October was another positive month for superannuation, as confidence was high, in anticipation of lockdowns lifting and the economy opening up further. According to SuperRatings’ data, the median balanced option rose an estimated 0.7% in October, with the median growth option rising by a similar amount. While the median capital stable option was flat returning 0.0% in the month.

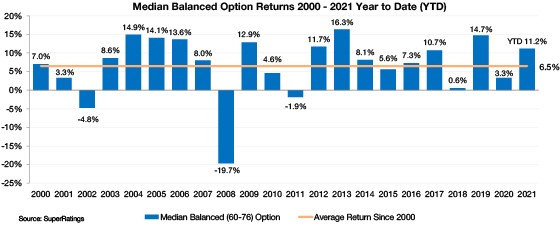

The 2021 calendar year to date has shown robust growth, with the median balanced option up 11.2%. This result remains well in excess of funds’ objectives and suggests funds are likely to record another year of healthy returns for members. SuperRatings Executive Director, Kirby Rappell, says “2021 has been a strong year for superannuation, with returns nearly three and a half times those of calendar year 2020 and almost double the yearly average for the past 20 years.”

Accumulation returns to October 2021

| FYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SR50 Balanced (60-76) Index | 2.5% | 18.0% | 9.1% | 8.7% | 8.0% | 8.8% |

| SR50 Capital Stable (20-40) Index | 0.9% | 7.1% | 4.8% | 4.6% | 4.6% | 5.4% |

| SR50 Growth (77-90) Index | 2.9% | 22.2% | 10.6% | 10.2% | 9.0% | 10.0% |

Source: SuperRatings estimates

Pension returns were also positive in October. The median balanced pension option returned an estimated 0.7% over the month and 11.7% over the calendar year to date. The median pension growth option returned an estimated 0.8% and the median capital stable option gained an estimated 0.1% through the month.

Pension returns to October 2021

| FYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SRP50 Balanced (60-76) Index | 2.5% | 19.3% | 9.9% | 9.6% | 8.6% | 9.8% |

| SRP50 Capital Stable (20-40) Index | 1.0% | 7.8% | 5.4% | 5.3% | 5.1% | 5.9% |

| SRP50 Growth (77-90) Index | 2.9% | 24.1% | 11.6% | 11.1% | 10.0% | 11.2% |

Source: SuperRatings estimates

November 1 also marked the beginning of the government’s new stapling legislation, intended to prevent multiple accounts being created for members when they move employers. The new stapled fund will be a member’s super fund for life, following them as they change employers, and will mean that employers will need to check with new employees if they have an existing superannuation account before creating a new super fund account for them.

Mr Rappell comments “While this legislation will cut down on members having multiple super accounts, it is really important that members check which fund they are stapled to, to see if its performance stacks up and fees are competitive, as this could have a significant impact on their final retirement account balance.”

SuperRatings also suggests making sure the insurance cover offered by your stapled fund is suitable for you, as one of the benefits of default super accounts created with each employer was that insurance may have been tailored to the workplace. “If you are unsure what insurance cover is suitable for you, many funds provide insurance needs calculators that can help and also offer advice services,” concludes Mr Rappell.

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au

Require further information? Simply visit www.superratings.com.au