Market Overview, Portfolio Performance & Positioning Update

Given the recent market conditions – increased volatility, fear of inflation, rotation away from growth and quality stocks towards cyclical and value stocks – we asked Lonsec’s Chief Investment Officer Lukasz de Pourbaix to give us an update on his views of the market and how Lonsec’s portfolios are positioned for the environment ahead. In this video, Lukasz provides an overview of Lonsec’s current asset allocation positions following the most recent Asset Allocation Investment Committee meeting, and explains how Lonsec’s portfolios are positioned to manage risk and recovery.

Transcript:

Hello, my name is Lukasz de Pourbaix, I’m the Executive Director and CIO of Lonsec Investment Solutions. Today, I wanted to give you an interim performance update on our managed account portfolios, and specifically in relation to market events, which has certainly caused increased volatility in markets.

What has occurred in markets during the last 12 months?

So what have we been seeing in markets over the course of this year? And I guess the one thing I’d point to is, we’ve seen US 10-Year Treasuries go up from about 0.9% at the end of last year to above 1.6%. So what does that mean? It means that, on the positive side, signals that the economy is recovering, and our view would be that we are seeing signs of economic recovery, we’re seeing improved payroll data, we’re seeing improved productivity numbers. So there’s a lot of things that are pointing to the right direction in terms of economic recovery. But at the same time, what the market has been factoring in is the prospect of inflation. So with all the stimulus, we’ve just seen the US approve $1.9 trillion worth of stimulus coupled with all the other stimulus we’ve seen over the course of the last 12 months, the market is worried that all of this stimulus and the accelerated recovery, will cause inflation. So from a market perspective, we’ve seen, and it started probably in November last year, a big rotation away from those parts of the market that are more growth focus, towards more of your value, your cyclical type of exposures, and the rotation has been very sharp and very pronounced. So if you think about the Australian market, for example, resources, and banks were up about 30% over the course of November last year. Conversely, sectors such as healthcare were down over that same period. So we’ve seen a very abrupt rotation. And if you sort of step back and think that for the last 10 years or so those cyclical and, in particular, value stocks have really struggled.

How have our Lonsec portfolios been positioned?

So from a portfolio perspective, if we look across the board, so the Listed diversified portfolios, certainly did have a bias towards that quality end of the market. So in terms of stocks, those stocks that have had solid balance sheets, have navigated the COVID environment very strongly. So if you think about some of those stocks, we actually had no stocks in the portfolio that needed to raise capital over that period, which goes to point out how strong some of those companies are. But what has performed well since November are some of those stocks that arguably are not in that quality part of the market, as well as some of your cyclical exposures. So the portfolios all in all have had underperformance notably, I’d say over the last three months. Now, we’re very well aware of this underperformance. And we recently had our investment selection committee, along with our asset allocation committee. And from a broad portfolio positioning perspective, so if you think back in terms of from an asset allocation perspective, how we’ve been positioned, we continue to think that risk asset, so equities, are where you want to be at this point in time, relative to bonds. And that equities still provide a reasonable risk premium to bond assets. So we’ve been underweight bonds, and we’ve been overweight risk assets. And we continue to believe that, over the medium term, that’s where you want to be positioned and the portfolios remain positioned in that way.

How are we diversifying our portfolios by investment strategy?

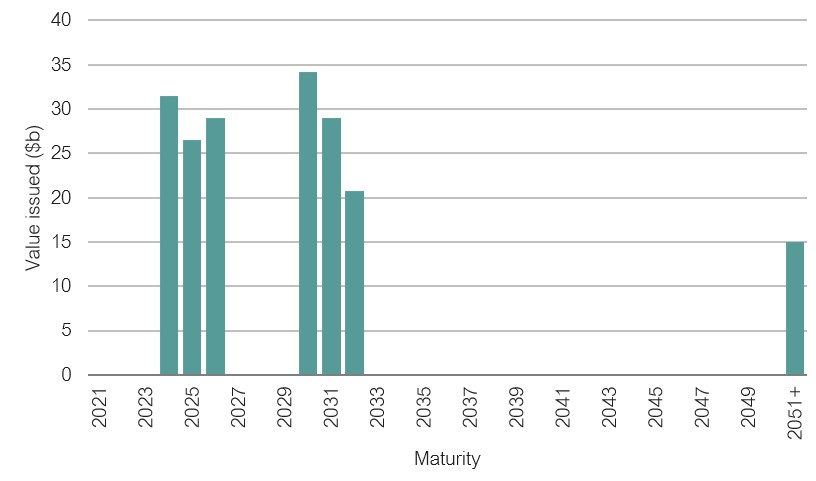

From a bottom-up perspective, in terms of investment selection, as I noted, we have been hurt over the last three months because of that bias towards some of the quality and defensive positions. And those positions have been there, from the perspective that while we think that markets and risk assets, in particular, are going to do well, we also note that there is the risk that the recovery may not be as strong, and we may see some stumbling blocks. So we do still want some of the defensiveness within the portfolios. Having said that, we are reviewing the portfolios at the moment and if you look at the Listed portfolios, where we’re focusing on is – do we add some more cyclical type of exposures just to balance some of the risks within the portfolio. So that is an area that we are exploring, particularly on the global equity side. We have already incrementally been doing that on the Australian equity part of the portfolio. And the other key area we’re focusing on is the bond part of that portfolio, which does have significant exposure to the duration or be it, we are underweight fixed interest. And we are looking at ways to further diversify the portfolios away from duration or interest rate risk within that defensive part of the portfolio. So, you recall, we did add Ardea back in January of this year, and that has proven to be a really good diversifier in this market environment. And we’re looking to further broaden that out. One of the challenges is obviously just identifying products because, in that bond space, the non-duration type of exposure is a little bit more limited. But we will be looking to adjust that part of the portfolio as well.

Are we making changes to our asset allocation positions?

So from a Listed portfolio perspective, overall, we’re relatively comfortable where we’re positioned. If you think about beyond these last three months, longer-term we still think that we will be in a lower rate environment. While we think inflation will go up marginally over the coming months, our base case is that we’re not going to see out-of-control inflation. So if you think about an environment where all things being equal, rates are still low, inflation is under control, and central banks are continuing to support markets, whether it be through monetary policy or fiscal policy, that type of dynamic is still conducive to having that long term quality exposure within the portfolios. So we are cognizant of the recent performance. Over the long term, though, we do think the portfolios are well-positioned in terms of the market environment we’re heading into. And we are making some adjustments just to limit some of those risks within the portfolios. If I just touch on very briefly in the other portfolios, our Multi-Asset portfolios, just by nature of the construct, and the ability to use different types of funds, have had a little bit more of that cyclical exposure, that value exposure, notably, managers like Allan Gray, for example, we have had less duration risk within those portfolios. One of the things we are looking at also in those portfolios is again reducing some of those more defensive exposures, keeping some in there because that is part of our process, as part of managing risk. But also just adjusting that given that our view on equities has become more constructive. And certainly, as I said before, we think that relative to bonds, equities will continue to look attractive.

We are here to support you.

So thank you for taking the time today to listen to this video. We will be coming out with more material to help you with your conversations with your clients relating to the portfolios. We’re working on a frequently asked questions document, which will delve a little bit deeper into some of the things I spoke about. And as always, we’ll do our quarterly update on our portfolios which again will provide an update on the performance and positioning. And with that, I hope you found today’s video useful and I want to thank you again for your support for the portfolios, and if there are any questions, please get in contact with our BDM team.

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd ACN 608 837 583, a Corporate Authorised Representative (CAR 1236821) (LIS) of Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Holdings Pty Ltd ACN 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document.

DISCLOSURE AT THE DATE OF PUBLICATION: Lonsec Research receives a fee from the relevant fund manager or product issuer(s) for researching financial products (using objective criteria) which may be referred to in this document. Lonsec Research may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec Research services. LIS receives a fee for providing the model portfolios to financial services organisations and professionals. LIS’ and Lonsec Research’s fees are not linked to the financial product rating(s) outcome or the inclusion of the financial product(s) in model portfolios. LIS and Lonsec Research and their representatives and/or their associates may hold any financial product(s) referred to in this document, but details of these holdings are not known to the Lonsec Research analyst(s).

WARNINGS: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to general advice and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. Before making an investment decision based on the rating or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If the financial advice relates to the acquisition or possible acquisition of a particular financial product, the reader should obtain and consider the Investment Statement or the Product Disclosure Statement for each financial product before making any decision about whether to acquire the financial product.

DISCLAIMER: No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by LIS. The information contained in this document is current as at the date of publication. Financial conclusions, ratings and advice are reasonably held at the time of publication but subject to change without notice. LIS assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, LIS and Lonsec Research, their directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2021 Lonsec Investment Solutions Pty Ltd ACN 608 837 583 (LIS). This document may also contain third party supplied material that is subject to copyright. The same restrictions that apply to LIS copyrighted material, apply to such third-party content.