Super funds are off to a positive start in the December quarter, regaining momentum following a rocky September and paving the way for double-digit returns for the 2019 calendar year.

While markets have come under pressure in recent months, super funds have once again proved they are up to the task of navigating the significant uncertainty in markets, geopolitics, and the global economy.

Super fund returns held up well in October, despite weakness from Australian shares and signs of softer economic growth globally. The major financials sector has come under pressure due to constrained lending, lower net interest margins, and continued fallout from the Royal Commission. IT shares also suffered a dip as investors questioned the lofty valuations of Australia’s local tech darlings.

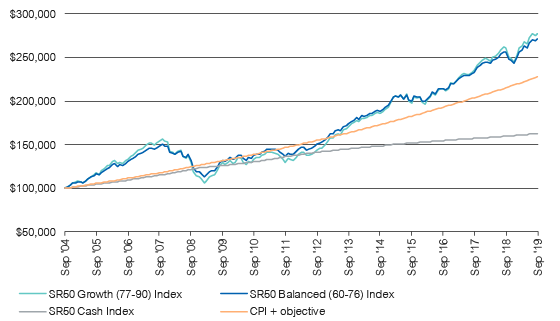

According to SuperRatings’ estimates, the median balanced option returned a modest 0.3% in October, but the year-to-date return for 2019 is sitting at a very healthy 12.5%. The median growth option has fared even better, returning 14.4%, while the median capital stable option has delivered a respectable 7.1% to the end of October.

Over the past five years, the median balanced option has returned an estimated 7.6% p.a., compared to 8.3% p.a. from growth and 4.7% p.a. from capital stable (see table below).

Estimated accumulation returns (% p.a. to end of October 2019)

| YTD | 1 yr | 3 yrs | 5 yrs | 7 yrs | 10 yrs | |

| SR50 Growth (77-90) Index | 14.4% | 11.9% | 10.1% | 8.3% | 10.1% | 8.5% |

| SR50 Balanced (60-76) Index | 12.5% | 10.5% | 8.9% | 7.6% | 9.1% | 7.9% |

| SR50 Capital Stable (20-40) Index | 7.1% | 6.8% | 5.0% | 4.7% | 5.3% | 5.6% |

Source: SuperRatings

Estimated pension returns (% p.a. to end of October 2019)

| YTD | 1 yr | 3 yrs | 5 yrs | 7 yrs | 10 yrs | |

| SRP50 Growth (77-90) Index | 16.4% | 13.3% | 11.2% | 9.4% | 11.4% | 9.5% |

| SRP50 Balanced (60-76) Index | 13.8% | 11.7% | 9.8% | 8.3% | 9.9% | 8.7% |

| SRP50 Capital Stable (20-40) Index | 8.3% | 7.7% | 5.9% | 5.5% | 6.0% | 6.4% |

Source: SuperRatings

“This year has provided further solid evidence of the ability of super funds to deliver for their members through a challenging market environment,” said SuperRatings Executive Director Kirby Rappell.

“Whether it’s the US-China trade conflict, the weaker economic outlook, falling interest rates, or the rolling Brexit saga, there’s been a lot for funds to take in. This has been a real test of their discipline and ability to manage risks on the downside. Growing wealth in this environment while protecting members’ capital is a tall order, but they have managed it well.”

Shifting asset allocation key to managing risk

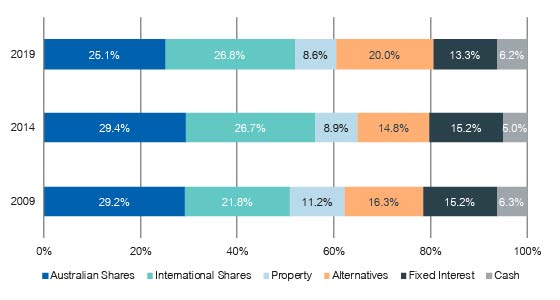

One of the most important trends in the superannuation industry is the broadening of members’ investments across different asset classes. Over the past five years, super funds have shifted away from Australian shares and fixed income and moved a higher proportion of funds into international shares and alternatives (see chart below).

Change in asset allocation (2009 to 2019)

Source: SuperRatings

The shift to alternatives is significant and has been the subject of debate within the industry. Alternatives include private market assets and hedge funds, which despite the negative connotations can provide an important source of diversification and downside protection when markets take a turn for the worse.

These assets tend to be less liquid, but they can play an important role for funds looking to generate income while managing risks for their members in a world characterised by low yields and growing uncertainty. However, funds should be clear about their alternatives strategy and the risks they could potentially add to members’ portfolios.

“This shift in asset allocation is in part being driven by the low interest rate environment, which has prompted super funds to reach for yield by allocating to alternatives and other less liquid assets,” said Mr Rappell.

“This isn’t necessarily a bad thing, and it may in fact result in a more robust asset allocation, but it’s something members should be aware of. Alternatives can help protect capital under certain market conditions, but they can also be used to boost returns by taking on some additional risk. We generally think the shift to a broader asset allocation is positive, but funds should not be complacent in ensuring risk is appropriately managed.”