When industry funds first came on the scene in the 1990s, the member contribution rate was three percent of wages and there was one investment strategy that applied for all members. The last thing trustees were thinking about was the need to cater to the increasingly complex advice needs of their members before and after retirement. Fast forward to today and the situation is very different. As fund membership grows and average account balances rise, the need to support advice is becoming critical.

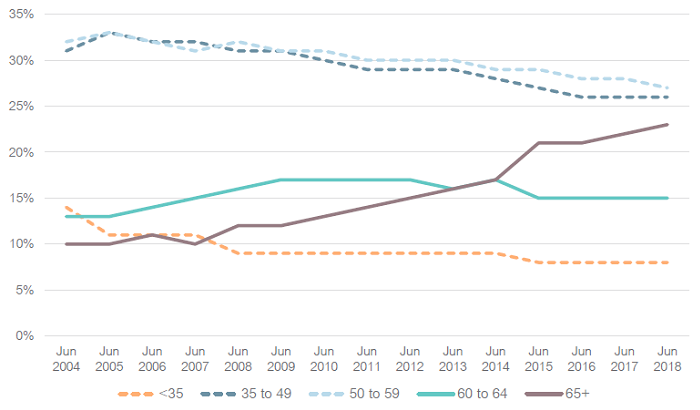

To get a sense of how significant the advice challenge is across the whole super industry, consider how membership has changed over the past decade. As the chart below shows, there has been a steady decline in the proportion of benefits accruing to members under 65, while the proportion accruing to older members, including those over retirement age, has been rising.

Proportion of member benefits by age group – all fund types

Source: SuperRatings

For industry funds this means there is a need to adapt to the increasingly sophisticated needs of their members in retirement. Industry funds are now keeping more post-retirement members in their fund, rather than seeing them shift to a retail fund or SMSF. The larger the member account, the more likely the member is to consider leaving their money in the fund during the retirement phase. While the average account balance across all industry funds is not incredibly high, there is significant variation across individual funds.

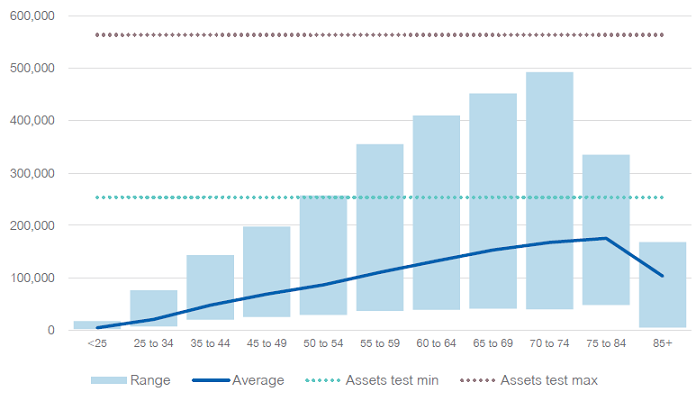

Average accounts – industry funds 2018

Source: SuperRatings

In the 70-74 age bracket, the average account balance is well under $200,000, but there are funds out there with significantly higher average balances, with the largest ranging as high as $600,000. This gives rise to a range of different product and advice needs depending on the member’s situation. For members with relatively low account balances, the age pension can be used to manage investment risk. For members with larger account balances, their advice requirements will be closer to those in an SMSF.

The reality is that member advice needs are moving well beyond the capacity of the inhouse advice provided by the funds themselves. To meet the advice challenge, funds are increasingly turning to third party advice, but there is still some reluctance to support members in accessing advice outside the fund.

In the past there has been an element of tension between super funds and financial advisers. From the super fund’s perspective, the adviser is a possible threat to member retention and can disrupt the fund’s engagement process. For the adviser, the super fund can sometimes seem like a closed shop, unwilling to give up control of the advice experience or shed any real light on its investment process, structures and strategy.

Third party advice networks facilitate greater reach through their advice channels, while concerns over quality control can be managed through the delivery of accurate and timely information to advisers and dedicated monitoring. While funds must be prepared to give up some control, advisers will need to work harder to ensure their advice is in their clients’ best interest. The limitations of many advice businesses have been laid bare by the Royal Commission and there will likely be significant turnover in coming years, with more advisers distancing themselves from aligned groups. This provides an opportunity to support and build traction within the new advice landscape.

Many funds are already recognising this opportunity, but generally industry funds still have a way to go in embracing third party advice. According to SuperRatings’ data, only 59% of Not for Profit (NFP) funds have formal relationships with advisers, which have traditionally been the domain of retail funds through vertically integrated business functions. Even fewer NFPs have a dedicated servicing team for third party advisers – only 46% compared to 68% of Retail Master Trusts (RMTs) – which is essential for enabling advisers to provide a competitive service.

Industry fund support for third party advisers is lagging

| Third party adviser servicing | Not for profit | Retail master trust | All funds |

|---|---|---|---|

| Formal relationships | 59% | 84% | 69% |

| Third party adviser panel | 15% | 15% | 15% |

| Dedicated servicing team | 46% | 68% | 55% |

| Adviser portal | 12% | 57% | 29% |

| Ability to transact | 15% | 73% | 38% |

| Access to client reports | 38% | 92% | 60% |

| Facilition of fee payments | 67% | 92% | 77% |

| Provision of data feeds | 8% | 81% | 37% |

Source: SuperRatings

Funds and advisers need each other, but how can they go about creating mutually beneficial and trusting relationships? The answer is by sharing information and being transparent about members’ needs. For advisers, this means having access to high quality investment product research that enables them to efficiently assess a wide range of NFP, retail and corporate funds, and ensures they have an in-depth understanding of how each fund stacks up.

Equally, super funds need to support this process by giving advisers the information they need to make decisions in their client’s best interest. Transparency is no longer a radical strategy for super funds – it not only reduces friction for the adviser and their client by making it easier to do business, it means that the adviser is in a position to assess the product and consider it for their client. Communicating third party assessments, such as Lonsec’s well recognised investment option ratings, also helps advisers to easily identify and justify high quality superannuation offerings.

We expect to see significant changes in funds’ external advice offerings in coming years, particularly as funds continue to report growing success in this area. SuperRatings is supporting this evolution by making its specialised superannuation research available to financial advisers via Lonsec’s market leading iRate platform, giving advisers the tools to make in-depth fund comparisons and ensure that they can fully justify their fund decision on a best interest basis.

With potential risks over default models and concerns about the sustainability of the old model, it is impossible for funds to ignore these opportunities. While funds and advisers might not always see eye to eye, they can’t afford to allow their differences to get in the way of the vast opportunity staring them in face.