Super funds continue to face a challenging economic and investment environment, though we have seen a small recovery so far over the month of July. The median balanced option is estimated to have increased by 0.9% over the first 11 days of July.

Leading research house SuperRatings has released the top performing funds within its SR50 Balanced Index which tracks performance of 50 options with exposure to growth assets of between 60 to 76%. Hostplus – Balanced was the top performing option for the 1-year period ending 30 June 2022, returning 1.6%.

David Elia Chief Executive Officer for Hostplus indicated the fund’s performance was “…a testament to Hostplus’s active investment approach, especially in navigating volatile markets.”

QANTAS Super’s balanced option came in second achieving a return of 0.6%, following its first-place result for the financial year to 30 June 2021.

QANTAS Super’s Chief Investment Officer Andrew Spence commented, “Our focus on diversification, risk management and investment governance help to deliver competitive returns despite the uncertainty in markets, as evidenced by our returns in FY 21/22 and FY 20/21.”

Top 10 balanced options over 12 months

| Rank |

Option Name |

1 Year % |

10 Year % pa |

| 1 |

Hostplus – Balanced |

1.6 |

9.7 |

| 2 |

QANTAS Super Gateway – Growth |

0.6 |

8.1 |

| 3 |

Christian Super – MyEthicalSuper |

0.5 |

7.9 |

| 4 |

legalsuper – MySuper Balanced |

-1.0 |

8.3 |

| 5 |

Australian Retirement Trust – Super Savings – Balanced |

-1.0 |

9.0 |

| 6 |

Energy Super – Balanced |

-1.2 |

8.1 |

| 7 |

Aust Catholic Super & Ret – Balanced |

-1.2 |

7.8 |

| 8 |

CareSuper – Balanced |

-1.7 |

8.7 |

| 9 |

HESTA – Balanced Growth |

-1.8 |

8.5 |

| 10 |

TelstraSuper Corp Plus – Balanced |

-1.9 |

8.5 |

| |

SR50 Balanced (60-76) Index |

-3.1 |

8.1 |

The table above also displays 10-year performance for these funds that have performed the best over the 1-year period, as super is ultimately a long-term investment and while it is interesting to compare performance over shorter-term periods, it is not the full story. This is particularly important to emphasise given the unprecedented levels of volatility we have seen since the beginning of the pandemic.

Hostplus was also the top performer over the long-term, with an average annual return of 9.7% over the last decade. Followed closely by AustralianSuper – Balanced with a return of 9.3% and Australian Retirement Trust – Super Savings with a return of 9.00%. Cbus – Growth (MySuper) delivered a close fourth ranking return of 8.96%.

AustralianSuper Chief Investment Officer Mark Delaney stated, “After more than 10 years of economic growth our outlook suggests a possible shift from economic expansion to slowdown in the coming years. In response, we have started to readjust to a more defensive strategy, as conditions become less supportive of growth asset classes such as shares.”

Top 10 balanced options over 10 years

| Rank |

Option Name |

1 Year % |

10 Year % pa |

| 1 |

Hostplus – Balanced |

1.6 |

9.7 |

| 2 |

AustralianSuper – Balanced |

-2.7 |

9.3 |

| 3 |

Australian Retirement Trust – Super Savings – Balanced |

-1.0 |

9.0 |

| 4 |

Cbus – Growth (MySuper) |

-3.8 |

9.0 |

| 5 |

UniSuper Accum (1) – Balanced |

-4.2 |

8.9 |

| 6 |

CareSuper – Balanced |

-1.7 |

8.7 |

| 7 |

VicSuper FutureSaver – Growth (MySuper) Option |

-3.3 |

8.7 |

| 8 |

HESTA – Balanced Growth |

-1.8 |

8.5 |

| 9 |

Hostplus – Indexed Balanced |

-5.7 |

8.5 |

| 10 |

Aware Super – Growth |

-3.7 |

8.5 |

| |

SR50 Balanced (60-76) Index |

-3.1 |

8.1 |

The Bumpiness Factor

SuperRatings has for many years also looked at how bumpy or consistent a fund’s returns are over time. We have continued to focus on this amid the ongoing ups and downs we are seeing across Australian and global investment markets.

Kirby Rappell Executive Director of SuperRatings commented, “Since the bottom of the GFC we haven’t seen huge amounts of volatility coming through, there have been a few moments, but we have seen extreme levels of volatility since COVID-19 hit and in terms of the menu for the year ahead, we expect to see more volatility.”

The table below shows the top 10 funds ranked according to their volatility-adjusted return, which measures how much members are being rewarded for taking on the ups and downs.

Australian Retirement Trust – QSuper Accum. – Balanced sits at the top of the table below, which shows that the fund achieved a return of 6.1% p.a. over the past seven years. Hostplus – Balanced follows closely in terms of the ranking based on the ability to navigate the ups and downs of the market. While CareSuper – Balanced rounds out the top 3 with a 7-year return of 6.8%.

Australian Retirement Trust’s Chief Investment Officer Ian Patrick commented, “Both Australian Retirement Trust portfolios incorporate dynamic asset allocation processes that see weights increased as expected forward returns increase. While the recent sell off in many markets clearly makes them cheaper, this is tempered by economic views, particularly given the uncertain outlook for inflation.”

Top 10 Funds Based on Risk-Adjusted Performance with 7 Year Return Shown

| Rank |

Option Name |

Rolling 7 Year % |

| 1 |

Australian Retirement Trust – QSuper Accum. – Balanced |

6.1 |

| 2 |

Hostplus – Balanced |

8.1 |

| 3 |

CareSuper – Balanced |

6.8 |

| 4 |

Cbus – Growth (MySuper) |

7.1 |

| 5 |

Mercy Super – MySuper Balanced |

6.8 |

| 6 |

BUSSQ Premium Choice – Balanced Growth |

6.3 |

| 7 |

Australian Retirement Trust – Super Savings – Balanced |

7.3 |

| 8 |

AustralianSuper – Balanced |

7.6 |

| 9 |

Prime Super – MySuper |

6.3 |

| 10 |

QANTAS Super Gateway – Growth |

6.8 |

|

SR50 Balanced (60-76) Index |

6.1 |

Kirby Rappell commented, “While the 2022 financial year has seen super funds record a modest fall, the benefits of diversification have shone through. When we compare returns for equity, bond and listed property markets to balanced style portfolios among super funds, these results should be reassuring to members.”

Mr Rappell continued, “Superannuation is a long-term investment and patience remains key. For those Australians under 50, the recent market volatility is not expected to have any impact on their retirement. This year’s results are just one out of a 30 to 40 year investment for younger Australians.”

This result is more concerning for those nearing or in retirement, however, we often see these members sitting in investment options which are less exposed to these market movements which can lessen the impact. The sobering result for this year is likely to be those members invested in diversified fixed interest, with rising bond yields resulting in capital losses for members in an area often considered defensive.

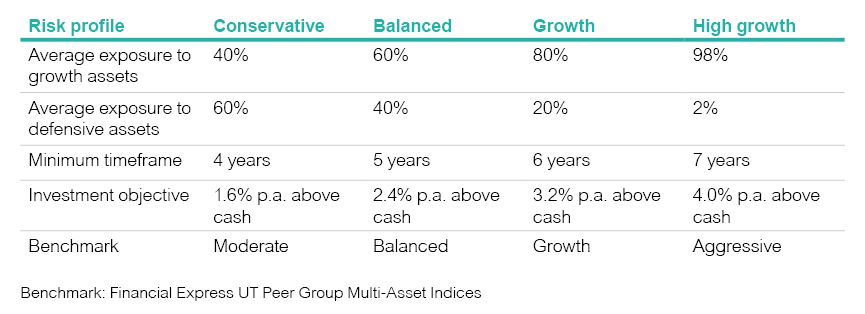

As 30 June returns are now being finalised, funds will be focused on preparing member statements. Making sure you are putting aside some time to engage with your super statement will be time well spent. Checking the type of investment option you are in, and whether it suits the level of ups and downs you’re comfortable with, is worthwhile, with most funds offering a risk profiling tool on their websites to help members understand their own attitudes to risk. As well as seeing the calculators your fund offers, about 60% of super funds now offer an app, so if you have never checked your super before, now might be the time to get started.

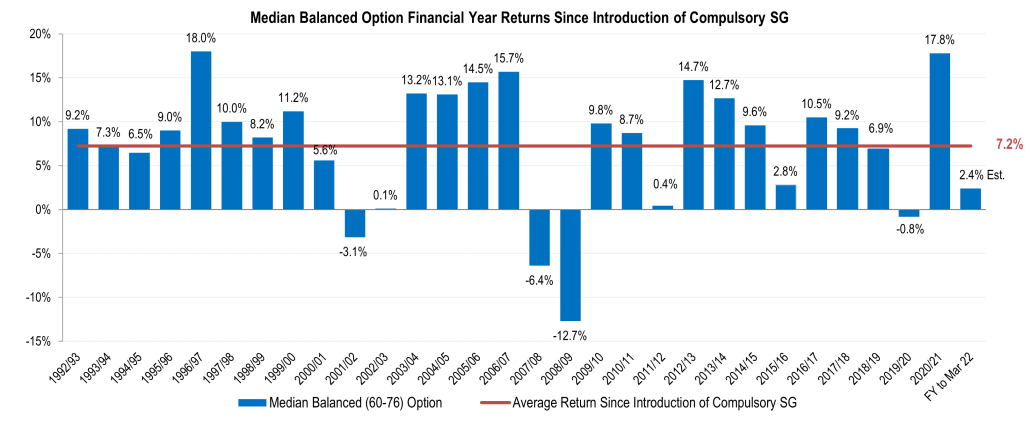

Super has a lot to celebrate over the past 30 years. Since 1992, an estimated 7% per annum return means that $1 invested in 1992 is now estimated to be worth $7.67, depending on fees. While we will see ups and downs over time, super has performed strongly over the long term with 25 positive returns over the past 30 years.

How can you access help?

We rated over 530 superannuation products. Our product ratings are accessible on our website here: https://www.superratings.com.au/products/

You can access advice services on many different types of topics including investments, insurance and retirement, with more detailed advice also available that considers your personal situation – this may be available through your fund directly or by using an adviser that is part of their network.

Contact your fund to see what advice services are available but note there may be a cost for doing so, check how much advice will cost and how you can pay for it before going ahead to ensure it’s right for you.

Alternatively, you may wish to discuss your super with a financial adviser you trust to understand whether your current super settings are appropriate for your personal situation.

The Government provides information on how to select a financial adviser through the MoneySmart website:

https://www.moneysmart.gov.au/investing/financial-advice/choosing-a-financial-adviser

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au

Require further information? Simply visit www.superratings.com.au