2014″,”Oct 2014″,”Nov 2014″,”Dec 2014″,”Jan 2015″,”Feb 2015″,”Mar 2015″,”Apr 2015″,”May 2015″,”Jun 2015″,”Jul 2015″,”Aug 2015″,”Sep 2015″,”Oct 2015″,”Nov 2015″,”Dec 2015″,”Jan 2016″,”Feb 2016″,”Mar 2016″,”Apr 2016″,”May 2016″,”Jun 2016″,”Jul 2016″,”Aug 2016″,”Sep 2016″,”Oct 2016″,”Nov 2016″,”Dec 2016″,”Jan 2017″,”Feb 2017″,”Mar 2017″,”Apr 2017″,”May 2017″,”Jun 2017″,”Jul 2017″,”Aug 2017″,”Sep 2017″,”Oct 2017″,”Nov 2017″,”Dec 2017″,”Jan 2018″,”Feb 2018″,”Mar 2018″,”Apr 2018″,”May 2018″,”Jun 2018″,”Jul 2018″,”Aug 2018″,”Sep 2018”];

// All prices

var allPrices = balancedPrices.concat(growthPrices, australianPrices, internationalPrices, cashPrices);

// FUNCTIONS

var balancedPoints = calcpoints(balancedPrices, chartHeight, chartWidth);

createchart(balancedPoints, balancedPrices);

createaxes(balancedPrices);

createDates();

function removeChart(){

var lines = document.getElementsByClassName(“line”);

while(lines.length > 0){

lines[0].parentNode.removeChild(lines[0]);

};

var labels = document.getElementsByClassName(“price-label”);

while(labels.length > 0){

labels[0].parentNode.removeChild(labels[0]);

};

var polyline = document.getElementById(“polyline-id”);

polyline.setAttribute(“points”, “”);

var polylineFill = document.getElementById(“polyline-fill”);

polylineFill.setAttribute(“points”, “”);

};

function report(portfolio){

if(portfolio == “balanced”){

removeChart();

createaxes(balancedPrices);

createDates();

var balancedPoints = calcpoints(balancedPrices, chartHeight, chartWidth);

createchart(balancedPoints, balancedPrices);

} else if(portfolio == “growth”){

removeChart();

createaxes(growthPrices);

createDates();

var growthPoints = calcpoints(growthPrices, chartHeight, chartWidth);

createchart(growthPoints, growthPrices);

} else if(portfolio == “australian”){

removeChart();

createaxes(australianPrices);

createDates();

var australianPoints = calcpoints(australianPrices, chartHeight, chartWidth);

createchart(australianPoints, australianPrices);

} else if(portfolio == “international”){

removeChart();

createaxes(internationalPrices);

createDates();

var internationalPoints = calcpoints(internationalPrices, chartHeight, chartWidth);

createchart(internationalPoints, internationalPrices);

} else if(portfolio == “cash”){

removeChart();

createaxes(cashPrices);

createDates();

var cashPoints = calcpoints(cashPrices, chartHeight, chartWidth);

createchart(cashPoints, cashPrices);

};

};

function numberWithCommas(num){

var parts = num.toString().split(“.”);

parts[0] = parts[0].replace(/\B(?=(\d{3})+(?!\d))/g, “,”);

return parts.join(“.”);

};

function dataconvert(prices, dates){

var data = [];

for(var i = 0; i < prices.length; i++){

var datum = {

price: prices[i],

date: dates[i]

};

data.push(datum);

};

return data;

};

function calcdollar(data, startAmt){

var oneData = [];

for(var i = 0; i < data.length; i++){

oneData.push(data[i] + 1);

};

var dollarAmts = [];

var start = startAmt;

var accum = start;

for(var i = 0; i < oneData.length; i++){

accum = oneData[i] * accum;

dollarAmts.push(accum);

};

return dollarAmts;

};

function calcpoints(prices, chartHeight, chartWidth){

var points = [];

var xPoint = 0;

var step = chartWidth / prices.length;

var max = Math.max.apply(null, allPrices);

var min = Math.min.apply(null, allPrices);

var range = max – min;

var firstInterval = range / numAxes;

var interval = 20000;

var minAxis = 60000 // startAmt – (interval * Math.ceil((startAmt – min) / interval));

var maxAxis = 240000 // minAxis + (numAxes * interval);

var axisRange = maxAxis – minAxis;

for(var i = 0; i < prices.length; i++){

if(prices[i] === maxAxis){

var yPoint = 0;

} else if(prices[i] === minAxis){

var yPoint = chartHeight;

} else {

var yPoint = ((maxAxis – prices[i]) / axisRange) * chartHeight;

}

var xandy = {

x: xPoint,

y: yPoint

};

points.push(xandy);

var xPoint = xPoint + step;

};

return points;

};

function createaxes(prices){

var max = Math.max.apply(null, allPrices);

var min = Math.min.apply(null, allPrices);

var range = max – min;

var firstInterval = range / numAxes;

var interval = 20000;

var minAxis = 60000 // startAmt – (interval * Math.ceil((startAmt – min) / interval));

var maxAxis = 240000 // minAxis + (numAxes * interval);

var axisRange = maxAxis – minAxis;

var step = chartHeight / numAxes;

var accum = step;

var d = "";

// DRAW AXES

for(var i = 1; i minAxis; i = i – interval){

accum = accum + step;

var div = document.createElement(“div”);

div.style.position = “absolute”;

div.className = “price-label”;

div.style.left = chartWidth + 5 + “px”;

div.style.top = accum – 12 + “px”;

var commaNum = numberWithCommas(priceLabel);

div.innerHTML = “$” + commaNum;

document.getElementById(“main-chart”).appendChild(div);

priceLabel = priceLabel – interval;

};

};

// DRAW DATES

function createDates() {

var step = chartWidth / dateNum;

var left = 0 – 25;

for(var i = 0; i <= dateNum * 12; i += 12) {

var date = dates[i];

var div = document.createElement("div");

div.className = "price-label";

div.style.position = "absolute";

div.style.top = chartHeight + 5 + "px";

div.style.left = left + "px";

div.style.zIndex = "4";

div.innerHTML = date;

document.getElementById("main-chart").appendChild(div);

var step

left += step;

};

};

function createchart(points, prices){

// DRAW CHART LINE

var pairs = [];

for(var i = 0; i < points.length; i++){

var xPoint = points[i].x;

var yPoint = points[i].y;

pairs.push(xPoint);

pairs.push(yPoint);

var chart = document.getElementById("chart");

var point = chart.createSVGPoint();

point.x = xPoint;

point.y = yPoint;

var polyline = document.getElementById("polyline-id");

polyline.points.appendItem(point);

};

// DRAW CHART FILL

for(var i = 0; i < points.length; i++){

var xPoint = points[i].x;

var yPoint = points[i].y;

pairs.push(xPoint);

pairs.push(yPoint);

var chart = document.getElementById("chart");

var point = chart.createSVGPoint();

point.x = xPoint;

point.y = yPoint;

var polyline = document.getElementById("polyline-fill");

polyline.points.appendItem(point);

};

var num = points.length – 1;

var chart = document.getElementById("chart");

var point = chart.createSVGPoint();

point.x = points[num].x;

point.y = chartHeight;

var polyline = document.getElementById("polyline-fill");

polyline.points.appendItem(point);

var chart = document.getElementById("chart");

var point = chart.createSVGPoint();

point.x = 0;

point.y = chartHeight;

var polyline = document.getElementById("polyline-fill");

polyline.points.appendItem(point);

var chart = document.getElementById("chart");

var point = chart.createSVGPoint();

point.x = 0;

point.y = points[0].y;

var polyline = document.getElementById("polyline-fill");

polyline.points.appendItem(point);

var left = 0;

var step = chartWidth / points.length;

// CREATE INTERACTIVE ELEMENTS

for(var i = 0; i < points.length; i++){

var top = points[i].y;

var div = document.createElement("div");

div.id = left;

div.className = "line";

div.style.position = "absolute";

div.style.height = chartHeight + "px";

div.style.width = step + "px";

div.style.left = left – (step / 2) + "px";

div.style.top = "0px";

document.getElementById("chart-container").appendChild(div);

var div = document.createElement("div");

div.className = "cursor";

div.style.height = chartHeight – points[i].y + "px";

div.style.top = chartHeight – (chartHeight – points[i].y) + "px";

div.style.left = "2px";

div.style.position = "absolute";

div.style.zIndex = "2";

document.getElementById(left).appendChild(div);

var div = document.createElement("div");

div.className = "dot";

div.style.position = "absolute";

div.style.top = points[i].y – 6 + "px";

div.style.left = 0 – (step / 2) + "px";

div.style.zIndex = "3";

document.getElementById(left).appendChild(div);

var div = document.createElement("div");

div.className = "label-chart";

div.style.position = "absolute";

div.style.top = chartHeight – 26 + "px";

div.style.left = "-50px";

div.style.zIndex = "4";

var num = Math.round(prices[i]);

var commaNum = numberWithCommas(num);

div.innerHTML = dates[i] + ": $" + commaNum;

document.getElementById(left).appendChild(div);

var left = left + step;

};

};

Listed Fund Award

Listed Fund Award