Over the past few months Lonsec has seen a noticeable increase in the number of fund managers seeking to bring alternative products to the market. This trend has been largely driven by market factors, with investors anticipating a period of increased volatility, lower returns, and a challenging valuation environment for key asset classes, which have remained at fair to expensive levels for a number of years.

The ability of alternative asset managers to provide diversification to traditional asset classes, as well as achieve positive absolute returns during market downturns, is an attractive proposition, especially for those who believe the market has reached a turning point. Fund managers have been keen to offer their own solutions, ranging from market neutral and risk premia strategies, to global macro and liquid alternatives.

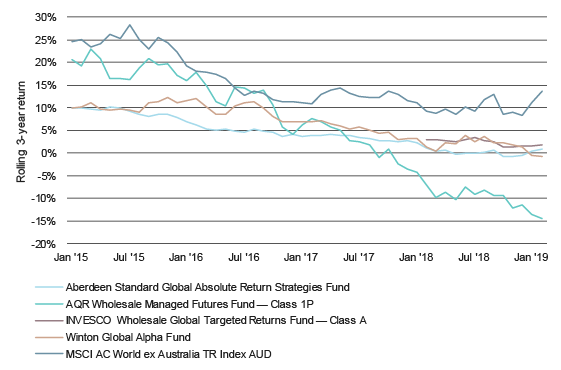

The appeal of alternatives is due in no small part to their track record during the global financial crisis, which saw strategies like managed futures deliver positive returns even as market panic reached its crescendo. As the chart below shows, global managed futures funds like the Winton Global Alpha Fund outperformed global shares, which remained beaten down for around four years after the GFC.

Managed futures outperformed following the GFC

Source: Lonsec

The Winton Global Alpha Fund, which is a managed futures strategy for example generated 25.6% for the year ending 2008 compared to global equities which generated -26% (MSCI AC World ex Australia TR Index AUD). However, as the chart also shows, extrapolating such exceptional performance into the future is dangerous and can lead to a mismatch between expectations and reality.

Diversification does not mean downside protection

While certain alternative strategies performed exceptionally well during the GFC, most financial advisers will tell you that recent performance has been mixed at best. The chart below shows rolling three-year returns for a range of alternative strategies, including multi-asset strategies (Invesco and Aberdeen) and managed futures (AQR and Winton).

Performance has been divergent, highlighting the heterogenous nature of alternative assets even among similar strategies. Some alternatives products have generated negative returns during periods when equity markets were relatively strong and have also struggled to protect capital in down markets.

Managed futures have struggled in recent years

Source: Lonsec

This brings us to the major issue investors must understand when thinking about alternatives: diversification is not downside protection. Alternative assets may provide protection in certain market environments, and certainly there have been periods when this has been the case, with the GFC being the most powerful case study. But when markets are volatile and there is no clear trend, investors should not expect alternatives to rescue their portfolio.

Take managed futures as an example. These strategies seek to identify price trends across a range of asset classes (equities, bonds, commodities and currencies), using futures contracts to take long and short positions. A key contributor to the underperformance of these strategies in recent periods has been the lack of persistent trends within these asset classes. In the case of multi-asset strategies, the lack of market volatility (at least until very recently) has made it challenging to generate alpha through relative value trades.

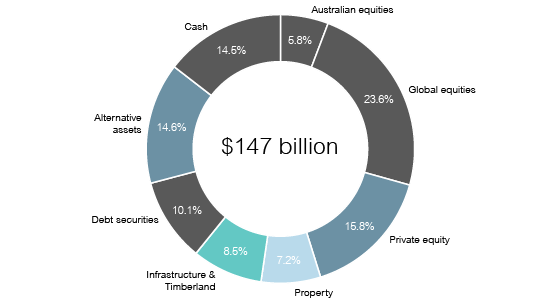

A better way to incorporate alternatives in your portfolio

Despite some common misconceptions, alternatives can be an invaluable part of your portfolio if you understand what they can and cannot do. Indeed, alternatives are a mainstay of many institutional portfolios, as well as major not-for-profits like some of the big US college endowment funds. We don’t have to look far afield to Australia’s own sovereign wealth fund, which has significant exposure to alternative assets. As at the end of 2018, 14.6% of the Future Fund’s assets were invested alternatives, which does not even include the allocations to private equity, property and infrastructure.

Future Fund asset allocation

As at December 2018

Source: Future Fund, Lonsec

Alternative assets provide a different source of returns to traditional assets, which can be beneficial to portfolios where there is heightened uncertainty and a risk of markets moving up and down. They may offer downside protection in certain environments, but they should not be positioned within a portfolio as an ‘insurance policy’ against down markets. Considering the market outlook over the next 12 months, we believe that markets will be characterised by periods of heightened volatility.

Central bank policy will continue to be a major driver of sentiment, and market reaction to themes such as the US-China trade war and Brexit will continue to contribute to volatility. If this is the case, then it will likely continue to be a challenging period for managed futures. Lonsec’s preference is to allocate to diversified multi-asset strategies that are in a position to take advantage of the increased volatility.

However, given the heavy reliance on manager skill in the sector, manager selection becomes a very important factor, and understanding exactly what individual strategies bring to a portfolio and how they may perform in different market environments is critical. This is the foundation of Lonsec’s research-driven approach to portfolio construction. Alternatives can be valuable source of alpha and diversification, but choosing the right products means understanding which individual strategies are likely to achieve your portfolio’s objectives.

This article has been prepared for licensed financial advisers only. It is not intended for use by retail clients (as defined in the Corporations Act 2001) or any other persons. This information is directed to and prepared for Australian residents only. This information may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.