It has been an interesting month in markets. The S&P 500 Index reached 12 month highs with markets brushing off March’s COVID-19 panic. There have been many discussions about how narrow the rally has been in that a handful of stocks have driven the sharp rebound. In fact, just over 35% of stocks in the index have had a positive gain over the year. Leading stocks in the technology sector have been the winners, with Alphabet Inc (Google), Amazon.com Inc and Apple Inc rebounding strongly from March. Essentially, growth and quality stocks have been rewarded and the impact of COVID-19 on such companies has been minimal relative to other sectors. In some instances, the pandemic has accelerated growth for online retail businesses such as Amazon. On the other hand, there have been notable losers. Airlines, retail property and infrastructure assets such a toll roads and airports have been losers on the back of COVID-19. This divergence has been reflected in the recent Australian reporting season with companies such as JB Hi-Fi reporting record annual profits, while Qantas continues to cut more jobs as it prepares for a $10 billion revenue hit.

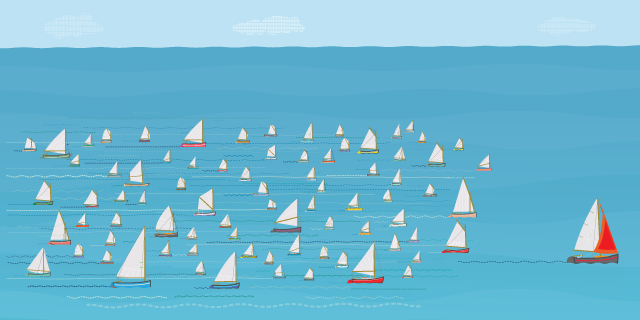

A key challenge for investors at the moment is whether to continue to back the ‘winners’ and pay more for growth, or to look for value amidst some of the ‘losers’ and try to identify a bargain. From a portfolio perspective we have taken the view that the current market conditions are favourable to quality/growth companies particularly given the low interest rate environment. However we also continue to have some exposure to the value part of the market, as we believe that some of the bad news has lowered the price of some of these sectors and that over the medium to long term there is an opportunity for these stocks to rebound.

While the current market dynamics are different to what we experienced during the tech bubble what is very similar is some of the narrative. I recall prior the collapse of the tech sector we were in a ‘new paradigm’ where value investing was dead and growth companies prospered. History generally doesn’t repeat but it can rhyme. Ensuring that your portfolios are not anchored to one part of the market and they remain diversified, particularly in an environment where uncertainly persists, remains important.

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd ACN 608 837 583, a Corporate Authorised Representative (CAR 1236821) (LIS) of Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Holdings Pty Ltd ACN 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document.

DISCLOSURE AT THE DATE OF PUBLICATION: Lonsec Research receives a fee from the relevant fund manager or product issuer(s) for researching financial products (using objective criteria) which may be referred to in this document. Lonsec Research may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec Research services. LIS receives a fee for providing the model portfolios to financial services organisations and professionals. LIS’ and Lonsec Research’s fees are not linked to the financial product rating(s) outcome or the inclusion of the financial product(s) in model portfolios. LIS and Lonsec Research and their representatives and/or their associates may hold any financial product(s) referred to in this document, but details of these holdings are not known to the Lonsec Research analyst(s).

WARNINGS: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to general advice and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. Before making an investment decision based on the rating or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If the financial advice relates to the acquisition or possible acquisition of a particular financial product, the reader should obtain and consider the Investment Statement or the Product Disclosure Statement for each financial product before making any decision about whether to acquire the financial product.

DISCLAIMER: No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by LIS. The information contained in this document is current as at the date of publication. Financial conclusions, ratings and advice are reasonably held at the time of publication but subject to change without notice. LIS assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, LIS and Lonsec Research, their directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2020 Lonsec Investment Solutions Pty Ltd ACN 608 837 583 (LIS). This document may also contain third party supplied material that is subject to copyright. The same restrictions that apply to LIS copyrighted material, apply to such third-party content.