The performance of the Alternatives universe during the recent market downturn has been widely dispersed, albeit skewed to the downside. Systematic Risk Premia strategies have been an area of poor performance with long running statistical relationships breaking down in current market conditions. Sharp spikes in volatility and the speed of asset price reversals have tested many strategies.

Exposure to risk premia such as value and carry, specifically short volatility, have been key points of pain. Momentum or trend following within Systematic Risk Premia strategies were positioned largely risk-on going into February this year, and during the initial market sell-off, signals were slow to react and re-position the portfolio or reduce risk. Meanwhile, dedicated trend followers with shorter trend horizons and faster twitch signals have generally fared well through the period.

Systematic Risk Premia products encompass a wide range of investment styles and strategies, although they are largely designed to offer liquid, transparent and cost-effective solutions for accessing hedge fund-like return streams.

The rise of Systematic Risk Premia strategies shares similarities with the shift towards passive investing in more traditional asset classes, spurred in part by the general underperformance of higher-fee fundamental investment managers.

These strategies are generally rules-based, multi-asset, and utilise a long-short approach with leverage and derivatives forming a key part of portfolio construction. Fund managers within Lonsec’s Systematic Risk Premia sector seek to provide long-term absolute returns through a variety of replication techniques or by employing other commonly used (or ‘classic’) trading strategies used by active hedge funds (this may also include exposures to more commonly recognised ‘factors’).

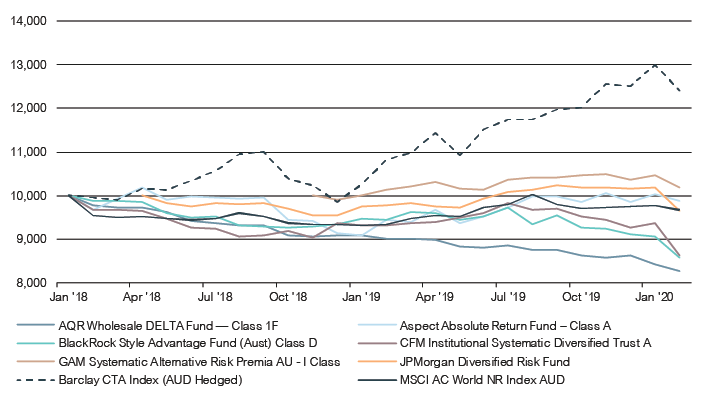

Performance of Systematic Risk Premia strategies during the COVID-19 pandemic

In February and March 2020, as the COVID-19 outbreak worsened and many major growth asset classes suffered severe losses, many Systemic Risk Premia strategies came under pressure. Underperformance within Lonsec’s universe of rated funds has largely been driven by carry factors such as short volatility, although value also detracted across many asset classes, as did momentum/trend.

Portfolio construction and risk management processes for many Systematic Risk Premia strategies rely on the back-tested assumptions that risk premia are uncorrelated, or at least lowly correlated. That said, recent performance in down-markets has suggested that this may not always be the case, which is when these relationships are needed most.

It is well known that trend factors often suffer losses during sudden inflection points and risk-off events like the current COVID-19 outbreak. Depending on prior signal direction and positioning, this is also the case for merger arbitrage and carry factors. For example, the Lonsec Systematic Risk Premia peer group underperformed in 2018 and most notably in Q4 2018 when most financial markets, including equity markets, experienced a relatively rapid drawdown of greater than 10%.

Overall, this has led to disappointing results in recent down markets. We believe more scrutiny regarding portfolio construction approaches is required, including the reliance on longer-dated statistical relationships that can deteriorate as market regimes shift. This remains a key area of focus for Lonsec during research reviews.

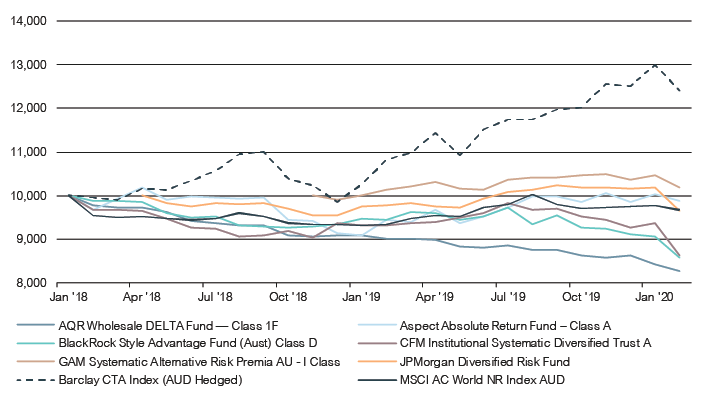

Performance of Systematic Risk Premia strategies (growth of $10,000 since January 2018)

Source: Lonsec

Using Systematic Risk Premia strategies in a portfolio

Lonsec believes that these products, especially those with more conservative risk-return targets, should generally suit moderate risk profile investors with specific liquidity requirements. Investors should also expect limited or no exposure to less liquid hedge fund strategies, such as Event Driven strategies.

That said, some fund managers like GAM have researched and established products with allocations to replicate less-liquid strategies, such as Merger Arbitrage, in a more liquid and lower cost offering. While increased liquidity is ordinarily a good thing for investors, the question also needs to be asked if the push towards more liquid underlying assets comes at the cost of lower returns. Hedge funds have historically benefitted from investing in illiquid assets, where the freedom to leverage into assets holding an illiquidity premium has delivered strong returns.

These types of strategies are not generally possible in a daily liquid vehicle due to the potential for a redemption freeze. Much like the discovery of over 400 factors, the efficacy of the risk premia employed by Lonsec’s peer group are subject to back-test bias. This makes it difficult to assess the performance and diversification benefits of these strategies given limited track records.

While live data is limited, these strategies have so far demonstrated medium-to-low correlation to major asset classes. However, without experiencing many sustained market downturns, through-the-cycle expectations are sceptically reliant on back-tested data. The current market environment will offer further evidence of how these strategies behave.

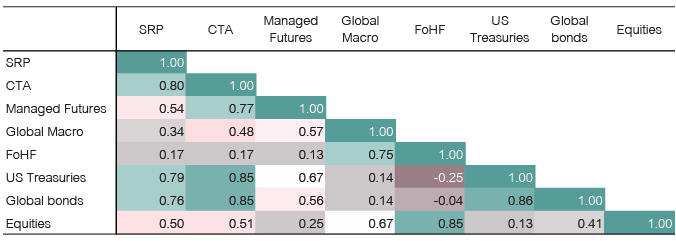

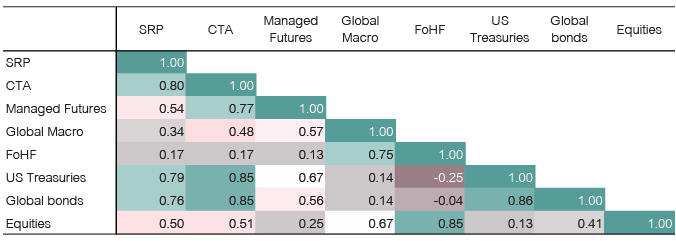

Correlations between Alternatives strategies

Source: Lonsec

As the chart above shows the correlation between common Alternative strategies including Systematic Risk Premia (SRP) and traditional asset classes based on monthly data from August 2011 to August 2019 (in Australian dollar terms). As can be seen, the reasonably high correlation between SRP, Managed Futures and CTA strategies is not unexpected given the inclusion of trend and momentum factors within SRP strategies. This is the case for a number of SRP managers in the Lonsec peer group, who have a heritage in trend following, meaning this premium can often dominate a strategy’s risk allocation.

The modest correlation to Equities (as defined by the MSCI AC World Index) may mean that the diversification benefits in a balanced portfolio are muted, although this will be dependent on the observation period. As mentioned, there is significant variation in the strategies and risk premia within the Lonsec rated peer group. The correlation to US Treasuries – and to a lesser extent global bonds – may be more sample-dependent and attributed to the synchronised monetary easing exhibited by most global central banks. As such, over the period, persistent declines in global interest rates have benefitted fixed income–oriented premia strategies, in particular those seeking to extract carry, trend, and volatility premia within the fixed interest asset class.

The need for a holistic portfolio approach

Investors also need to consider how best to incorporate Systematic Risk Premia strategies in a holistic portfolio, whether it be as a hedge fund replacement or to complete a balanced Alternatives allocation. Consideration must also be given during the Manager selection stage, as risk premia exposures can vary significantly between strategies.

While not designed as a hedge, diversification is best provided during risk-off market environments, and the inclusion of particular carry risk premia such as short volatility, which potentially experience drawdowns during these risk-off events, may make them unsuitable within a strategy designed to simply provide diversification. Further, there is the potential for some risk premia to already be represented in other parts of an investor’s portfolio (e.g. a strong value bias within an equity allocation) and having a sizeable allocation to the value premia within a systematic risk premia strategy may further reduce diversification benefits.