The COVID-19 crisis is a living example of how an extraneous shock to economies can result in a rapid change in market dynamics and swings in sentiment as investors struggle to parse a constant flow of incoming news and data.

In this environment, the investors need two things to weather the storm: firstly, the discipline to stick to their long-term investment strategy, and secondly, the ability to quickly implement tactical changes to their portfolio to manage risk and take advantage of opportunities as they appear.

The value of timely implementation can have a very material impact on the performance of your portfolio even in relatively normal market conditions. During periods of market stress, timeliness becomes essential to protecting wealth, taking advantage of value in certain companies or sectors, and benefiting from the recovery when it happens. In this market, failure to implement changes quickly can even be fatal to your long-term strategy.

To be clear, timeliness does not mean timing the market. There is a big difference between trying to pick the top or bottom of a market cycle and being able to implement tactical changes quickly. Given the uncertainty that investors face, especially in periods of heightened volatility, timing the market is usually a losing game.

However, once you have identified a risk or opportunity in the market, the faster you can adjust your portfolio, the more value you can extract from your tactical views before market conditions change. As COVID-19 has taught us, things can change very, very fast.

The true cost of delayed implementation

Timely portfolio implementation is more than just an academic exercise. It can have a very real impact on the long-term value of your investment.

This can be demonstrated by taking a look at some key portfolio changes that Lonsec Investment Solutions has made to its Core SMA and comparing the effect of immediate versus delayed implementation. To get a meaningful comparison, we need to look at the difference in performance over at least one year.

As an illustration, in April 2019 we decided to remove Computershare (CPU) – an IT sector share – from our Core SMA and add Aristocrat Leisure (ALL) – a Consumer Discretionary sector share. Our view was that CPU had performed strongly over the past two years, but that a lack of organic growth across some of its divisions meant it was time to take profit. Similarly, ALL was attractive due to the growth in its digital revenue, driven by recent acquisitions, and we believed this would continue.

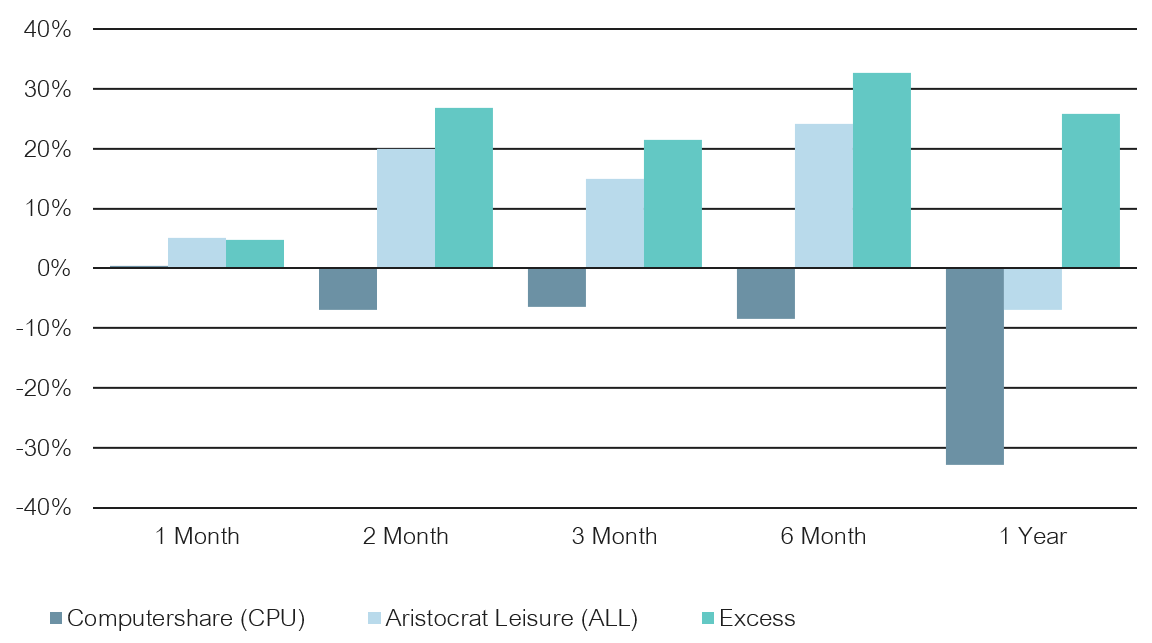

The charts below show the performance of each share over the subsequent year and the cost of delaying implementation, measured by the excess return forgone as a result of delay.

CPU and ALL performance over 12 months

Both ALL and CPU took a big hit in March 2020 due to COVID-19, but ALL’s growth over the preceding period, compared to CPU’s flat trajectory, meant the portfolio change ultimately resulted in significantly better performance.

What would have happened if we delayed this implementation?

Effect of delayed implementation on Core SMA returns

Return since portfolio change 17 April 2019

As the above chart shows, delaying implementation by one month would have meant losing out on 4.8% in excess returns (the difference between ALL’s and CPU’s performance). However, moving this out to a two-month delay sees a vast increase in the cost to investors, namely 26.9% in missed excess return. Wait six months, and this rises even more to 32.7%.

Once an opportunity in the market has been identified, it needs to be taken advantage of immediately for the investor to benefit from it. If portfolio changes are made to reduce risks, then the investor can not only miss out on the upside but may end up taking a harder hit to their portfolio that could have ramifications for long-term performance.

Using managed accounts to facilitate rapid implementation

Over the past three months, Lonsec has made a number of changes to its suite of managed portfolios and SMAs, ranging from asset allocation adjustments through to individual fund manager and stock changes. These changes have been made to further diversify the portfolios, manage risk, and take advantage of investment opportunities where there has been significant dislocation in markets and value has been identified.

In such an environment, the ability to implement in a timely manner has been important as market dynamics have shifted quickly.

The managed account structure has facilitated the efficient implementation of these changes. In practice, the process of making an investment decision – from the time the investment committee meets, to the implementation of the changes, through to the communication of these changes to advisers and end-investors – takes around two days.

Compare this to the conventional process: an investment decision, the adviser produces a Statement of Advice (SOA) that’s sent to the client, the client confirms the changes, and then the adviser implements the changes to the client’s portfolio, but only after they’re done making changes to other portfolios.

For those running their own portfolio through an SMSF, the challenge is in identifying opportunities and risks, identifying the necessary changes, and then implementing them quickly. For this process to work smoothly, the investor needs to be continually monitoring the markets and the portfolio’s position while taking an active role in managing exposures.

Unfortunately, neither scenario is ideal for investors or advisers who are time poor or lack the capability to actively manage their investments efficiently. Right now, advisers need to focus on running their business and helping clients through a period where many require more guidance than usual across a range of issues, from early access to super, business cash flow advice, government payments, and negotiating with the Australian Taxation Office. Likewise, individual investors might lack an understanding of how to align or tailor their portfolio to their financial objectives and needs.

A key benefit of managed accounts is the efficiency they offer and the ability to implement high quality, active investment strategies quickly. A large component of this efficiency relates to the fact that once someone is invested within a separately managed account (SMA) structure there is no requirement for the financial adviser to issue a Record of Advice (RoA) when portfolio changes are made.

For the average advice firm with an average book size, this represents a serious advantage. Advisers can be high-energy individuals but contacting 80 clients every time a change is made to the portfolio is a tall order. Not only is it inefficient, but by the time the adviser is part way through the process of implementing the changes and notifying clients, market dynamics have changed, and previously identified investment opportunities have faded away.

Changes made to managed and SMA portfolios are instructed to all relevant platforms usually within two days after an investment committee has recommended a change. This means that investors can be aligned to the recommended portfolio structure almost immediately, allowing them to capture the full benefits of portfolio changes.

The advantage this provides for financial advisers and end investors goes beyond saving time and making the process of portfolio implementation more efficient. As demonstrated, delays in implementation can cost investors, and in the long run can have a significant impact on investment performance and outcomes.

Issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Warning: Past performance is not a reliable indicator of future performance. Any advice is General Advice without considering the objectives, financial situation and needs of any person. Before making a decision read the PDS and consider your financial circumstances or seek personal advice. Disclaimer: Lonsec gives no warranty of accuracy or completeness of information in this document, which is compiled from information from public and third-party sources. Opinions are reasonably held by Lonsec at compilation. Lonsec assumes no obligation to update this document after publication. Except for liability which can’t be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the document or any information. ©2020 Lonsec. All rights reserved. This report may also contain third party material that is subject to copyright. To the extent that copyright subsists in a third party it remains with the original owner and permission may be required to reuse the material. Any unauthorised reproduction of this information is prohibited.