In the world of haute couture, a famous designer once quipped – “In a world full of trends, I want to remain a classic”.

At Investors Mutual we would rephrase it as: “In a world full of trends, we want to remain a true-to-label value investor”.

The past 18 months has been a challenging and at times a frustrating environment for value investors. At IML we pride ourselves on our strict adherence to the IML investment mantra which has defined our approach to investing for the past 20 years – through all market cycles. That is to buy and own companies with a competitive advantage, with recurring earnings, run by capable management, that can grow, at a reasonable price.

This can be neatly described as an investment style of Value with a strong focus on Quality. However, over the past 18 months this proven approach has significantly lagged the styles of Growth and Momentum based investing.

A quick recap of the different styles

Value investors

Seek companies whose share prices are trading below their intrinsic value as determined by bottom-up, fundamental analysis. This may include buying companies that are trading below their tangible book value, their net asset value, that have a long history of earnings and dividends and that trade at reasonable valuations.

Growth investors

Seek companies that exhibit above average earnings growth and often are happy to buy when the share price looks expensive or trading well ahead of reasonable fundamentals. Growth investing is an act of faith, often buying earnings which have not yet materialised or where a company is expected to continue grow at a quick pace well into the future. Traditionally these companies trade on very high PE ratios as their earnings are expected to continue to accelerate for many years into the future.

Momentum strategies

Disregards much of the fundamental analysis that Value and Growth investors utilise. Momentum investors seek to capitalise on a continuation of short term existing trends. To put it simply this style – often used by quant investors and hedge funds – buys because the share price is trending higher or sells because it is trending lower. This style includes investing in whatever current market fads or concepts are capturing investors’ imagination. This style is self-fulfilling for a time as the more people believe the hype, the more the share price incites others to jump in.

So where are we today and why has it been a challenging 18 months for a Value investor?

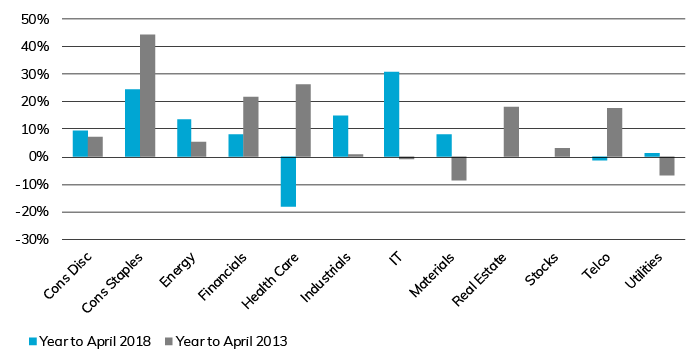

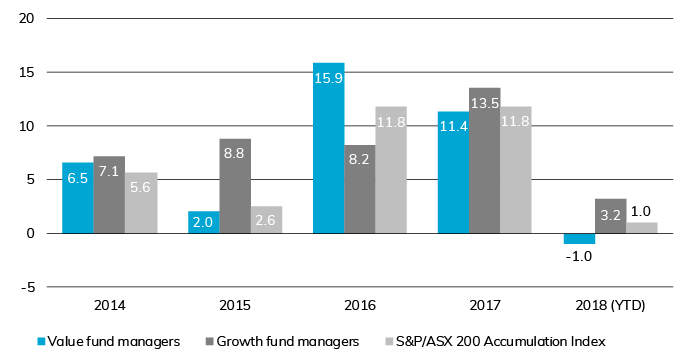

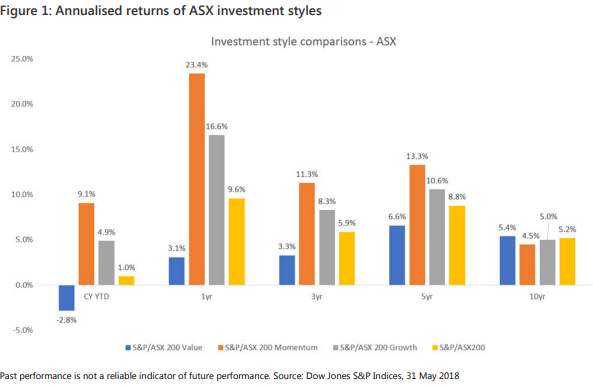

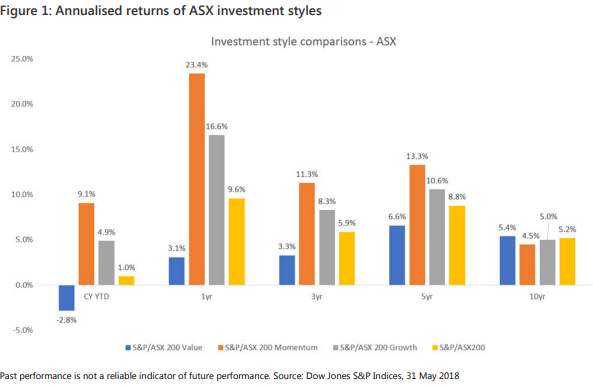

As can be seen from figure 1: Momentum and Growth have outperformed Value and the ASX300 by a significant margin over the last 12 months. The scale of the out performance of the last 12-18 months has been so significant that it is now impacting the 3- to 5-year comparisons.

Figure 1: Annualised returns of ASX investment styles

There are a number of dynamics at play in the current market

We are now nine years into the current market phase which has been driven by a record breaking US market and by continued record low interest rates in many parts of the world – including Australia. Since Donald Trump was elected 18 months ago the US market has risen strongly and until recently volatility was at all-time lows. This renewed and unflinching sense of confidence in the sharemarket has made it difficult for Value investors such as IML to keep pace with the sharemarket, while the environment has favoured both Growth and Momentum strategies.

The majority of companies we visit continue to indicate that conditions remain very competitive in many industries and it remains a challenging environment to grow profits. As an experienced Value manager, it makes little sense in this environment to take on additional risk and pay excessive multiples for stocks which are attractive because they are growing faster than the average company.

However, over this same period many Growth and Momentum managers have shown a willingness to pay high multiples for companies such as; Treasury Wines, Bluescope Steel, Qantas, A2 Milk, NextDC, Cochlear, Macquarie Bank, Resmed and Aristocrat. While many of these are decent companies we challenge the thesis of buying these companies on such high valuations simply because of their short-term earnings outlook. It seems to us that some of the buying is being fuelled by hopes that current macro conditions will last forever.

As an example, a major theme has been the stellar performance of companies rising on exposure to the ‘daigou’ market into China, share prices continue to be based on the expectation that they can sell ever larger amounts of their products into China without any hitches.

We continue to ask ourselves when looking at many of these companies: is too much faith being baked into the future earnings projections of these companies? It seems to us that many companies are priced to perfection and any small slip or earnings downgrade will lead to a very rapid derating in many of these companies.

As demand for these Growth companies continue, we are now seeing Momentum strategies joining in and bidding these stocks up to vastly excessive valuations. The past 12 months has resulted in a very narrow universe of growth and momentum type stocks driving the market higher, whilst good quality industrial companies with modest yet sustainable earnings have lagged.

As Value managers, it is not our style to participate in this exuberance, we have a clear valuation framework around every company in our universe and one which we have always stuck to successfully since our inception.

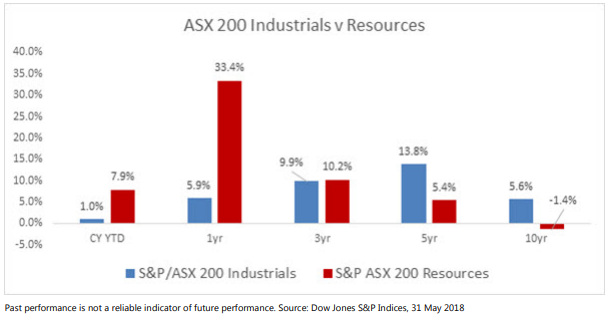

Resources v Industrials – another growth v value conundrum

This brings us to the topic of the significant outperformance of Resources over Industrials since February 2016, which is also a major factor contributing to IML’s portfolios recent underperformance. Resource stocks by virtue of their nature fit the designation of chasing growth. IML always takes a cautious view on Resources given their high volatility and unpredictable earnings. Resource companies’ earnings and dividends remain beholden to the movement in underlying commodity prices, which remains totally unpredictable – as clearly seen in the last few years in the wild swings we have seen in the prices of commodities such as oil and iron ore.

In January 2016 commodity prices reached decade lows (yet still above longer-term averages), beset by global oversupply, tepid economic growth and significant concern for China’s financial markets. However, the Chinese Government responded with significant amounts of stimulus which helped many commodity prices to rapidly recover and in turn to a significant rally for Resource companies.

IML has always preferred to invest clients’ monies in a diversified portfolio of good quality Industrial companies. This method of investing in quality Industrial companies allows the prudent investor such as IML to model out the earnings streams of these companies into the future with some degree of certainty. Such a diversified portfolio of good quality Industrial companies will also provide investors with a predictable income stream in the form of dividends over time.

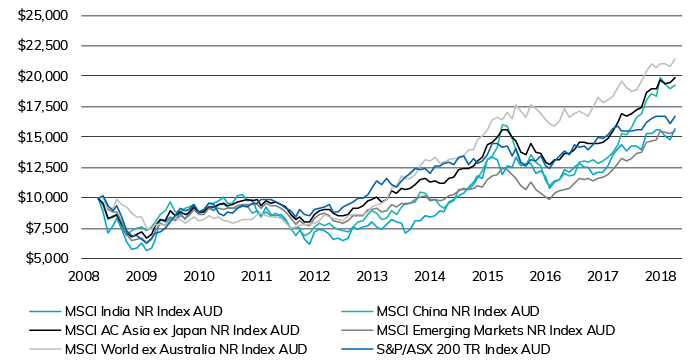

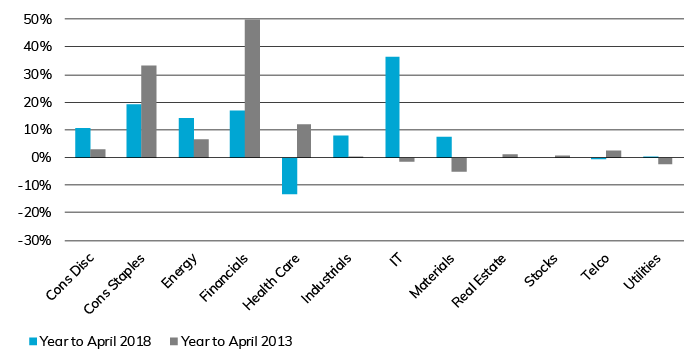

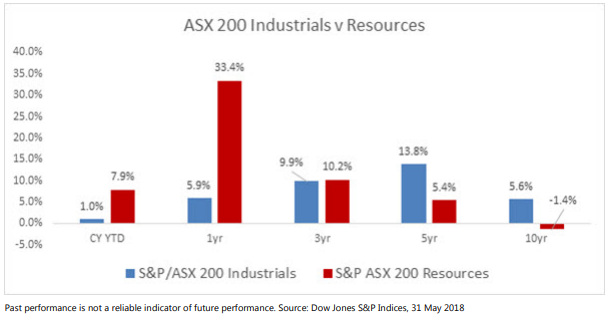

While at times a difficult market for value investors, we remain confident in our long-term approach and point to figure 2 below highlighting the long-term performance of the Industrials and Resources sectors. It is worth highlighting that the Resources sector returns are negative on a total return basis over 10 years.

Figure 2: ASX Industrials v Resources

What are we buying and why?

We have been buying the following companies on current share price weakness, companies which we believe have very resilient earnings, and strong management teams, yet whose share prices are all being impacted by factors which, in our view, are temporary in nature. We believe these investments will serve IMLs portfolios and their investors well in the longer term.

Amcor – a resilient global packaging company which is currently under pressure due to higher input prices and uncertainty around their emerging markets businesses. Amcor generates strong cash flows and has been relatively inactive on M&A for a while now as target businesses have been excessively priced. If reasonable acquisitions don’t eventuate, the focus will return to capital management which has been a key facet of Amcor’s strategy for capital deployment in the past.

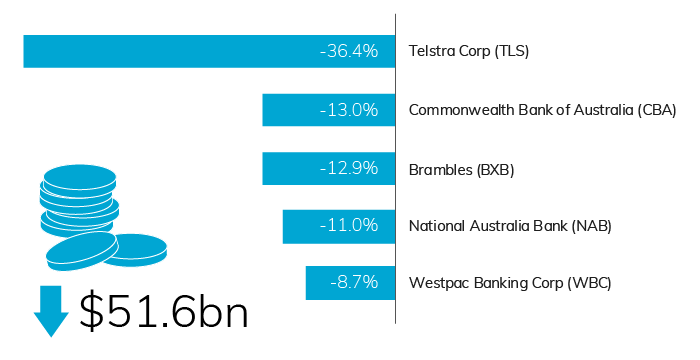

Brambles – a global pallet pooling business, currently trading on 16.5x PE, with benefits still to come from productivity increases in its US pallet business. Brambles’ share price is currently trading lower because of fears that increases in lumber and transport costs will impact margins.

Pact Group – a rigid plastic packaging company which has diversified their business into contract manufacturing and materials handling. Concerns around organic growth from recent results have weighed on the share price, however we think Pact has a very strong management team, and is a durable business which can grow earnings over time via continued cost-outs and bolt-on acquisitions.

Caltex – a leading fuel distributor in Australia with a hard-to-replicate infrastructure network across the country. The share price has been weak of late due to slower near-term earnings growth as refining margins have declined and the company transitions from a franchise model to company operated.

Transurban – a toll road operator with a quality portfolio of roads spanning Sydney, Melbourne, Brisbane and the US, currently offering investors a 5.1% dividend yield with strong growth. Transurban’s share price is currently weighed down by uncertainty surrounding the WestConnex sale process.

Conclusion

The last 18 months has been a difficult market to perform in for value investors such as IML. Companies caught up in the latest theme, fad or concept are being rewarded despite, at times, questionable fundamentals and often a distinct lack of sustainable earnings.

We continue to remain disciplined in continuing to focus on the fundamentals of all the companies we invest in and we seek to not over pay for companies that are often over promising and on companies where the outcome

is often far from certain. With many companies’ valuations stretched, we continue to believe that portfolios underpinned by value and quality stocks remain the best place to be.

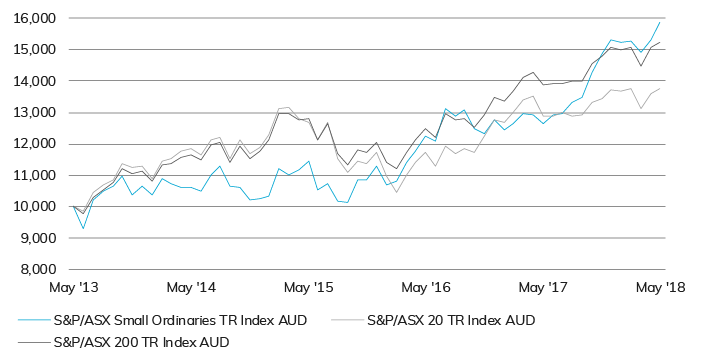

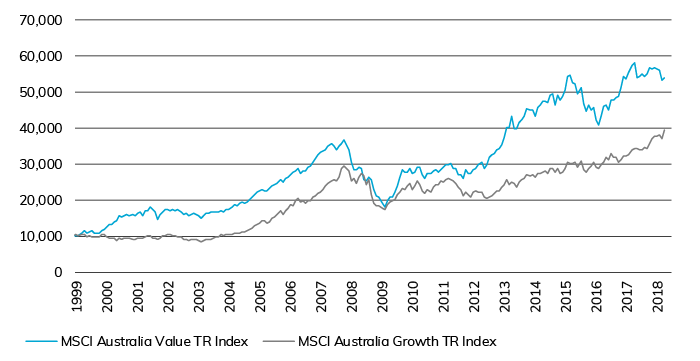

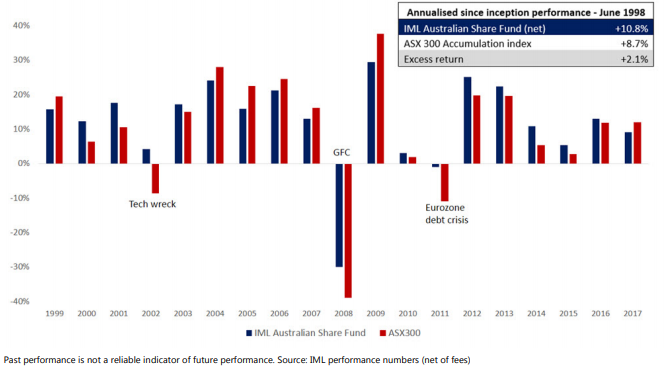

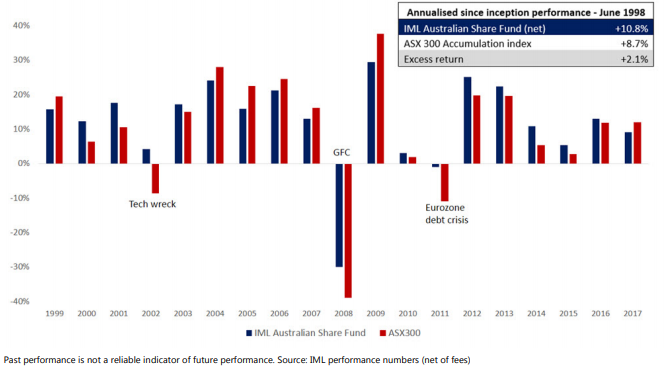

Referencing figure 3 below, IML’s proven and successful investment approach has guided investors through volatile and challenging times, notably the tech wreck of 2001-02, the GFC in 2008 and the Eurozone debt crisis of 2011. We remain prudently positioned for any possible correction.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned

should not be interpreted as a recommendation to buy, sell or hold that stock. Investors Mutual Limited does not guarantee the performance of any Fund, repayment of capital or any particular rate of return. Performance returns are

calculated using the exit price, net of management fees and assuming the reinvestment of distributions. No allowance is made for tax. Past performance is not indicative of future performance. Returns can be volatile, reflecting rises and falls in the value of the underlying investments. Investors should seek independent advice as to the suitability of the Fund to their investment needs.

Investors Mutual Limited is the issuer of the Investors Mutual Australian Share Fund. Applications can only be made by reference to the current Product Disclosure Statement or through IDPS products that include these Funds. The Product Disclosure Statement can be obtained by contacting Investors Mutual or at http://www.iml.com.au/how-to-invest/pds-and-forms. Potential investors should consider the Product Disclosure Statement before deciding whether to

invest, or continue to invest in the Fund.