Thanks to Covid-19, investors face “lower for even longer” when it comes to yields. With interest rates at historic lows and around a third of ASX-listed companies having suspended, cancelled, or revised dividend payments, generating the same level of income that investors have enjoyed in the past is becoming ever more challenging.

In this environment it is understandable that investors might start to view yield as overrated, especially if they are seeing potential growth opportunities that are going begging. Aiming for total returns and drawing down on capital as needed might seem like a smarter way to fund your retirement. However, while a total return strategy is valid, it comes with risks that all retirement investors should be aware of. In fact, the Covid-19 situation is itself the perfect example of how a total return strategy can come unstuck.

Drawing down on capital to provide regular income might work when markets are rising and volatility is relatively low, but when a crisis hits, investors can end up sacrificing more capital than they desire. This can be detrimental to your client’s ability to regrow their capital following a period of sustained losses, making it more likely that they will fall short of their retirement funding needs. It may be harder to target yield in this environment, but you should not neglect it as core building block of your client’s portfolio.

Where to find income in a Covid-19 world

Generating income was already challenging before the Covid-19 outbreak. Now, with companies hit incredibly hard by lockdown measures and central banks embarking on unprecedented easing measures, it is more difficult than ever before.

Lonsec has analysed its own retirement portfolios and factored in a 30% cut to dividends across its entire equity and A-REIT book. Over the next 12 months, Lonsec expects that yield will fall well short of the long-term yield target of 4%, especially for lower risk profile portfolios. It expects yield to be maintained at this level in the long-run and to pick up once companies begin paying dividends again in the latter part of next year, but in the meantime it is going to be an uphill battle.

The question is how to target additional sources of income without materially adding to risks in the portfolio. The key here is diversification. Just as it is important to diversify across your growth assets, it is equally important to diversify sources of yield. Even within equities, there are many ways fund managers are able to gain exposure to different sources of income. In the fixed income space, this means looking beyond safe but relatively low-yielding government bonds to things like corporate credit and syndicated loans, where informed asset selection and prudent portfolio construction can deliver solid results.

This is where an active portfolio approach can make a big difference by giving investors the flexibility to take advantage of the opportunities that have arisen to source additional sources of income for multi-asset portfolios. Certain sources of credit and syndicated loans are something Lonsec looked at carefully as the Covid-19 crisis hit.

Leading up to the crisis, some areas of the credit market were looking overpriced, but recent market dislocation has thrown up some potential opportunities for close observers. In our conversations with fixed income fund managers, especially back in March when bond markets were all but locked up, one common theme was the emergence of value and the sudden appearance of opportunities that had not been seen in that area for many years.

Lonsec took advantage of this situation and made some key changes to its own retirement portfolios. It added the Bentham Syndicated Loans Fund, which is a sub-investment grade strategy that offers a higher yield than those with an investment grade focus, and the Ardea Real Outcome Fund, which offers a return source that is not dependent on duration or credit risk. Lonsec also increased its exposure to Talaria Global Equity, a strategy that sources much of its income from option premia and tends to benefit from these types of environments when volatility is elevated.

Yield should form a key building block of your retirement portfolio

Once again diversification and risk management are key, but an active portfolio approach can allow investors to pull a number of different levers to generate higher income returns without materially altering the risk characteristics of their portfolio. Targeting income is not always easy, and investors will still need to manage their expectations, but it can done, even in the current environment.

Falling back on a total return approach to generate your required income is possible, but it can leave investors exposed during a crisis. As the following section explains, it is worth getting the income component of your retirement portfolio right.

Sequencing risk is real, and not just for those transitioning to retirement

While market bumps are nothing to be feared for those building wealth, a sudden major event like the Covid-19 pandemic can spell disaster for those entering the decumulation phase. While we will inevitably experience losses, both in the leadup to and during retirement, the timing of losses can matter a great deal.

Sequencing risk refers to the order in which investors experience returns, and it can have a big impact on retirement outcomes. Making withdrawals during a falling market has the potential to accelerate the depletion of capital. This is why going for total returns can be risky, especially during the period we are in now, where there is heightened market volatility and a lot of uncertainty regarding a potential second wave of infections and further lockdown measures.

If your client’s portfolio is not structured appropriately, they could end up drawing down on their capital at a time when it is been heavily depleted by large market losses. This could leave them exposed to much greater sequencing risk than you they might have envisaged.

When capital returns are potentially high and yields are low, it is natural that investors will consider a total return approach to achieve their objectives. However, we should beware the risks. Capital growth is still a core objective, even for those in the retirement phase, but we should be careful how much capital we are prepared to sacrifice to meet out income needs. Inevitably, we may find ourselves getting by with less income that we hoped, but this is better than the alternative.

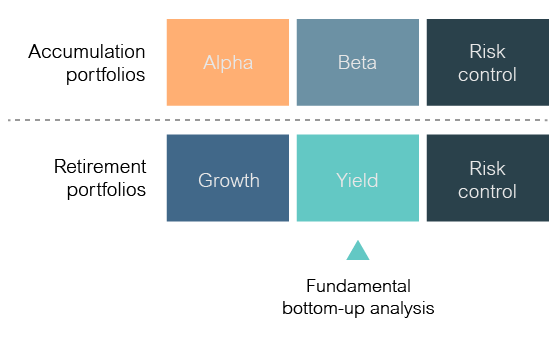

As soon as disaster strikes, and we face very subdued capital returns or even an extended bear market, that is when a well-structured portfolio delivers real value. That is why you should focus on growth, yield, and risk control as individual portfolio building blocks. We might need to be smarter about how we source our income, and more active and flexible in our approach, but it is worth it if we want to weather a crisis.

Issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Warning: Past performance is not a reliable indicator of future performance. Any advice is General Advice without considering the objectives, financial situation and needs of any person. Before making a decision read the PDS and consider your financial circumstances or seek personal advice. Disclaimer: Lonsec gives no warranty of accuracy or completeness of information in this document, which is compiled from information from public and third-party sources. Opinions are reasonably held by Lonsec at compilation. Lonsec assumes no obligation to update this document after publication. Except for liability which can’t be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the document or any information. ©2020 Lonsec. All rights reserved. This report may also contain third party material that is subject to copyright. To the extent that copyright subsists in a third party it remains with the original owner and permission may be required to reuse the material. Any unauthorised reproduction of this information is prohibited.