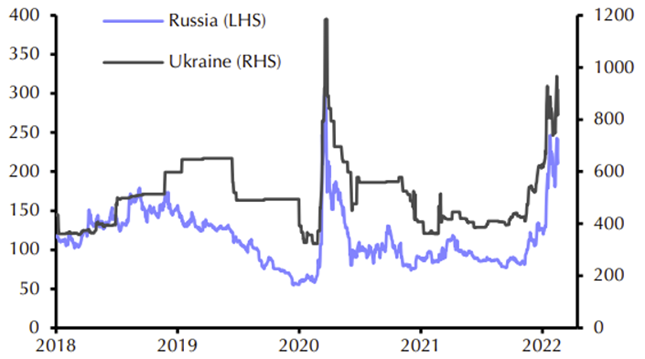

Given the impact the Russian-Ukraine conflict has had on financial markets, Lonsec has surveyed relevant Global Emerging Market Equity managers to ascertain their exposure to Russian, Ukrainian and Belarussian securities through the months of December 2021 to February 2022. Where such exposures are identified, Lonsec has also ascertained the underlying holdings and what steps managers have taken given the equity market fall-out from the conflict.

In terms of products with exposures, Lonsec notes that throughout the month of February 2022 the situation was fluid and highly volatile. Key market events included the closure of the Moscow Stock Exchange for all trading alongside major foreign exchanges suspending trading of all Russian Global and American Depository Receipts (GDRs/ADRs). These actions severely limited the optionality of asset managers to respond and transact as desired.

In light of this, asset managers who held Russian equity holdings in mid-to-late February 2022 have been forced to write these off entirely following a period of these being severely impaired. These actions have already been taken and are reflected in unit prices. Additionally, such managers have typically placed hard limits on not acquiring Russian, Ukrainian and Belarussian securities for the foreseeable future.

This report aims to outline exposure levels and commonly held Russian stocks from those relevant asset managers within the Global Equities – Global Emerging Market sub-sector, an overview of the Russian equity market alongside a more detailed sequence of events.

| Lonsec rated universe: Global Equities – Global Emerging Markets Funds Russian Exposure | Weights | |||

| APIR | Funds | 31-Dec-21 | 31-Jan-21 | 28-Feb-21 |

| ETL4207AU | GQG Partners Emerging Markets Equity Fund – A/Z Class | 15.1% | 8.3% | 1.3% |

| ETL3590AU | Ashmore Emerging Markets Equity Fund | 7.8% | 6.4% | 0.6% |

| ETL4930AU | NB EME Select Trust – I Class | 7.3% | 6.1% | 0.8% |

| ETL1713AU | NB EME Select Trust – W Class | 7.3% | 6.1% | 0.8% |

| LAZ0003AU | Lazard Emerging Markets Equity Fund | 7.2% | 6.5% | 2.4% |

| ETL0032AU | Aberdeen Standard Emerging Opportunities Fund | 6.3% | 6.0% | 1.5% |

| UBS8018AU | UBS Emerging Markets Equity Fund | 5.6% | 3.3% | 1.2% |

| VAN0221AU | Vanguard Active Emerging Markets Equity Fund | 5.4% | 5.0% | 1.2% |

| CHN8850AU | Redwheel Global Emerging Markets Fund | 4.1% | 4.0% | 0.2% |

| ETL7377AU | GQG Partners Global Equity Fund – A Class | 3.1% | 1.8% | 0.2% |

| PER0736AU | BMO LGM Global Emerging Market Fund | 2.6% | 2.5% | 1.4% |

| BTA0419AU | Pendal Global Emerging Markets Opportunities Fund – WS | 2.4% | 4.9% | 0.9% |

| ETL0201AU | Legg Mason Martin Currie Emerging Markets Fund | 2.3% | 2.1% | 0.2% |

| EMMG | BetaShares Legg Mason Emerging Markets Fund (Managed Fund) | 2.2% | 2.1% | 0.2% |

| FID0031AU | Fidelity Global Emerging Markets Fund | 1.9% | 2.5% | 0.4% |

| FEMX | Fidelity Global Emerging Markets Fund (Managed Fund) | 1.9% | 2.5% | 0.4% |

| FID0010AU | Fidelity Asia Fund | 0.0% | 0.0% | 0.8% |

| MSCI EM Benchmark | 3.6% | 3.2% | 1.6%* |

(*On March 4th, 2022, MSCI announced Russia would be removed from the Index effective March 9th, 2022)

MSCI Russia 25 / 50 Index constituents, index weights, performance and Lonsec Global Emerging Markets sub-sector portfolio representation as of 28 February 2022

| Stock name | Sector | Index Weight (%) | Performance (31 Dec 21 – 28 Feb 22) | No. of funds holding |

| GAZPROM | Energy | 21.1% | -51.5% | 5 |

| NK LUKOIL | Energy | 16.0% | -45.1% | 9 |

| SBERBANK ROSSII | Financials | 8.9% | -68.8% | 7 |

| GMK NORILSKIY NIKEL | Materials | 7.0% | -38.7% | 2 |

| TATNEFT | Energy | 4.8% | -47.5% | – |

| POLYUS | Materials | 3.6% | -40.5% | 2 |

| TCS GROUP HOLDING REPR CLASS A RE | Financials | 3.6% | -61.0% | 5 |

| SEVERSTAL | Materials | 3.1% | -38.6% | 2 |

| NOVOLIPETSK STEEL | Materials | 3.0% | -39.7% | – |

| MOBILE TELESYSTEMS PUBLIC JOINT AD | Communication | 3.0% | -30.8% | 2 |

| NK ROSNEFT | Energy | 2.9% | -64.1% | 2 |

| POLYMETAL INTERNATIONAL PLC | Materials | 2.7% | -52.3% | – |

| YANDEX NV CLASS A | Communication | 2.5% | -70.1% | 5 |

| SURGUTNEFTEGAZ PREF | Energy | 2.5% | -41.2% | – |

| AK ALROSA | Materials | 2.3% | -51.2% | – |

| PAO NOVATEK GDR | Energy | 1.9% | -83.6% | 3 |

| SURGUTNEFTEGAZ | Energy | 1.8% | -60.4% | – |

| X5 RETAIL GROUP GDR NV | Consumer Staples | 1.7% | -54.7% | 1 |

| MOSCOW EXCHANGE | Financials | 1.7% | -54.4% | 1 |

| INTER RAO EES | Utilities | 1.4% | -50.0% | – |

| UNITED COMPANY RUSAL | Materials | 1.3% | -41.4% | 1 |

| PJSC PHOSAGRO GDR | Materials | 1.1% | -71.7% | – |

| MAGNIT PJSC SPONSORED RUSSIA RU DR | Consumer Staples | 0.6% | -89.3% | – |

| OZON HOLDINGS ADR PLC | Consumer Discretionary | 0.4% | -66.7% | – |

| MAIL RU GROUP GDR LTD | Communication | 0.4% | -75.9% | – |

| HeadHunter Group PLC | Communication | 0%* | -70.6% | 1 |

| Fix Price Group Ltd – GDR | Consumer Staples | 0%* | -87.5% | 1 |

| Globaltrans Investment Plc | Industrials | 0%* | -89.7% | 1 |

* Not included with the MSCI Russia 25 / 50 Index

Timeline of events

January 2022

- The build-up of Russian troops along the border of Ukraine and heightened tensions compelled some Managers to reappraise the geopolitical risks and pair back their associated Russian exposures throughout the month.

February 2022

- Sanctions against Russia escalate throughout the month from the US, UK and EU. Asset managers faced increasing liquidity issues trading their Russian equities. On February 22, the US announced full blocking sanctions on several Russian banks and cancelled Russian sales of sovereign bonds on US money markets.

- February 24, Russian troops invade Ukraine which brings further international condemnation. As a result, Russia’s local bourse fell 40%.

- February 25, Russia’s Central Bank closed the Moscow exchange, suspending all stock and foreign currency trading.

- February 25, asset managers begin to severely impair their Russian assets and introduce fair value pricing to calculate unit prices due to the inability to trade and accurately price Russian assets.

- February 26, the European Union announces sanctions to limit Russia’s ability to access an estimated US$630bn in reserves to finance war and avoid the impact of sanctions being applied.

- 27 February, the US and EU announce a ban on Russian banks from the SWIFT interbank transaction system which is the backbone of the international financial transfer system. The sanction cuts Russia off from the international banking system crippling their ability to trade with the rest of the world.

- 28 February, major stock exchanges progressively introduced suspensions on trading Russian equity American Depository Receipts/Global Depository Receipts (ADRs and GDRs).

- 28 February, the Russian Ruble succumbs to heavy exchange pressure, weakening by over 20% against the greenback. In an effort to stabilise the currency, Russia’s Central Bank called an emergency meeting and increased interest rates from 11% to 20%.

- 28 February, asset managers begin to write down their Russian asset entirely.

March 2022

- 1 March, S&P Global Ratings downgrades several Russian banks and placed the ratings of another 19 on CreditWatch negative.

- 2 March, Russia’s Central bank desperately attempts to prevent a run on Russian bank reserves by announcing lower reserve requirements. The Central bank announced that the liquidity gap in the Russian banking system was US$68 billion dollars, a 27% increase in the gap in just one day.

- 3 March, the International Energy Agency unveils a 10-point plan to reduce Europe’s dependency on Russian gas. Europe currently is immensely reliant on Russian oil with roughly 40% of its gas supplied by Russia.

- 4 March, Major index providers, such as MSCI, FTSE and S&P begin to announce that the Russian market is “uninvestable” with indices recalculated by 9 March. All Russian assets were marked down to effectively zero.

- 4 March, the Australian Federal government called on Australian superannuation funds to divest Russian assets. Australian superannuation funds confirm that they are set to encounter losses of up to A$2bn on Russian assets when trading resumes on the Moscow Stock Exchange.

- 6 March, Visa, Mastercard and American Express announce that they will be suspending all foreign transactions associated with Russia.

- 8 March, countless top brands and industry leaders such as Disney, Exxon, Shell, Apple and McDonalds either suspend operations in Russia or make plans to wind them down. Further, the US announced a ban on all imports of Russian Energy in addition to banning exports of oil refining technology making it substantially more difficult for Russia to continue the modernisation of their oil refineries.

- 10 March, Russian companies begin looking into the possibility of relocating employees from Russia.

Conclusion

While share price movements have been severe in isolation, Lonsec notes that losses at an overall fund level have tended to be relatively contained given Russia makes up only a small proportion of emerging markets universe. There were however a small number of managers which had a material allocation to Russia through the early parts of 2022. While these exposures were progressively paired back in most instances, the write-off of the remaining holdings will however meaningfully impact Fund performance in the short-to-medium term.

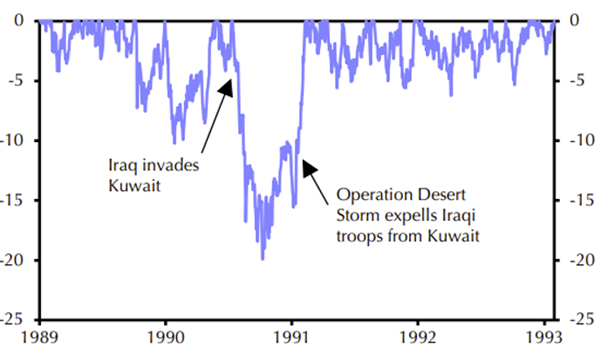

Regardless of direct exposure, Lonsec highlights that Russia’s invasion of Ukraine will continue to meaningfully influence financial markets for the foreseeable future given the long-lasting repercussions on global trade. The idea of a single and open global economy is now a distant dream given the geopolitical tensions between superpowers Russia, China, the US and NATO nations. This comes off the back of already fractured relations following the onset of the pandemic in 2020. The onset of war and related sanctions add fuel to an inflation bonfire initially lit by a resurgence in demand as the world emerged from the pandemic. Higher interest rates could well be imposed at an even quicker rate than expected, potentially stifling economic growth and asset prices in the process.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure as at the date of publication: Lonsec receives fees from fund managers or product issuers for researching their financial product(s) using comprehensive and objective criteria. Lonsec receives subscriptions for providing research content to subscribers including fund managers and product issuers. Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other advice. Lonsec’s fees are not linked to the product rating outcome or the inclusion of products in model portfolios, or in approved product lists. Lonsec and its representatives, Authorised Representatives and their respective associates may have positions in the financial product(s) mentioned in this document, which may change during the life of this document, but Lonsec considers such holdings not to be sufficiently material to compromise any recommendation or advice.

Warnings: Past performance is not a reliable indicator of future performance. The information contained in this document is obtained from various sources deemed to be reliable. It is not guaranteed as accurate or complete and should not be relied upon as such. Opinions expressed are subject to change. This document is but one tool to help make investment decisions. The changing character of markets requires constant analysis and may result in changes. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Where Lonsec’s research process relies upon the participation of the fund manager(s) or product issuer(s) and they are no longer an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2022 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This document is subject to copyright of Lonsec. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this document may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec.

This document may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.