The superannuation industry reached a major milestone on the first of July, with the superannuation guarantee system being in place for 30 years. However, it comes at a time of significant market turbulence, with fund performance dipping into the red this financial year. This is off the back of the growing challenges of inflation and interest rate hikes, as well as ongoing global supply chain difficulties due to COVID-19 and the war in Ukraine. Despite the market volatility we have observed over the period, $1 of super invested on 1 July 1992 in the median balanced option, with 60-76% growth assets, is estimated to be worth $7.67 today (depending on fees), underlining the significant benefits super has brought to Australians over the past 30 years.

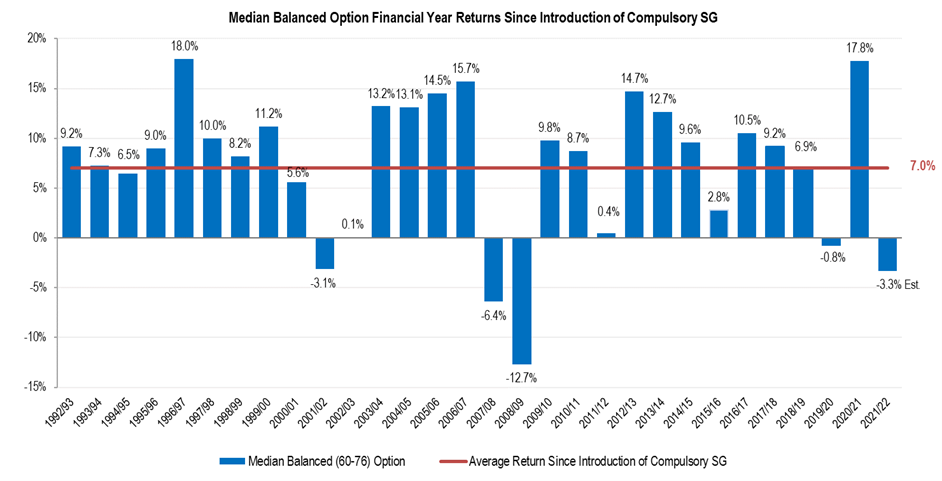

Leading superannuation research house SuperRatings estimates a return of -3.3% for the median balanced option for the financial year ending June 2022. This is the fifth time financial year returns have been negative since the inception of superannuation in 1992.

Executive Director of SuperRatings, Kirby Rappell said, “Funds have had a challenging second half of the financial year, dragging on a solid first half. This was the 5th negative return for balanced options we have seen since the introduction of super 30 years ago; however, it follows the second highest annual return of 17.8% in 2021. So, when you look at it over the last two years, members’ balances are up.”

Mr Rappell continued “Superannuation is a long-term investment and funds continue to provide strong long-term returns on average and have outperformed the typical CPI+3.0% investment objective. When you consider that share markets are down around 10-12% across Australia and globally, super funds have done well to prevent some of the steep falls that we have seen from being passed through to members’ super account balances.”

The median balanced option declined by an estimated -3.4% over June, while the median growth option reduced by an estimated -4.4%. While capital stable options which hold more traditionally defensive assets such as cash and bonds only fell by an estimated -1.7%.

Accumulation returns to June 2022

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SR50 Balanced (60-76) Index | -3.4% | -3.3% | 4.2% | 5.6% | 6.0% | 7.9% |

| SR50 Capital Stable (20-40) Index | -1.7% | -2.7% | 1.9% | 3.1% | 3.5% | 4.7% |

| SR50 Growth (77-90) Index | -4.4% | -4.3% | 5.1% | 6.8% | 7.0% | 9.1% |

Source: SuperRatings estimates

Pension returns also declined in June, with the median balanced pension option down an estimated -3.9%. The median growth option fell by -4.8% while the median capital stable option saw an estimated -2.0% return.

Pension returns to June 2022

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SRP50 Balanced (60-76) Index | -3.9% | -4.0% | 4.6% | 6.3% | 6.6% | 8.8% |

| SRP50 Capital Stable (20-40) Index | -2.0% | -3.2% | 2.0% | 3.4% | 4.0% | 5.1% |

| SRP50 Growth (77-90) Index | -4.8% | -4.9% | 5.4% | 7.3% | 7.6% | 10.2% |

Source: SuperRatings estimates

30 Years of Super Fund Performance

The chart below shows that the average annual return since the inception of the superannuation system is 7.0%, with the typical balanced fund exceeding its long-term return objective of CPI+3.0%. If we consider this in dollar terms $1 invested in the median super fund’s balanced option would now be worth approximately $7.67 depending on the impact of fees.

Perils of Timing the Market

We continue to emphasise the importance of setting a long-term strategy for your superannuation. We suggest members remain alert and review their superannuation settings such as whether they are in the most appropriate investment option for their situation and checking their fees. We encourage people not to panic and speak with their fund or an adviser they trust before making any changes to their superannuation settings.

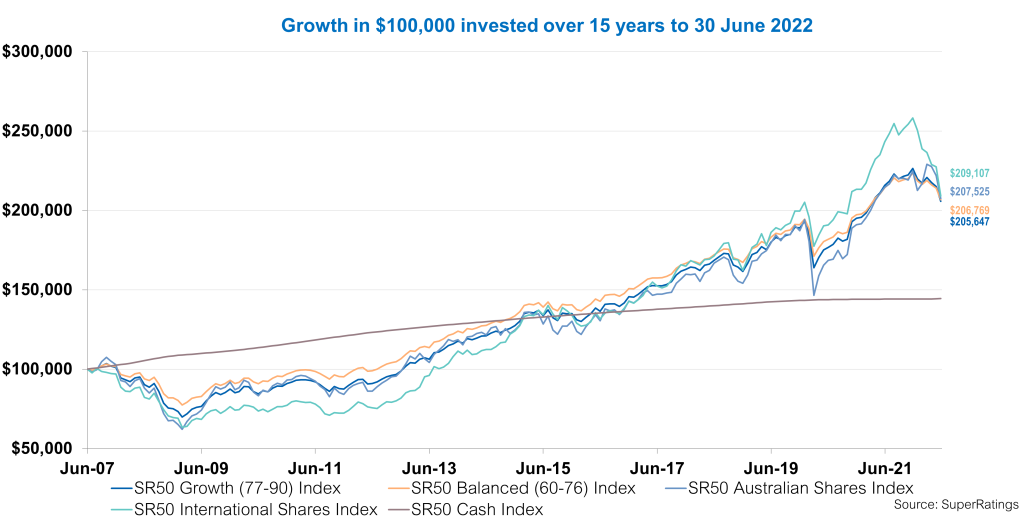

We found that a member who had a $100,000 balance and switched to cash from a growth or balanced option at the onset of the pandemic in March 2020 would be $35,000 to $45,000 worse off as at the end of June 2022. We continue to emphasise that while markets do dip at points over time, they are expected to recover over the longer term.

The chart below shows that over the last 15 years a member in the typical balanced option would have seen a balance of $100,000 in June 2007 grow to $206,769. A member in a growth option saw their balance accumulate to $205,647.

International Shares options have performed the strongest with the median option rising to $209,107, though it has been a bumpy ride across global markets in the last few years. While the median Australian Shares option sat slightly below its global counterpart at $207,525.

Mr Rappell commented, “Members should prepare for continued volatility with a rocky road ahead for investment markets. If you are not approaching or in retirement, keep in mind that all market movements in the short term are not the real story as you can’t access your money now. You only realise that loss if you switch investment options or take your money out, which would take away the opportunity to participate in any future recovery.”

“Whereas the current situation is more concerning for those nearing or in retirement. Typically, we see these members sitting in investment options which are less exposed to these market movements which lessens the impact of the bumps. The silver lining of the recent interest rate rises is it will help those deriving an income from fixed income assets, following the anaemic cash rate levels we have seen in recent years.”

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au