In the wake of the most challenging quarter for financial markets in living memory, super members are scrambling to check their account balances to see what effect the sell-off is having on their retirement savings.

While members are undoubtedly nervous and wondering what the market has in store for them next, leading research house SuperRatings cautioned members against making investment decisions based on an emotional reaction to the current environment.

“Our message for super members, especially those further from retirement, is stay invested if you can,” said SuperRatings Executive Director Kirby Rappell.

“Knee-jerk changes to your portfolio could have a negative effect on your retirement. Switching to cash will lock in losses and mean you miss out on the upside when the market eventually recovers. We suggest members talk to their fund or financial adviser to help ensure any decision is aligned with a long-term strategy.”

Superannuation has been hit hard by the coronavirus and the market’s reaction to extreme measures such as social distancing, lockdowns, and travel bans.

According to estimates from leading research house SuperRatings, the median balanced option fell 8.9% in March and is down 10.0% over the quarter.

The median growth option, which generally has a higher exposure to shares, fell 12.5% in March and 14.1% over the quarter. The median capital stable option fared relatively well amid the market turmoil, falling only 4.1% in March and 3.8% over the quarter.

Accumulation returns to end of March 2020

| CYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a) | |

| SR50 Growth (77-90) Index | -14.1% | -6.4% | 3.1% | 3.7% | 6.8% | 6.5% |

| SR50 Balanced (60-76) Index | -10.0% | -3.1% | 3.7% | 4.3% | 6.7% | 6.5% |

| SR50 Capital Stable (20-40) Index | -3.8% | 0.4% | 3.1% | 3.2% | 4.5% | 4.9% |

Source: SuperRatings estimates

Pension returns have also been buffeted by the wave of selling. The median balanced pension option fell an estimated 10.2% over the March quarter, while the median growth option fell 14.4%. In contrast, the median capital stable option was down 3.8%.

Pension returns to end of March 2020

| CYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a) | |

| SRP50 Growth (77-90) Index | -14.4% | -5.9% | 3.7% | 4.4% | 7.8% | 7.3% |

| SRP50 Balanced (60-76) Index | -10.2% | -2.5% | 4.2% | 4.6% | 7.3% | 7.2% |

| SRP50 Capital Stable (20-40) Index | -3.8% | 1.0% | 3.8% | 3.7% | 5.1% | 5.6% |

Source: SuperRatings estimates

The only good news in March seemed to be signs of a relief rally as markets priced in the government’s fiscal stimulus packages and the Reserve Bank of Australia’s bond-buying program, along with similar efforts from governments globally.

While more pain is expected, markets have already sold off heavily in response to the coronavirus and the measures taken to contain it.

How is your super option exposed to market moves?

According to SuperRatings, times of severe market stress can make investors second-guess their long-term investment strategy. For super members, switching to a more conservative investment option in the middle of a crisis can lock in significant losses and mean missing out on the upside when markets inevitably recover.

Older members nearing retirement are likely to be in conservative balanced or capital stable options which have higher allocations to defensive assets, providing protection from share market movements.

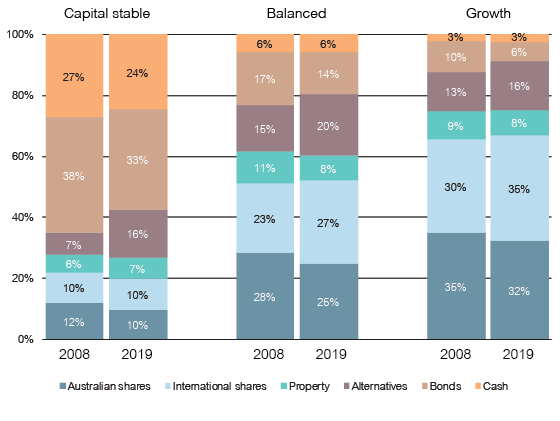

As the chart below shows, Australian and international shares generally make up just over half of the portfolio for a balanced option, with the rest invested in bonds, property, alternative assets, and cash. For growth options, shares typically make up around 67% of the portfolio, meaning members are more exposed to movements in share markets.

In contrast, members in a capital stable option will typically have only a 20% allocation to shares, with much higher allocations to bonds and cash, providing more stability and protection against share market swings.

Over time we have seen funds investing more in Alternative assets such as unlisted property, infrastructure and private equity, with these assets representing around 20% of the average balanced fund’s portfolio in 2019, up from 15% in 2008.

Asset allocation by investment option

Source: SuperRatings indices

Members need to keep the current market conditions in context. For most members, while there may be a fall on paper, the loss only becomes crystallised when members sell out. If you’re in the 20 to 40 age bracket, you have another 30 to 50 years to go before you need to start drawing down on your super. Even members in their 50s will need to rely on their super for drawdowns over the next 20 to 30 years.