Is the world a more uncertain place today than it was yesterday? And if so, how much more uncertain is it? If these questions only lead to more uncertainty, then the Atlanta Fed might have some answers. The central bank calculates two indices – one for economic policy uncertainty and one for market uncertainty – that are designed to reflect the degree of unpredictability in the world.

The first index is based on the proportion of news stories that refer to uncertainty, major policy changes, and disagreement among forecasters. The second index does something similar but relates to stories about the economy and share markets. While not exactly a hard science, both provide an indication of how much the world disagrees on what will happen next.

While the practical utility of such measures might be a little dubious (unless you enjoy staying awake at night), it’s interesting to see if our own experience of the world correlates with what the media and other commentators are saying. Of course, the challenge is in differentiating real risks and uncertainty from the feedback loop of fear – in other words, these charts should be used responsibly!

Is the world more uncertain? It depends how you look at it

Source: Atlanta Fed

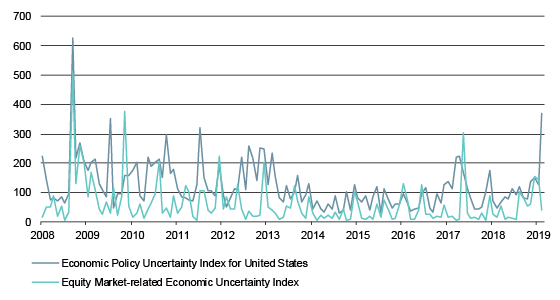

So, what are these indices telling us right now? The economic policy uncertainty index for the US shot higher at the start of 2019, reaching its highest level since the start of the Global Financial Crisis. This would certainly fit with the current geopolitical climate, including the US-China trade dispute, ongoing debate on tax reform, and of course the political deadlock over congressional funding for a border wall.

Interestingly, however, the index relating to market uncertainty dropped, and historically the two series have not always moved tightly together. Does this mean markets have entered a state of delusion, or is the uncertainty surrounding geopolitics overblown?

This is the critical question for wealth managers, and one we’ll be investigating with some of Australia’s leading strategists at the upcoming Lonsec Symposium. If you’re interested in how portfolio managers and financial advisers can manage uncertainty and the risks of regulatory change, then you can’t afford to miss out.