Pre-pandemic, Australian office market fundamentals were solid and in high demand from both investors and tenants. This was supported to a large extent by high population and employment growth, significant infrastructure spending by governments and a lag in supply, particularly in Sydney and Melbourne. However, over the last 12 months market dynamics have shifted significantly as COVID-19 restrictions left the CBDs of Australian capital cities empty/under-capacity for large parts of 2020, fuelling a major shift in habits of working (‘working-from-home’), shopping, leisure and education.

Announcements of successful vaccine trials in late 2020 have given a much-needed boost of confidence and as the vaccine roll-out progresses and lock-down restrictions ease, a sense of normality will begin to return. However, the debate in Australian and global property markets is now focussed on how the pandemic may have changed demand for office space on a permanent basis.

In Australia, the immediate impact has seen CBD office vacancy levels rise in Sydney and Melbourne from 3-4% to around 8-9% over the year to January 2021. Net absorption for Australia overall has reduced from +50,000sqm in the six months to January 2020 to -90,000sqm in the latest six months to January 2021. Sub-leasing has spiked as tenants with longer leases look to offload spare capacity. While face rents have remained largely unchanged, incentives have risen to over 35% compared to around 25% pre-pandemic, dampening net effective rents. Businesses are taking longer to commit to new leases and when they do, there is a trend towards shorter terms.

Rental collections have held up and investor interest remains high in this relatively higher yielding sector, thus placing a floor under valuation reductions. In response to COVID-19 conditions, valuations were conservatively adjusted down for office (-10%) and retail (-15%) assets, while industrial/ logistics asset values remained steady to slight increases in line with rental escalations and/or lease extensions.

As restrictions ease (barring the occasional lockdown) and workers begin returning to their offices with encouragement from businesses and government, there is a growing realisation that more flexibility to work-from-home is both possible and desired. While dependent on industry and function, the consensus view is that a ‘hybrid’ working model is the most likely outcome – two or three days working from home with the remaining days spent in the office. While some firms experienced increased worker productivity during the lockdowns, intangible aspects such as corporate culture, team morale, creativity and innovation rely on human interaction to a large extent.

As corporates plan ahead and leases come to an end, there is already demand for core space plus an option for a flexible amount. Landlords will also need to ensure that buildings provide good quality space (including high environmental ratings) with facilities being upgraded in line with social distancing requirements. While these guidelines are being progressively relaxed, the floor densification trend of the last few years may have peaked, and businesses may require more floor space per person. However, it is likely that the trend for more flexible space/work-from-home will drag on demand while the world works its way through this pandemic. Given the possibility of further pandemics, the outlook for office space has a high degree of uncertainty. One bright spot is medical and life sciences office space, where demand benefits from pandemic conditions, as such tenants are usually businesses deemed ‘essential’ with minimal operating restrictions.

A noticeable trend is the ‘flight to quality’, where premium/A-grade office assets on long leases to strong corporate and/or government tenants remain very well bid, due to greater perceived stability of cashflows for investors. Assets that are of secondary quality and/or location, tenanted by less robust tenants are coming under valuation pressure. There is also some debate on whether suburban offices, which are usually in less preferential locations compared to the CBD and accordingly charge lower rent per square metre, will benefit from the working-from-home trend.

A further consideration is the expiry of the National Cabinet Mandatory Code of Conduct for commercial tenancies and the expiry of the JobKeeper program, both of which helped businesses survive through the pandemic. With this support now largely withdrawn, the impact on business insolvencies, employment and associated office demand remains to be seen.

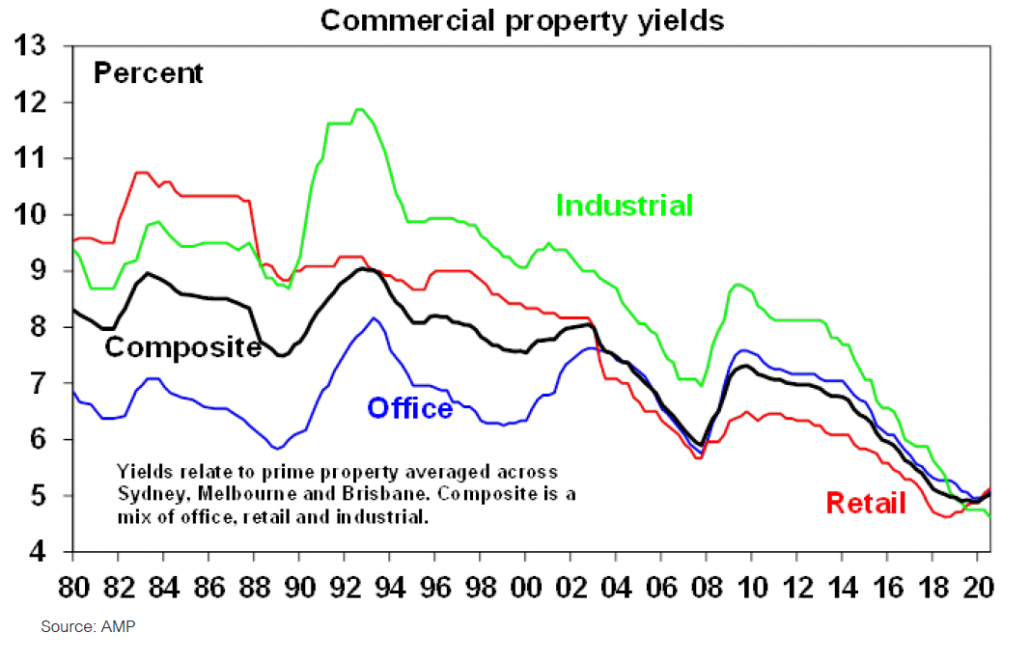

Chart 1 — Commercial property yields

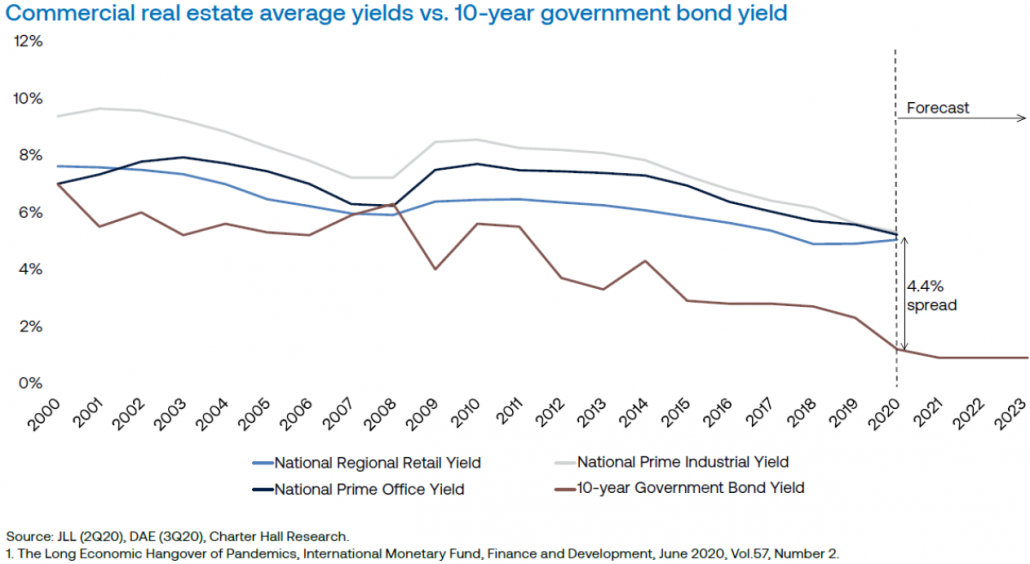

Chart 1 shows office yields bottomed-out during 2020 and now appear to be rising, but the extent of this reversal of the trend of falling yields is still uncertain. The office sector continues to offer yields of 5-7% p.a., which is an attractive spread over bond rates as Chart 2 illustrates. Central banks have adopted ultra-low monetary policy settings, which maintains investor demand and underpins tight market capitalisation rates (apart from discretionary retail property assets which faced headwinds well before the pandemic).

These policy settings are artificially low, and as inflation resurfaces bond rates and borrowing costs are likely to increase as exemplified by the US 10-year bond yield rising from 0.70% in early October 2020 to 1.74% at the end of March 2021. While this rate has come off in recent weeks, the only certainty is uncertainty.

Chart 2 — Commercial property yields vs. 10-year bond yield

Source Chart 1: AMP Capital (April 2021); Chart 2: Charter Hall (December 2020).

Author: Balraj Sokhi, Senior Investment Analyst

Issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Warning: Past performance is not a reliable indicator of future performance. Any advice is General Advice without considering the objectives, financial situation and needs of any person. Before making a decision read the PDS and consider your financial circumstances or seek personal advice. Disclaimer: Lonsec gives no warranty of accuracy or completeness of information in this document, which is compiled from information from public and third-party sources. Opinions are reasonably held by Lonsec at compilation. Lonsec assumes no obligation to update this document after publication. Except for liability which can’t be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the document or any information. ©2021 Lonsec. All rights reserved. This report may also contain third party material that is subject to copyright. To the extent that copyright subsists in a third party it remains with the original owner and permission may be required to reuse the material. Any unauthorised reproduction of this information is prohibited.