A look at Chinese equity managers’ performance over 18 months to March 2022.

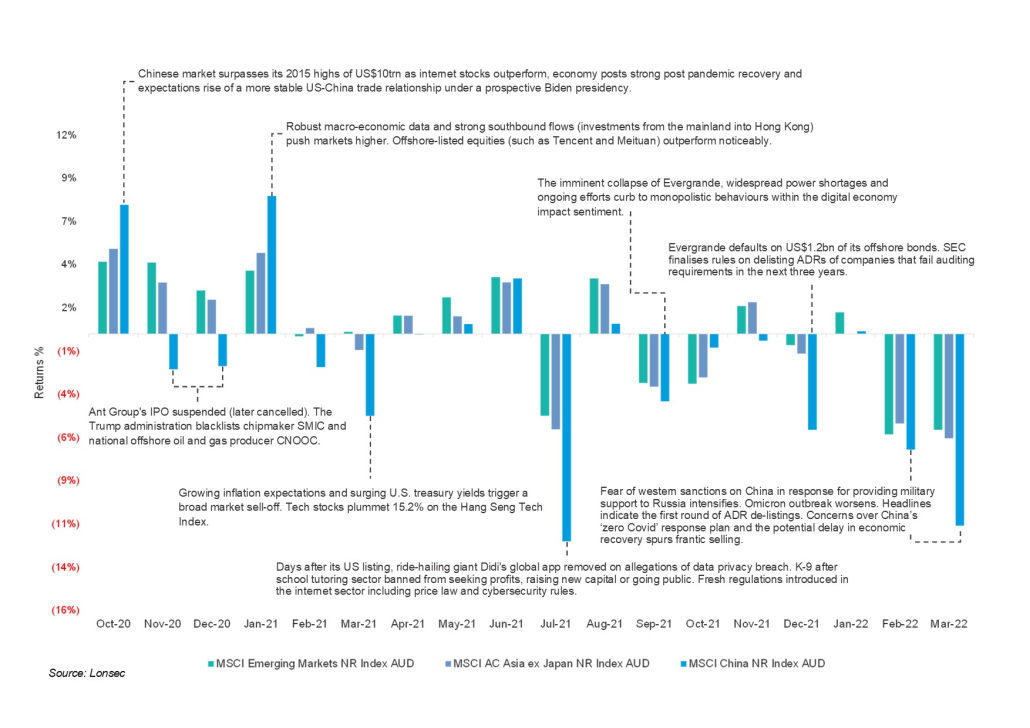

To say that the last several months have been difficult for the investment landscape within China would be an understatement. For the 18 months ending March 2022, the MSCI China NR Index (measured in AUD) has returned -28.7% on a cumulative basis. On a monthly basis, the Index has ended in red in 11 of the 18 monthly periods. Given China’s prominence in the Emerging markets and Asia ex Japan Indices, performance for these broader Indices (measured in AUD) also remained weak generating cumulative returns of 3.6% and -0.8% respectively. The period was marked by a series of regulatory developments, each one more extreme than the prior in terms of testing investor patience, discipline, and appetite for Chinese equities. The ‘common prosperity’ theme, a rhetoric increasingly promoted by the Chinese Communist Party (CCP) during this time, permeated strongly in all instances.

This report looks to delve into the key developments within China over the analysed period (October 2020 to March 2022), analyse the evolution of Chinese/Hong Kong stock holdings and the aggregate allocation of a majority of Lonsec’s Global and Emerging Markets equities rated universe alongside the associated performance outcomes for the period. It concludes with an outlook of the investment landscape moving forwards.

Thunder, lightning, and everything frightening!

A quick Covid-19 recovery through early and mid-2020 led the Chinese market to surpass its 2015 highs of US$10trn ($14trn). However, the euphoria quickly fizzled out as the first wave of regulatory crackdowns surfaced. After a four-month anti-monopoly probe, Chinese regulators fined Alibaba a record RMB 18bn (US$2.75bn) and suspended (eventually cancelled) the upcoming IPO of its financial arm, Ant Group to tackle a long simmering problem in the tech sector: anti-competitive practices. During this time, China enforced an antitrust guideline for the “platform economy” giving more teeth to the first major revisions made to the Antitrust Law (the second public consultation was completed in November 2021) in 13 years. A new antitrust bureau was also launched in November 2020, responsible for conducting antitrust investigations and oversight into M&A activities and market competition.

The subsequent sell-off in internet stocks, although initially short lived, signalled the start of a sharp reversal of a long-term uptrend of large cap technology companies. Throughout the year, other internet conglomerates including Tencent, Baidu, ByteDance, Meituan and Didi Chuxing were also fined for violating the anti-monopoly law resulting in significant share price corrections.

The interventions were not isolated to the technology sector however, reforms also took place in the education, online gaming and property sectors precipitated by a desire to prioritise social stability and common prosperity objectives. The education sector bore the full brunt of policy actions in July 2021 when the State Council released the ‘double reduction’ policy guidelines to address the burden of an excessively competitive academic success culture. The stipulations contained within overhauled the entire industry structure effectively transforming it into a non-profit sector overnight and resulting in a swarm of tutoring companies going bankrupt. Share prices of the three largest players New oriental education, TAL education and Gaotu techedu fell 54%, 71% and 63% respectively on the day of the announcements and have since been effectively worthless (down 92% on average for the 12-months ending April 2022).

Besides taking aim at the education sector, China’s focus on the growth and development of the next generation also spilt over to the online game industry. In August 2021, China limited the amount of time children can spend on video games to avoid gaming addiction, which may harm their academic and personal development. This had significant implications for the world’s largest online gaming market and materially impacted the fortunes of companies such as Tencent and NetEase.

Volatility returned in the last quarter of 2021, as the property sector, a key driver of economic growth, local government funding, and investment savings for a large portion of the Chinese population, succumbed to stringent policies to curb speculation and credit expansion. The latest rules included further restrictions on developer financing and home purchases, serving a significant blow to the overall industry. Additionally, China Evergrande, one of China’s biggest real estate developers, found itself in a headline-making liquidity crisis eventually defaulting on US$1.2bn of its offshore debt, followed quickly by other lower quality developers.

The flurry of negative headlines has continued well into 2022. Chinese equities have underperformed for the most part in the first quarter of the year due to several domestic and external events hitting the market simultaneously. Key factors contributing to this have been a combination of macro / policy headwinds including further regulatory reforms in key sectors, rising geopolitical tensions with the US, re-escalation of American Depository Receipts (ADR) delisting risks, surging Covid-19 cases and China’s rigid ‘zero Covid’ response plan, and more recently the Russia-Ukraine conflict which presents a real threat to global growth.

Navigating the tides…

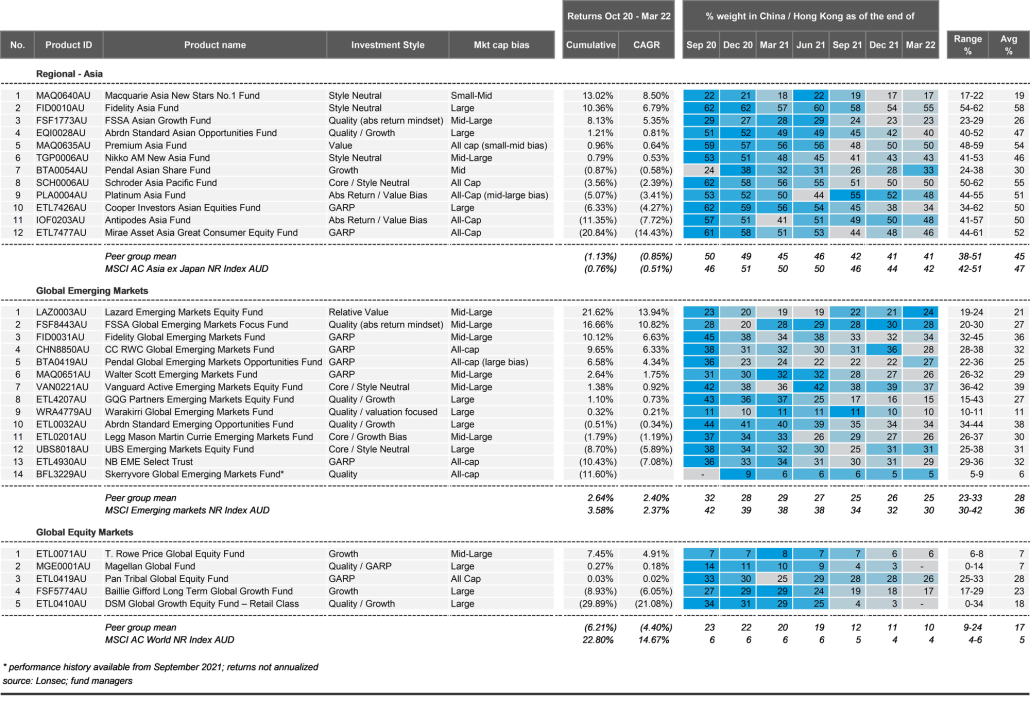

For investment managers with significant exposure to China, the period was challenging to say the least. The table below looks at performance and portfolio allocation to China/Hong Kong for a manager peer group of 31 products across both Emerging Markets / Regional Asia and Global Equity sectors (26 and 5 respectively) between the months of October 2020 to March 2022. During the 18-month period, the peer group delivered an average cumulative return of -0.2% (median 0.3%). On a quarter end basis between September 2020 to March 2022, the region’s representation in the benchmark Indices declined meaningfully, from 46% to 42% in MSCI Asia ex Japan, from 42% to 30% in MSCI Emerging Markets, and from 6% to 4% in the MSCI AC World Indices.

In terms of performance, on a subsector basis, global large cap managers with a significant exposure to China (>10% on average) within the peer group produced the weakest outcomes; an average cumulative return of -6.2%. Regional Asia and Global Emerging Markets managers within the peer group generated an average cumulative return of -1.1% and 2.6% respectively. Relative underperformance was tilted towards managers with higher exposure to offshore listed companies in Hong Kong and US listed ADRs which fell indiscriminately during this period. By contrast, managers who held onshore China A shares delivered stronger returns on the back of many sectors doing well. Within the Regional Asia cohort, managers with exposures to large cap growth names and sectors most severely impacted by the regulations faced headwinds while managers with a greater skew towards small and mid-caps, especially those linked to the green economy and the domestication of supply chains, benefitted during this time. And finally, performance fortunes tilted towards valuation sensitive Global Emerging Markets managers who either drastically rebalanced away from consumer and technology sectors at the start of the year or were already underweight these sectors.

Nearly all products within the peer group saw a reduction in their absolute portfolio allocation to China/Hong Kong to varying degrees depending on the performance of underlying holdings and their relative investment outlook. The exceptions to this were the Lazard Global Emerging Markets and FSSA Global Emerging Markets Focus funds where the ending allocation remained fairly consistent with that at the start of the period and the Pendal Asian Share Fund which saw an increase in its allocation. Nevertheless, all three products remained underweight relative to their respective Indices during this time.

On an aggregate basis, Global Equity managers with significant exposures to China demonstrated the largest adjustment to their absolute portfolio allocation to the region, followed by their Global Emerging Markets counterparts. The Global Equity peer group maintained an average quarterly weight of 17% relative to the 5% weight in the MSCI AC World Index. However, notably towards the end of March 2022, large cap quality / GARP and quality / growth managers such as Magellan and DSM capital fully divested their portfolio holdings on account of growing political and regulatory uncertainties.

Global Emerging Markets peers maintained a mean portfolio holding of 28% relative to 36% in the Index. The biggest change in ending allocation was in GQG Partners Emerging Markets Equity and Legg Mason Martin Currie Emerging Markets funds where absolute holdings to China/Hong Kong declined from 43% to 15% and 37% to 26% respectively. During this period, the group had only a small subset of managers that remained overweight relative to the Index (between 1 and 4 at any point in time). This included Vanguard Active Emerging Markets Equity and Abrdn Standard Emerging Markets Equity funds which held a 7% and 4% relative overweight to the Index at the end of March 2022 respectively. This was backed by a positive view on high quality growth names in the region and/or the prospect of a counter cyclical recovery. The group also included the Warakirri Global Emerging Markets Fund which held a 0% weight to China and a 10-11% weight to Hong Kong (primarily a global industrials exports business, Techtronic Industries) during this time.

The Regional Asia cohort maintained a mean exposure of 45% relative to 47% in the MSCI AC Asia ex Japan Index. The biggest change in allocation was in Cooper Investors Asian Equities and Mirae Asset Asia Great Consumer Equity funds, where holdings declined from 62% to 34% and 61% to 46% respectively. Several managers in this group maintained an overweight relative to the Index during the period, ranging between 5 to 9 managers at any point in time (7 as of March 2022). This included GARP style Cooper Investors and Mirae Asset funds, value style Premium Asia and core / style neutral Schroders Asia Pacific and Fidelity Asia funds which were c. 13-16% overweight at the start of October 2020. Of these, Cooper Investors experienced the largest decline, ending the period at a -8% relative underweight, while the remaining maintained their overweight positions to varying degrees despite a reduction in absolute allocations.

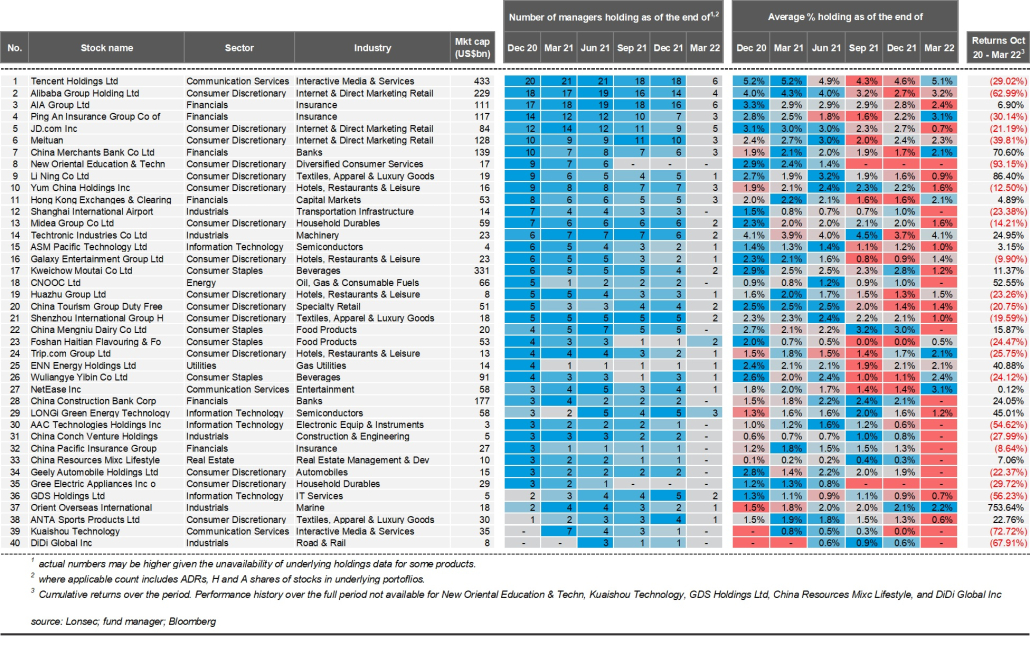

The following table lists stocks that saw the largest change in their representation across the peer group’s portfolios on a quarter end basis between October 2020 to March 2022. Large cap technology names such as Alibaba and Tencent that had previously benefitted from nearly a decade of tailwinds from the consumption growth thematic, both from both global and local investors, saw a sharp decline in their portfolio representation during this time. Insurance giants AIA group and Ping An were next in line as investors wary of the growing property sector woes sold the names frantically. Also struggling were technology stock JD.Com and delivery giant Meituan who faced ongoing anti-monopoly and competitive threats. Other notable mentions included exits in the ill-fated New oriental education which succumbed to the regulatory pressures and CNOOC which was placed on an economic blacklist by the US.

Stocks that have seen increasing representation in manager portfolios include names directly benefitting from a transition to a green economy, expanding domestic consumption and those linked to the broader strategic aims of the CCP such increasing self-reliance in semi-conductor manufacturing. Notably, given currently depressed valuations and forecasts of better medium to long term returns, there has also been a renewed interest in names like Alibaba and Meituan after their tremendous fall from glory.

Smoother sails ahead?

Having battled through monumental challenges over the last several months, investors have rightly been concerned about the future of the Chinese investment landscape. Risks of ongoing covid induced lockdowns, slowing growth, further regulatory interventions, and escalating geopolitical political tensions have been at the forefront of investment discussions. Given this backdrop, the CCP’s ‘Two Sessions’ meeting last month in March has provided investors with valuable insights into the government’s plan to promote stable growth in the region. Key priorities for 2022 include a GDP growth target of 5.5% with a CPI target of around 3%. This growth target is at the higher end of the market expectations range and emphasizes the government’s pro-growth policy stance. It also highlights the significance of 2022 as a politically important year for president Xi Jinping who is poised to extend his term as party chief for a precedent-breaking third time during the CCP national congress in the latter half of this year. In saying that, Lonsec considers these short-term targets to be ambitious and critically dependent on key aspects such as easing of lockdown restrictions and a more relaxed Covid approach.

Longer term, in Lonsec’s view, the regulatory storm appears to have subsided. In March 2022, Vice Premier Liu He addressed key market concerns and called for order and transparency in dealings with big tech firms. Alibaba’s share price subsequently rebounded by 65% showing the significance of this speech. Policymakers have demonstrated an urgency to reverse the liquidity crunch currently faced by quality developers and restore consumer confidence in the property sector. Regulators have also been working with the US SEC to resolve the data requirements for Chinese companies to remain listed in the US. Finally, the government has moved to provide monetary and fiscal stimulus at a time when the rest of the world is struggling with rampant inflation which has led to an increased risk of stagflation. On the back of these announcements in April 2022, Chinese equities generated 1.4% (as measured by the MSCI China NR Index AUD) recouping some of the losses experienced during the earlier month.

Valuations in China are currently attractive with many companies trading at historically low multiples and several managers in the peer group remain optimistic on future investment prospects. As of the end of March 2022, managers in the peer group held a considerable allocation to the region (29% on average). In the months to come Lonsec expects markets risks to abate further, albeit volatility and risk premiums may remain elevated for some time. Also given the recency of regulatory developments, some parts of the market such as the internet, education, healthcare may see a lower return profile over the medium term. However, high-quality companies in China with new growth drivers such as the green economy, improved mental and physical health of the nation, and inward-focused technology replacement programmes, for example in semi-conductors are expected to grow rapidly.

Note – an abridged version of this article was originally published in The Australian newspaper on Friday, 27 May 2022.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure as at the date of publication: Lonsec receives fees from fund managers or product issuers for researching their financial product(s) using comprehensive and objective criteria. Lonsec receives subscriptions for providing research content to subscribers including fund managers and product issuers. Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other advice. Lonsec’s fees are not linked to the product rating outcome or the inclusion of products in model portfolios, or in approved product lists. Lonsec and its representatives, Authorised Representatives and their respective associates may have positions in the financial product(s) mentioned in this document, which may change during the life of this document, but Lonsec considers such holdings not to be sufficiently material to compromise any recommendation or advice.

Warnings: Past performance is not a reliable indicator of future performance. The information contained in this document is obtained from various sources deemed to be reliable. It is not guaranteed as accurate or complete and should not be relied upon as such. Opinions expressed are subject to change. This document is but one tool to help make investment decisions. The changing character of markets requires constant analysis and may result in changes. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Where Lonsec’s research process relies upon the participation of the fund manager(s) or product issuer(s) and they are no longer an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2022 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This document is subject to copyright of Lonsec. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this document may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec.

This document may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.