The date for Britain’s departure from the European Union is still very much TBC. Prime Minister May went to Brussels to ask for an extension beyond the 29 March deadline, and assuming a deal is finally agreed to by the House of Commons, Britain will have until 22 May to complete the withdrawal. If a deal doesn’t pass, the cliff-edge is moved back to 12 April.

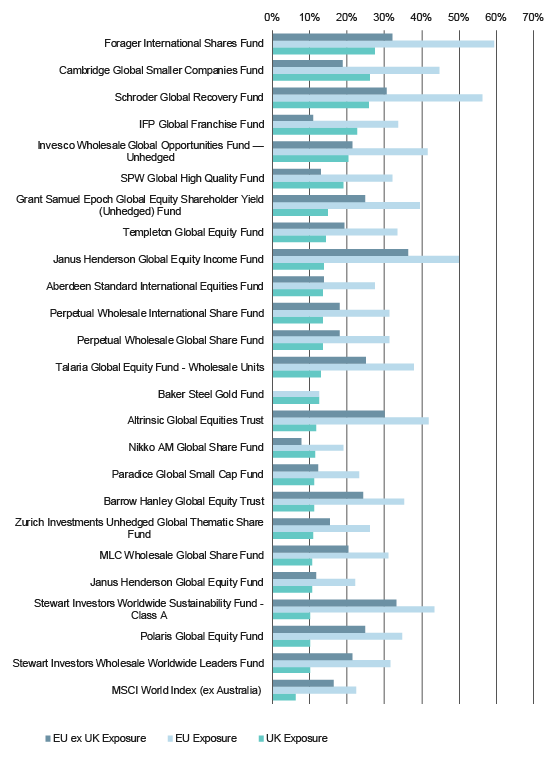

While the British parliament is adamant that a no-deal scenario must be avoided, a ‘hard Brexit’ remains on the cards so long as no deal is forthcoming. Then again, even if a deal is made, it is difficult to know what the ramifications will be for markets and the economy. Given the event risk this represents, Lonsec has surveyed the global equities universe to create an overview of product exposures for the UK and Europe. The UK represents 6.2% of the MSCI World ex Australia Index and the EU countries ex-UK represent 16.3%. In short, at least one fifth of the index is directly exposed to Brexit.

These exposures presented below represent a point-in-time snapshot (December 2018) and are subject to change as these are actively managed strategies. It is worth noting that any adverse outcomes for fund managers who are over- or under-exposed to the UK and Europe could be largely offset by subsequent currency movements.

Several managers have significant UK and EU exposure

The below chart shows global equity funds with greater than 10% exposure to the UK. For comparative purposes, the reference index’s composition includes 6.2% exposure to the UK.

Global equity fund managers’ European exposure (%)

Source: Lonsec

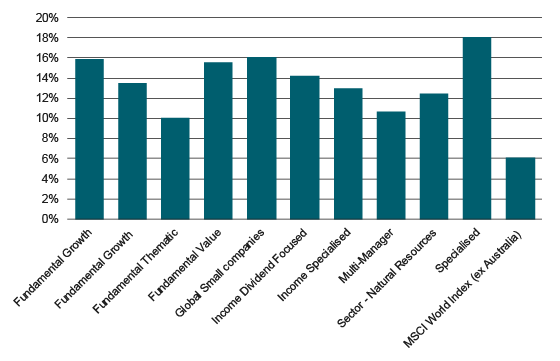

Value managers tend to have the highest Brexit exposure

The below chart demonstrates the propensity for ‘value’ managers to be overweight UK domiciled securities. Value investors typically target stocks which they deem to be trading at below their intrinsic value and are therefore not representative of the company’s long-term fundamentals. Lonsec posits that this could be reflective of the harsh depreciation that UK securities have experienced during the Brexit fiasco, which on this metric could be looking attractive to ‘value’ orientated investors.

Average UK exposure by sub-sector (%)

Source: Lonsec

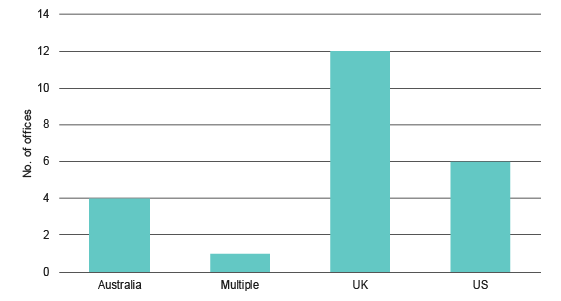

Location of fund manager’s HQ can create an investment bias

The below chart illustrates the proclivity for global equity fund managers domiciled in the UK to be overweight domestic equities. This may be reflective of a home bias which is common for fund managers due to the greater familiarity and understanding of their domestic market.

Office locations of managers with >10% UK exposure

10% UK exposure” width=”561″ height=”301″ class=”alignnone size-full wp-image-5666″ style=”margin: 0;” />

10% UK exposure” width=”561″ height=”301″ class=”alignnone size-full wp-image-5666″ style=”margin: 0;” />

Source: Lonsec

Protecting against Brexit chaos

Given the significance of the European and UK markets, the Brexit issue is not one that investors can afford to completely ignore. The challenge, however, is not in the evaluation of the risks associated with different outcomes but in managing the uncertainty involved in determining both the market’s reaction to developments and the short- and medium-term economic impacts. For wealth managers who recommend global exposure for their clients, this creates an extra layer of complexity in determining appropriate investment products and asset allocations.

The Brexit issue, along with other geo-political risks, are actively considered by Lonsec’s investment committees and feed into our model portfolio weights. Addressing these challenges requires a diverse mix of expertise, combining macro-economic, portfolio management, and research capabilities. For those interested in the broader topic of managing uncertainty in a portfolio context, our upcoming Lonsec Symposium is a must-attend event that will draw on the knowledge of Australia’s leading strategists and retirement experts.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2019 Lonsec Research Pty Ltd, ABN 11 151 658 561, AFSL 421 445. All rights reserved. Read our Privacy Policy here.