The Australian equity market experienced a very strong end to 2020, delivering an outsized 13.8% return as measured by the S&P/ASX 300 Accumulation Index in the December quarter. The recent advances contributed to the 2020 calendar year generating a surprising positive absolute return of 1.7% despite heightened volatility.

The impressive quarterly return was led by the largest index weighted sector financials with increasing optimism of a broad economic recovery predicated on recent positive developments from some of the front-running Covid-19 vaccine candidates, particularly Pfizer/BionTech and Moderna. Additional tailwinds were the federal government’s decision to ease lending restrictions, APRA’s removing a cap on listed companies paying out dividends, and an uptick in long-term bond yields, which in aggregate should lift profitability for the sector.

Over the December quarter, the four major banks recovered well from their lows earlier in the year, with ANZ gaining 32%, CBA jumping 29%, NAB up 27%, and Westpac rising 15%. The energy sector produced the largest sector gain of 26% supported by a stronger oil price and depreciating US dollar, while being highly leveraged to the re-opening of the economy.

A significant jump in the iron ore price was the principal catalyst for a re-rating of the three largest local miners, with Fortescue surging 44% higher, Rio Tinto climbing 21% and BHP rising 19%. The price of the key steel-making ingredient hit multi-year highs amid Brazilian miner Vale cutting production guidance and improved demand conditions in China as the government has undertaken a substantial infrastructure spending program to reignite their economy.

Some of the less economically sensitive sectors (i.e. Health Care and Utilities) delivered negative returns for the quarter. Key utility companies announced earnings downgrades (e.g. AGL, dragged down by lower wholesale electricity prices). Large index weight CSL led the healthcare sector down, with the company announcing the cessation of its Covid-19 vaccine, which was triggering false positives for HIV.

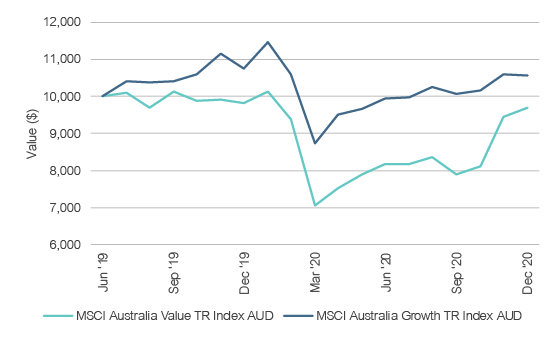

Value outperformed growth stocks by a staggering 18% in the December quarter

A rotation out of some expensive growth pockets into value sectors was clearly evident over the December quarter with further RBA stimulatory measures, including the cutting the official cash rate by 15 basis points in November and an additional $100 billion of bond purchases as part of its QE program. On top of the vaccine breakthroughs, additional stimulus was a trigger for a rally in many beaten-up cyclical-oriented sectors.

The small cap segment of the market experienced an almost identical return in the December quarter compared to its broad cap counterparts, returning 13.8% as measured by the S&P/ASX Small Ordinaries Index, with the small resources index delivering an even stronger return of 20.3%. The performance of the broad commodities complex—principally iron ore, copper and oil—all rallied strongly.

Presently, the Australian equity market is profoundly influenced by macro factors surrounding the management of Covid-19, with company specific fundamentals taking some form of a back seat. The unprecedented fiscal and monetary stimulus measures implemented over the past 12 months should continue over the medium term but gradually taper off on the basis that Covid-19 is well contained, and economic re-opening becomes a sustainable state of affairs.

While it is not expected to be smooth sailing, as the economy moves towards a solid recovery phase, the reflation trade is likely to occur with cyclicals benefitting on a relative basis over long-duration growth companies.

The Australian equity market is trading on a one-year P/E ratio of nearly 20 times, which is circa 30% above the long-term average of 14.5 times and prima facie looks stretched relative to history. However, based on the current environment, with policy and liquidity support underwriting economic activity for the foreseeable future, the market appears to be moderately expensive.