In what has since been touted as ‘Miracle May’, investors welcomed the shock federal election outcome, which saw the Morrison government returned to power for another three years. The Monday following the election weekend saw the S&P/ASX 200 Index surge in a post-poll relief rally, adding approximately $33 billion to its market capitalisation in what was the single largest gain this year. Much to the embarrassment of the political pundits who had boldly claimed a Labor victory was inevitable, the Coalition managed to secure a majority government in the face of pessimistic opinion polls and betting markets.

Investors have experienced a mild reprieve from some of the recent negativity, while the more pessimistic scenarios have been tempered by upcoming tax cuts—equivalent to around 0.5% of GDP—along with the prospect of further rate cuts from the RBA, APRA’s move to lower the serviceability buffer for home loans, and the removal of downside risk associated with Labor’s tax policy. At the same time, strong commodity prices are boosting export receipts and the government’s fiscal position. However, global risks remain, highlighted by the RBA’s concern about the US-China trade war, and some not-so-subtle indications that the Australian economy is in need of some real structural reform to take the pressure off monetary policy.

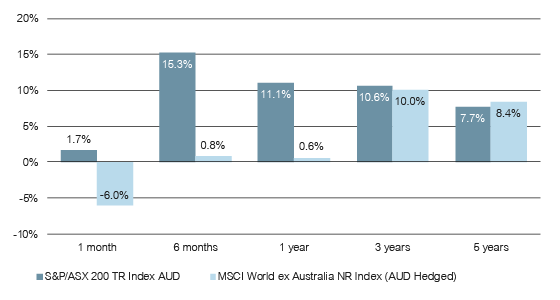

Period returns to end May 2019 (% p.a.)

Source: FE, Lonsec

Leading up to the election, equity markets had fully priced in a Labor victory, which had placed significant downward pressure on valuations, in part due to the proposed overhaul of the current taxation laws. As such, when the ‘Messiah from the Shire’ was safely returned to the lodge, investors reacted with exuberance, which saw the S&P/ASX 200 TR Index generate a 1.7% return for the month of May. While in isolation this may seem uninspiring, contrast this with the MSCI World ex Australia NR Index (AUD Hedged), which fell -6.0% over growing concerns of a synchronised global slowdown in concert with the on-again, off-again escalating US-China trade war. Resultingly, Australia was the only advanced economy able to buck the trend during the month of May and enjoy gains in its equity market.

Broadly speaking, investors had shifted their asset allocation away from domestic equities in anticipation of the abolition of excess franking credit refunds. The reason for this was two-fold. Returns on fully-franked securities were anticipated to decline, which in conjunction with a static equity-risk premium necessitated a lower entry price to entice prospective investors. Furthermore, the existing system favours an overweight allocation to domestic equities due to the favorable taxation treatment for those in a zero-tax environment.

Logically, once this incentive is removed, capital outflows overseas will likely ensue. In tandem with this was the proposed halving of the capital-gains tax concession which would have significantly dinted the value proposition associated with investing in property and shares. As such, simply maintaining the status quo was enough to see an extensive re-rate across the market throughout May.

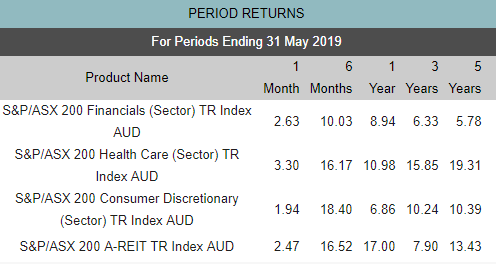

The Financials sector was one of the largest beneficiaries of the election outcome, with the ‘big four’ surging 6–10% on the Monday following the election. Once the animal spirits had subsided, this translated into a 2.6% gain for the S&P/ASX 200 Financials TR Index for the month. Labor’s proposed negative gearing limitations, CGT amendments, increased bank levies and more onerous restrictions on mortgage brokers had all coalesced into an unfriendly environment for future bank earnings. This is in stark contrast to the reform-shy Coalition, which was rewarded for sticking with the status quo. Given then Treasurer Morrison was opposed to a Royal Commission into Financial Services, it is perhaps unsurprising that this sector received a healthy post-election bump.

Likewise, A-REITs enjoyed a surge with the S&P/ASX 200 A-REIT TR Index achieving a 2.5% return for the month of May. This was again attributable to more sanguine housing market sentiment with the threat of proposed changes to negative gearing and CGT discounts now ameliorated. Specifically, Stockland, which is one of Australia’s largest diversified property developers, has since rallied 14% due to its large residential property exposure. The subsequent dovish pivot by the RBA, which cut interest rates to historic lows at its June meeting, has since provided additional tailwinds for the sector too.

Source: FE, Lonsec

Similarly, the Coalition government and health insurers are singing from the same hymn sheet, which saw the S&P/ASX 200 Health Care TR Index deliver 3.3% for the month of May. As above, the prospect of a Labor government mandating capped health insurance premiums and increased regulatory scrutiny had seen the likes of Medibank and NIB de-rate significantly prior to the election. However, following the surprise election announcement, Medibank and NIB subsequently shot the lights out and returned 11.5% and 15.8% at the close on Monday 17 May, respectively. More broadly, the perceived ability for the Coalition to demonstrate fiscal responsibility in the face of gathering economic storm clouds ushered in a 2.0% return for the S&P/ASX 300 Consumer Discretionary TR Index.

While it may have been ‘Miracle May’ for the Coalition and equity investors, unfortunately you can’t have winners without losers. Shareholders invested in Sportsbet’s parent company, Flutter Entertainment, were left aghast at the election result, given Sportsbet had presciently paid out on a Labor win. Equally, Clive Palmer has been left questioning his return on investment, following a $55 million advertising blitz that failed to deliver his party a single seat in parliament.

While miracles are always welcome by investors, unfortunately they are often unreliable when it comes to long-term, sustainable growth. While markets have received a nice boost, the weakness in Australia’s underlying position is difficult to ignore. The latest National Accounts data highlighted the extent of the slowdown, with quarterly growth just 0.4% and annual growth a meagre 1.8%. Households contributed just 0.1% to growth in the March quarter as heightened uncertainty, subdued confidence, and weakness in housing combined with still weak wages growth to constrain household spending. A miracle may have saved us in May, but we have to get through the rest of 2019 and beyond.