Bonds have been unrelenting in 2019, rising in stark defiance of investors who called a fade to the rally in late 2018, when the US Fed appeared determined to hike rates. This insatiable appetite for bonds has seen yields plummet to record lows in several markets, while the quantum of negative-yielding debt is climbing ever higher.

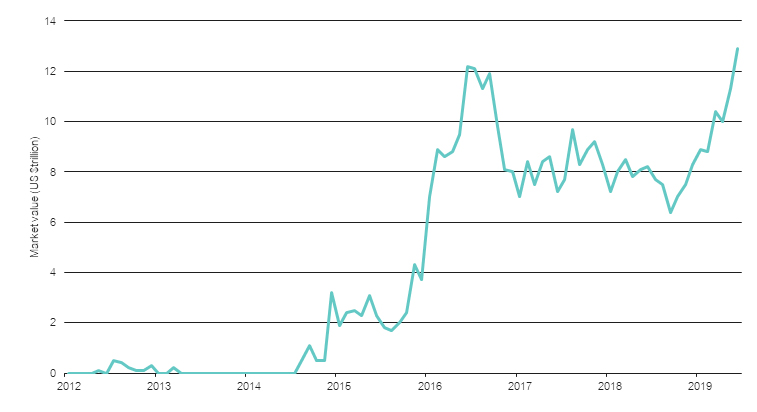

As the chart below shows, the market value of bonds tracked by the Bloomberg Barclays Global Aggregate Index has risen to nearly US $14 trillion and pushed above its 2016 peak. Negative-yielding bonds now make up around one quarter of the index. European safe-havens like Germany and France make up the lion’s share (if you can call it that), with more than 80% of Germany’s federal and regional government bonds in the red.

The value of negative yielding bonds has rocketed in 2019

Source: Bloomberg