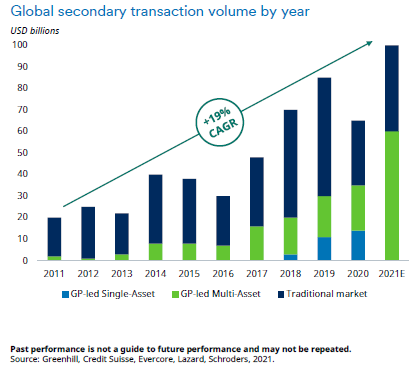

Secondary investments refer to the buying and selling of an investors interest and unfunded commitments in pre-existing private equity funds. Given the absence of an established trading market, the transfer of interests in private-equity funds can be a complex, time consuming and a labour-intensive process of negotiation. The volume of secondary market transactions has been climbing over the years, largely in-step with the growth of private assets generally. That said, the market can be cyclical, reflecting not only exit conditions but also the need for liquidity from investors which in turn dictates the price or discount paid for such interests.

A ‘traditional’ secondary transaction includes the transfer of investments and unfunded commitments from one Limited Partnership (LP) to another. The sale typically requires the consent of the General Partner (GP). There are several other secondary transactions such as ‘tail-end’, ‘structured joint venture’, ‘structured secondary’ to name a few but the common link between them all is they are predominately driven by the LP. As depicted in the graph above, these ‘traditional’ secondary market transactions have made up an overwhelming majority of aggregate secondary market transactions historically. In recent years however, the emergence of GP-led secondary transactions has become increasingly common, so much so that in 2020 they accounted for approximately 50% of all secondary transaction volume with the trajectory expected to continue for 2021.

What is a GP-led secondary transaction?

A GP-led transaction is when the GP initiates the transaction, generally in the desire to restructure the fund with the key objectives being to either extend the fund’s life, raise additional capital and/or return cash to existing investors. These can take numerous forms with the most common being a ‘continuation vehicle’ whereby the GP of an ageing fund believes it needs more time to maximise the value of its assets than the fund’s remaining term allows. The GP therefore establishes a new continuation vehicle to transfer residual assets. Existing LPs are then given the option of rolling their interests into the new fund or liquidating. The liquidation is typically financed by raising additional capital from new investors or ‘rolling’ of existing investors. Other GP-led transactions may involve preferred equity, priority distribution rights and transfer of follow-on capital commitments.

GP-led single asset secondaries have been of particular prevalence of late. These are similar to a ‘continuation’ vehicle albeit the new vehicle will only contain one asset and therefore closely resembles a co-investment. In these cases, GP’s don’t wish to be a forced seller of what is deemed a ‘trophy’ asset due to an ageing fund and/or desire for investor liquidity. The GP is of the view there is considerable value to be gained by holding and in some cases re-investing in the business for a longer duration to see the value creation plan come to greater fruition.

What has led to this sudden growth in GP-led secondaries?

Traditionally a GP’s exit path has been one of either a trade sale to another private equity sponsor, a strategic sale such as a merger or acquisition to another business or a public market IPO. The GP-led transaction has opened up a fourth avenue for an ‘exit’ of sorts.

Several factors are potentially at play but market conditions are likely to be a key driver of this trend. Industry dry powder continues to surge to all-time highs, with an estimated US$1.9 trillion globally yet to be deployed. Dry powder has built over the years from both strong fund-raising activities from growing investor interest and GP’s slowing deal activity due to becoming increasingly selective of the quality of businesses purchased alongside the market multiple being paid. This dynamic was exacerbated by a slowdown of deal activity throughout 2020 as exit conditions were less favourable and therefore GP’s were more inclined to hold onto assets they were familiar with. Other contributing factors that may be driving this trend is the notion of GP-led secondaries can provide the opportunity for a GP to reset fees and crystallise carried interest albeit an additional injection of capital or rolling of carried interest into the new vehicle is common.

Buyer beware

Historically, GP-led secondaries were often referred to as ‘orphaned’ or ‘zombie’ funds as they tended to have a few remaining assets that were either hard to sell at desired valuations or troubled assets that required time, investment and restructuring which were transferred into a new vehicle whereby creating a liquidity event for existing LPs and reset of expectations. While these certainly still exist, especially following a pandemic, the quality of the businesses within the Funds and the rationale for conducting transactions has largely evolved. Nonetheless, it is critical to conduct thorough due diligence of each transaction, specifically the quality and experience of the GP, motivation for the transaction, the potential conflicts that may exist, the alignment of the GP within the new fund, the valuation being paid by new LPs, the terms of the new fund (i.e. fees, preferred equity, unfunded commitments, use of capital etc.). As always, private market transactions are very much a relationship game and those with strong relationships tend to be notified first and given priority access to the higher quality, more attractive deal flow.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure as at the date of publication: Lonsec receives fees from fund managers or product issuers for researching their financial product(s) using comprehensive and objective criteria. Lonsec receives subscriptions for providing research content to subscribers including fund managers and product issuers. Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other advice. Lonsec’s fees are not linked to the product rating outcome or the inclusion of products in model portfolios, or in approved product lists. Lonsec and its representatives, Authorised Representatives and their respective associates may have positions in the financial product(s) mentioned in this document, which may change during the life of this document, but Lonsec considers such holdings not to be sufficiently material to compromise any recommendation or advice.

Warnings: Past performance is not a reliable indicator of future performance. The information contained in this document is obtained from various sources deemed to be reliable. It is not guaranteed as accurate or complete and should not be relied upon as such. Opinions expressed are subject to change. This document is but one tool to help make investment decisions. The changing character of markets requires constant analysis and may result in changes. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Where Lonsec’s research process relies upon the participation of the fund manager(s) or product issuer(s) and they are no longer an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2021 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This document is subject to copyright of Lonsec. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this document may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec.

This document may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.