This article is intended for licensed financial advisers only and is not intended for use by retail investors.

Equity markets have continued their recovery through February, with the S&P 500 and S&P/ASX 300 both rising 5.2% in Australian dollar terms in the first three weeks of the month. This comes on the back of January’s gains of 4.5% and 2.6% respectively. In price terms, the US index has recovered from a sharp fall in December, while the ASX has clawed back nearly all losses suffered in the final quarter of 2018.

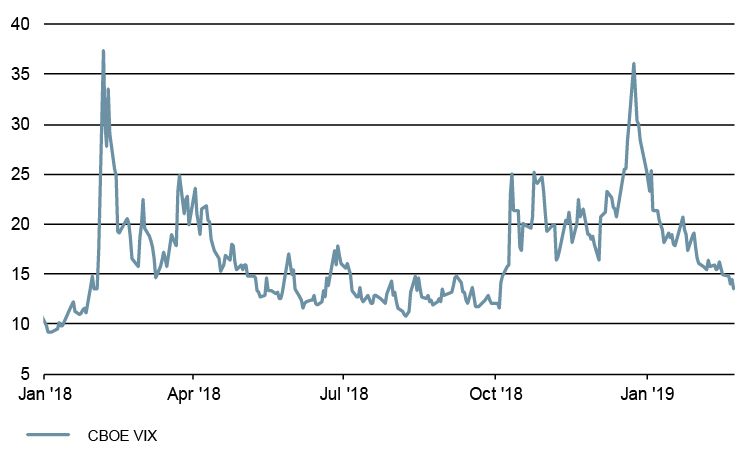

US markets have led the comeback, buoyed by the Federal Reserve’s pivot to a more dovish stance on monetary policy after announcing that it will keep rates on hold until further notice. This was coupled with strong earnings results from companies such as Facebook (+23.5% since the start of 2019) and General Electric (+34.4%), with both beating revenue and earnings expectations and addressing investor concerns head-on. Over the last 12 months we have also seen an increase in market volatility, with risk measures such as the VIX spiking in December. But as the chart below shows, volatility eased following the Fed’s revised expectations, with the VIX dropping to a four-month low.

Source: CBOE, Bloomberg

Does this mean that we’ve seen an end to volatility? Our view is that volatility will remain at a heightened level – or, arguably, at more normal levels – over the course of 2019. While we may see a pause in rate rises in the US, we continue to believe that we are at the late stage of the cycle. The winding back of central bank liquidity support via quantitative easing, tighter access to credit, and the possible flow on effects of a slow-down in the Australian housing market, remain the key issues for investors, while shorter-term indicators such as price momentum have turned negative. Furthermore, geopolitical risks associated with the Brexit negotiations and the ongoing trade discussions between the US and China remain potential sources of volatility.

So, what does this mean for Lonsec’s managed portfolios? We are starting to see pockets of value appearing on a sector level. An example of this is within emerging markets, which sold off over 2018 and have since showed signs of stabilising. We are also seeing more investment opportunities on a stock level where the increase in market volatility is providing an opportunity to invest in quality companies at a reasonable price. However, value measures take a long-term view of the market, and assets can remain ‘cheap’ or ‘expensive’ for extended periods, hence it is also important to look at business cycle and other medium-term indicators.

We remain neutral on equities, with our main active asset allocation position being a positive tilt towards alternative assets. The outlook for markets is far from clear, and in our portfolio communications we are emphasising the need for portfolio diversification across asset classes and investment strategies. Given our view that we should continue to expect bouts of volatility, we believe that such an environment will be conducive to an active approach to investing, both at the asset allocation and security level.

This article has been prepared for licensed financial advisers only. It is not intended for use by retail clients (as defined in the Corporations Act 2001) or any other persons. This information is directed to and prepared for Australian residents only. This information may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.