Mention the property market to Australian investors and the first thing they probably think of is the collapse in residential property values. These price falls are the result of a number of factors, some of which have also negatively affected Australian listed property (or A-REITs), while themes such as low wages growth and higher household indebtedness have had a significant impact on retail businesses and their landlords. The rise of online juggernauts like Amazon have further added to the pressure. But despite the challenges, listed property has held up remarkably well as a diversified source of income and capital growth.

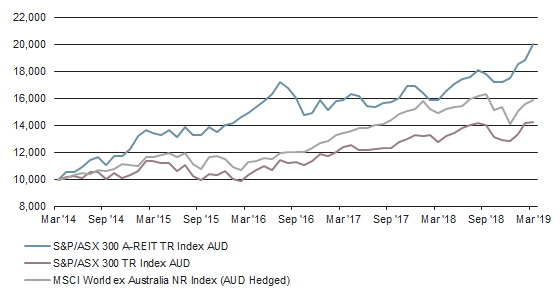

The S&P/ASX 300 A-REIT index overall has delivered an impressive 26% return over the year to March, outperforming local and global shares. With retail assets representing almost 46% of the index, the underperformance of this sector is certainly more pronounced. With retail sales growth currently around 3.0% per annum—well below peak years over the last decade of over 5.6% and the average 3.6%—this is translating into weaker rental growth and higher capital expenditure to improve patronage at shopping centres. In general, the super-regional centres will continue to adapt well and neighbourhood (food-based) centres are also reasonably placed, while it is the smaller shopping centres and retail strips that are most vulnerable.

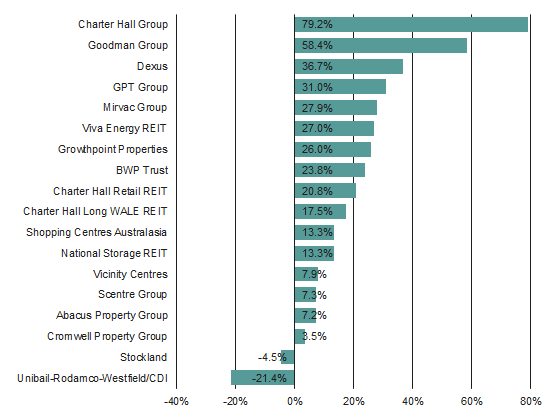

But while retail has struggled, other sectors have stepped up. Leading the way in terms of A-REIT earnings has been the diversified and industrial REITs, particularly those with funds management businesses. Charter Hall Group (+38% for the March quarter) and Amazon’s landlord Goodman Group (+26%) came out on top following similar gains over calendar year 2018. Lonsec notes that the elevated earnings of funds management (boosted by performance fees from cyclical high returns) and development activities can disappear when the cycle turns, as can the premium ratings for such stocks.

Nevertheless, Australian commercial property is being underpinned by a growing economy and infrastructure spending is benefiting the Sydney office sector in particular. Income growth of around 5.0% is expected for FY19, however the outlook is for some easing in rental growth (Sydney and Melbourne) with signs of recovery in Brisbane and Perth. Capitalisation rates are now at or below previous cyclical troughs (pricing peaks) and the next supply wave is 18–24 months away (new space predominantly pre-committed).

A-REITs versus shares (growth of $10,000 over five years)

Source: Financial Express, Lonsec

Even those A-REITs with residential exposure are still expecting a better second half of FY19 from previous sales coming through. However, the market is expecting a 10–20% fall in FY20 sales given the soft secondary residential price market, tighter lending, and potential changes to negative gearing for investors should the Labor Party win government at the 18 May federal election.

Nonetheless, Australia remains attractive for international and local investors, with one of the highest REIT market dividend yields of 4.7% and a +2.9% spread to 10-year bonds. The Australian dollar has been relatively steady during the March quarter. Given the recent in rise in A-REIT prices, valuations overall for the sector are around a 10% premium to NAV3 (although the pricing between sectors has retail/residential at a discount and office/industrial at a premium).

A-REIT member price gains (12 months to 31 March 2019)

Source: Bloomberg, Lonsec

Turning to the overseas market and Lonsec has observed some similar themes, but the macro setting has had a major influence, with bond rates continuing to soften in the March quarter and expectations of interest rate rises pushed back. As China-US trade war tensions eased, listed markets recovered from the December quarter pullback and more than made up for the negative returns of calendar year 2018. The discount that listed property markets were trading at has now dissipated and the sector is trading more in line with private market valuations.

The fundamentals in developed property markets remain much the same, with demand from tenants in retail assets the weakest and major retailers sporadically trimming outlet numbers or completely closing down. Investment performance from retail shares continues to lag, especially the industrial and logistics sector, which is attracting investment to improve the supply lines on the back of expanding online channels.

It is yet to be seen whether counter-cyclical investors that are chipping away at the deep value offered by retail property shares (especially the higher quality ones) will reap the benefits of an eventual normalising of relative values. Some fund managers believe there has been a permanent shift in investor valuations towards the industrial/logistics property sector. Lonsec is still of the view that global property markets are in the mature part of the cycle, although the tail end is being extended while inflation and interest rate pressures are kept at bay.

Some investors baulk at the thought of investing in listed property in an environment of rising interest rates, a softening residential housing market, and the rise of competition from the online world. While listed property is traditionally a defensive asset class with a negative correlation to bond yields, the sector has shown it is able to deliver in this environment, and the asset class has remained critical to investor portfolios as a means of achieving diversification and reliable income streams. While some sectors have certainly come under pressure, as a whole listed property has been a truly understated performer.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2019 Lonsec Research Pty Ltd, ABN 11 151 658 561, AFSL 421 445. All rights reserved. Read our Privacy Policy here.