Labor’s proposed changes to franking credits will result in a meaningful reduction in income for zero or low tax rate retirees invested in equity funds, according to analysis by leading research house Lonsec.

The research shows that the changes would have the biggest impact on dividend focused funds and Listed Investment Companies (LICs), which generally seek to maximise the value of franking credits to boost income for investors.

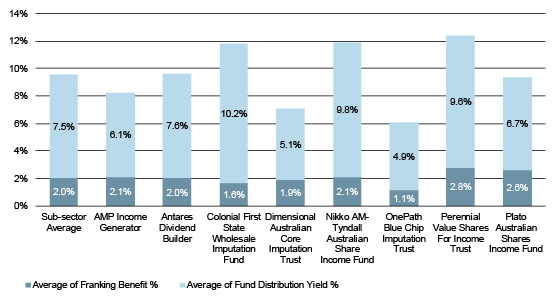

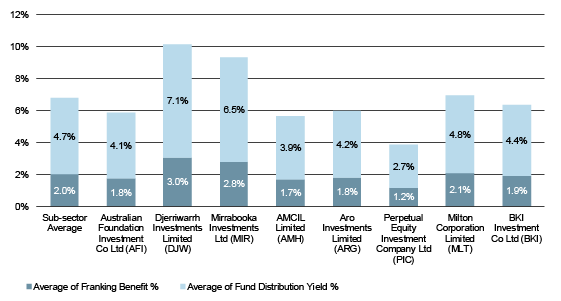

The charts below show the average yield and franking benefit for dividend focused funds and LICs researched by Lonsec. For a hypothetical investor paying no tax, the average franking benefit for both product groups is 2.0% on an annual basis, while the distribution yield is around 7.5% for dividend-focused funds and 4.7% for LICs. This compares favourably to the broader Australian equity market, which currently delivers a franking benefit of 1.6% and a distribution yield of 4.3%.

Average franking benefit & distribution yield for dividend focused funds (FY14 to FY17)

Source: Lonsec

Average franking benefit & distribution yield for LICs (FY14 to FY17)

Source: Lonsec

Labor’s proposal is designed to create a broader tax mix, and the removal of dividend refunds would help address distortions such as Australia’s significant home country bias. However, an Australian zero-percent taxpayer invested in an income-focused share fund would be at risk of losing a substantial boost to their after-tax investment income if the changes are implemented.

Most at risk are products with a higher than average franking benefit such as Plato Australian Shares Income Fund, Betashares Australian Top 20 Income Maximiser Fund, Perennial Value Share for Income Trust, Djerriwarrh Investments, and Mirrabooka Investments.

The changes would abolish cash refunds of franking credits for all Australian investors other than charities, endowments and some welfare recipients. Under the proposed changes, the system of dividend imputation will not change, but investors will no longer be able to claim cash refunds on excess imputation credits.