Leading superannuation research house SuperRatings estimates that the median balanced option fell by -0.9% in May, as funds face into global market headwinds.

The Reserve Bank of Australia increased rates for the second month in a row, signalling that it is facing inflation challenges head on, with a 50 basis point rise applied to the cash rate.

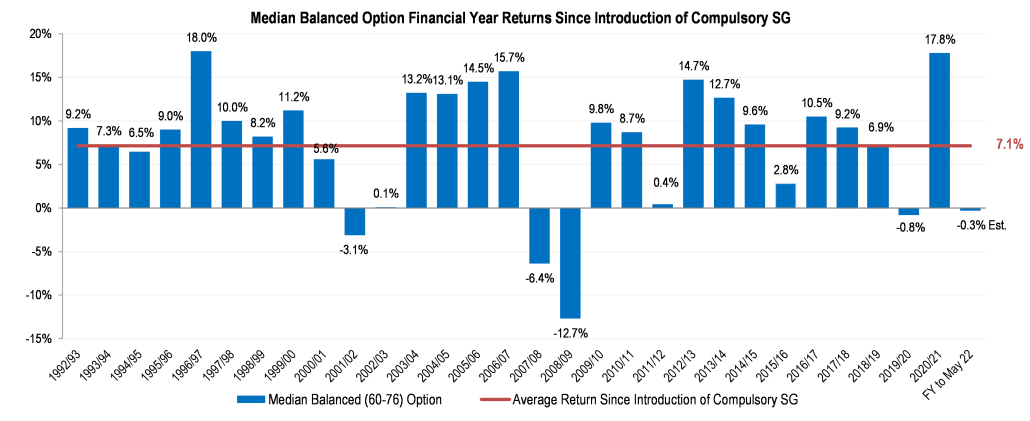

Our estimate of performance for the financial year ending 31 May 2022 has fallen slightly into the red at -0.3%, which is down from a return of 17.8% for the previous financial year.

Executive Director of SuperRatings, Kirby Rappell said, “It is not surprising to see a dampening in the performance of super funds, as the investment environment is very challenging lately. However, the benefits of diversification have been clear as the volatility of super fund returns remains much lower than share markets.”

Mr Rappell continued, “Whilst it has been a pretty challenging time for markets and savings, it is important to put this all into context. Superannuation is a long-term investment and funds have delivered strong performance on average over time. Markets and economies go through ups and downs, and while it’s hard to see your retirement nest-egg bouncing around, it’s important to remain focused on taking a long-term outlook and trying to avoid getting caught up in the noise.”

The median growth option declined by an estimated -1.2%. We saw capital stable options weather the storm somewhat, with a fall of -0.5% due to their greater exposure to bonds and cash.

Accumulation returns to May 2022

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SR50 Balanced (60-76) Index | -0.9% | 1.6% | 6.2% | 6.5% | 6.2% | 8.3% |

| SR50 Capital Stable (20-40) Index | -0.5% | 0.0% | 3.0% | 3.6% | 3.8% | 4.9% |

| SR50 Growth (77-90) Index | -1.2% | 2.3% | 7.6% | 7.7% | 7.2% | 9.6% |

Source: SuperRatings estimates

Pension returns also declined in May, with the median balanced pension option down an estimated -1.1%. While a drop of -1.3% was estimated for the median growth option and a fall of -0.6% was determined for the median capital stable pension option.

Pension returns to May 2022

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SRP50 Balanced (60-76) Index | -1.1% | 1.9% | 7.1% | 7.2% | 6.9% | 9.4% |

| SRP50 Capital Stable (20-40) Index | -0.6% | -0.2% | 3.2% | 3.9% | 4.0% | 5.3% |

| SRP50 Growth (77-90) Index | -1.3% | 2.4% | 8.3% | 8.5% | 7.9% | 10.7% |

Source: SuperRatings estimates

Financial Year Performance over Time

The chart below shows that the average annual return since the inception of the superannuation system is 7.1%, with the typical balanced fund exceeding its long-term return objective of CPI+3.0%. The estimated return of -0.3% for the financial year ending 31 May 2022 represents a slight dip and as you can see below, years in which performance has been negative are typically followed by bounce backs in returns and a positive outcome since 1992 is evident on average.

Check your Super

As a new financial year is approaching, now is the perfect time to think about your super and whether you have the settings right for your current situation. Running a health check on your super periodically is a great way to keep your super fit!

- Investment: check whether the investment option you’re in suits the level of risk, or amount of bumpiness in your balance, you’re comfortable with. Most funds have a risk profile tool on their website that can help you decide which investment option is most suitable for you. Having a look at performance for your fund is also important.

- Fees: check your fees. The typical total annual fee on a $50,000 account is approximately 1.1% of this balance. See how your fund compares to other funds and the broader market.

- Insurance: check the type of insurance and level of cover you have. Changes introduced in September 2019 mean that new members under the age of 25 will not automatically be given insurance when joining a super fund and members with a balance of $6,000 or less will not have insurance unless they opt-in. There are tools on fund websites that can help you understand how much cover might be right for you.

Kirby Rappell commented, “Getting the foundations right for your super is the best way to put yourself in good stead for a lifestyle in retirement that meets your needs. It is also beneficial to contact your fund and obtain guidance, support and advice to help set those foundations. Funds also provide access to advice service on investments, insurance, retirement and other topics to help you through the journey. This may be available through your fund directly or by using an adviser that is part of their network. Contact your fund to see what is available and how much it will cost – putting in the effort now can make a big difference to your future self.”

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au