A period of rapid change, coupled with the recent bout of heightened volatility, hasn’t aided the growing list of challenges facing the funds management industry.

The biggest challenge currently confronting fund managers within the Australian Equities sector (and potentially across most sectors) is one of survival. Fund management businesses that were already under pressure from insourcing investment management activities by super funds and low-cost index investing have now been hit with a significant loss of funds under management given downward market movements.

Lonsec Australian Equities sub-sector performance

| Sub-Sector | Average 1 mth | Average 3 mth | Average 1 yr |

| Absolute Return | -12.70% | -14.79% | -7.93% |

| Core / Style Neutral | -21.49% | -24.52% | -15.28% |

| Geared | -44.06% | -48.70% | -37.06% |

| Growth | -18.70% | -21.05% | -11.16% |

| Income Dividend Focused | -21.13% | -25.12% | -18.27% |

| Income Specialised | -18.80% | -22.16% | -16.17% |

| LIC | -18.44% | -24.62% | -12.01% |

| Responsible Investment | -21.31% | -24.12% | -14.51% |

| Value | -22.62% | -27.19% | -20.57% |

| Active Extension | -23.60% | -26.10% | -16.90% |

| Variable Beta | -17.25% | -19.89% | -13.30% |

| Microcap | -26.05% | -31.95% | -16.79% |

| Mid Cap | -21.16% | -25.41% | -18.19% |

| Small Cap | -23.72% | -27.96% | -18.43% |

Source: Lonsec. As at 31 March 2020

Boutique outfits without sustainable business models are increasingly susceptible to significant operational shocks in the current environment of uncertainty. Fund managers with lower funds under management are under increasing pressure to shore up their balance sheets and capital base via cost cutting or by entering into strategic partnerships. This is one key area of focus for Lonsec analysts currently reviewing the Australian Equities sector. That said, the underlying value proposition of boutiques remains compelling, with strong track records, high alignment with investors and autonomy to make decisions and set their own destiny.

The next challenge is the sheer uncertainty of what will happen next. The bottom up consensus earnings forecasts for flat growth in FY20 are not reflective of the current environment. The magnitude and duration of the virus induced disruption remains uncertain, attributing to market participants heavily discounting near term expectations. Over half of ASX 200 companies have downgraded or withdrawn earnings guidance due to the lack of visibility in assessing the extent and severity of the COVID-19 outbreak. Investors are now ready to disregard earnings this year and possibly well into 2021.

In an environment where ‘kicking the tyres’ is difficult, fund managers within the Lonsec universe are maintaining close contact with company management, looking at alternative sources of insights and closely monitoring news flow. While staying true to their traditional bottom-up approach, fund managers are also increasingly taking into consideration ‘top down’ risks, given the prevailing macroeconomic environment.

Importantly, fund managers within the Lonsec universe have stress tested their portfolios and conducted a review of their holdings, focusing on balance sheet resilience to help get through the current downturn. Any question marks around the strength of company balance sheets (i.e. high debt levels and low interest coverage ratios) has, in many instances, resulted in exiting its position.

The most recent drawdown has two stark contrasts compared to previous sizable downturns; the speed of the fall and the concentrated number of outperforming stocks. The dispersion of stock returns has spiked despite elevated sector correlations.

The consensus within the fund management community is that of cautious optimism, given Australia is already seeing the green shoots of a slowing of the spread and flattening the curve. This suggests that stocks exposed to the domestic economy will be direct beneficiaries.

A number of fund managers are taking advantage of opportunities in companies that benefit from the COVID-19 outbreak and stocks with leverage to a recovery. In particular, the surge in data usage emanating from government-imposed restrictions are positively impacting the likes of NextDC and Megaport. Supermarket operators Coles, Woolworths and Metcash are seeing a sharp bounce in their top-line sales as households hoarded a range of grocery staples including toilet paper and pasta.

As part of the ongoing review, Lonsec is monitoring for any ‘style drift’ in strategies chasing ‘high quality’ stocks.

History doesn’t repeat itself, but it often rhymes

If the GFC was any guide, one of the most profitable ways to generate short term gains was via capital raisings. This time is no different. A recent report by analysts at Macquarie who looked at the performance of 35 deals that had raised a combined $15.4 billion since 18 March 2020, found 74% of the deals were trading above their offer price, while raisings had on average returned 17% to date.

Within the small cap sector since late March to 22 April 2020, 29 companies raised capital totalling $5.4bn at an average discount of 22.2%. Only 6 of the 29 companies were trading below their placement price.

Many of these companies have benefitted from steps announced by regulators to facilitate capital raisings. In late March, and in response to the COVID-19 pandemic, the ASX temporarily increased the threshold to 25% (from 15%) for placements without needing to obtain shareholder approval. Last week, the waiver was amended to require additional disclosure by companies taking advantage of new share placements rules. Companies need to explain in detail how the shares are allocated, and which investors received stock, amid concerns existing investors are being diluted. For example, NextDC handed 20% of the stock issued in the placement ($672 million) to new investors at the expense of existing shareholders.

A large number of fund managers currently reviewed by Lonsec are taking advantage of this phenomenon, but the approach varies from taking their pro-rata allocation, investing in a stock with the intention of topping up at the capital raising stage, or using their networks to get an allocation despite not having previously held a position in the company.

Fund managers are finding new sources of dividend income

Fund managers across the board are expecting company dividends to come under pressure due to liquidity concerns and balance sheet stress. The ability to cancel or delay dividends may prove an important source of funding to preserve balance sheets and may also help avoid dilutive equity raisings. Fund managers expect any unpaid dividends to be kept on balance sheets as retained earnings for future dividends.

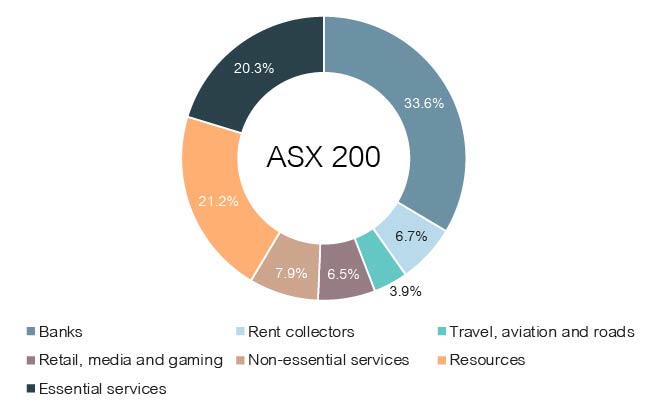

% of dividends exposed to COVID-19 disruption

Source: AMP Capital

As at 30 March 2020, ASX 300 dividends announced but not paid totalled around $14 billion. Of these around $450 million have been cancelled and $540 million deferred.

Lonsec expects all Income strategies to be impacted as dividends for banks, property and infrastructure companies are expected to decline as companies try to counter demand shocks through rapid cash conservation measures. For example, National Australia Bank recently cut its dividend by 64% to protect their capital positions in anticipation of rising bad debts. Historically (over the last five years), the Financial Services sector and Materials sector have paid 33% and 27% (respectively) of total dividends (net) paid by companies.

The market expectation is for average DPS to fall in the region of 25–30%, but fund managers expect this to recover by 2022. Prior to the current crisis, yield (cash dividend plus franking) was near 7% (add a further 2% for option-based strategies). These numbers will obviously fall, but the belief is they are unlikely to approach the level of bond yields.

Importantly, fund managers have found new homes in their quest for yield. Resources stocks are the new ‘kids on the block’ when it comes to dividend payers. Resources companies are benefiting from strength in commodity prices, weakness in Australian dollar and strong balance sheets. Stocks such as Rio, BHP and Fortescue now within the ‘low probability of dividend cuts’, whereas the previous ‘annuities’ being the bank dividends are under continued pressure. Lonsec notes that given resource companies are generally capital intensive, cyclical (commodity cycle), and have higher operational risks, they are not the best ‘through the cycle’ dividend plays. For example, BHP had to cut its dividend following the Samarco dam disaster.

Dividends will be cut, making the avoidance of dividend traps more important than ever. It is important for fund managers to be cognisant of the potential for stocks to cut their dividends and adjust their portfolios accordingly, rather than just remaining systematically overweight those stocks with the highest historical yields.

Managers are getting ahead of the regulatory curve

The ban on short selling during the GFC opened up a lively debate on how markets should function. While the merits of a short selling ban may be dubious, fund managers are nonetheless prepared for this. While this would not be a big deal in isolation, fund managers need to make sure they are not exposed to many illiquid or highly shorted names. In the event of a short selling ban, history suggests that many would more actively use shorting of the index for hedging purposes.

Similar to past crises, the COVID-19 outbreak will mark a key point in history. Key structural trends are likely to emerge, and fund managers have begun pondering the implications for their strategies. Themes include the transition to a more digital world and focus on automation, having been further highlighted by the enforced digitisation of workplaces. Changing consumer behaviour such as an increase take up of e-commerce and the fragility of global supply chains have also been brought into stark attention. How these broader trends will impact the economy is a different question, but they will undoubtedly work to reshape the future investment landscape.