Despite a recovery in the March quarter, superannuation funds are heading for a disappointing 2018-19 financial year, with global growth challenges and a loss of market momentum meaning funds will struggle to make up for sharp losses in the December quarter.

According to estimates from leading superannuation research house SuperRatings, balanced option returns were largely flat through March as markets were weighed down by weaker economic data and fears of further falls in home prices.

The typical balanced option (defined as an option holding between 60-76% growth assets) returned an estimated 0.8% in March as the share market recovery came to a halt. The typical growth option also grew at 0.8% following strong gains in January and February of 3.2% and 3.4% respectively.

Estimated median balanced option returns to 31 March 2019

| Period | Accumulation returns | Pension returns |

|---|---|---|

| Month of March 2019 | 0.8% | 1.0% |

| Financial year return to 31 March 2019 | 3.2% | 4.2% |

| Rolling 1-year return to 31 March 2019 | 6.3% | 8.0% |

| Rolling 3-year return to 31 March 2019 | 8.4% | 9.3% |

| Rolling 5-year return to 31 March 2019 | 7.1% | 8.1% |

| Rolling 7-year return to 31 March 2019 | 8.5% | 9.6% |

| Rolling 10-year return to 31 March 2019 | 8.8% | 9.8% |

| Rolling 15-year return to 31 March 2019 | 7.5% | 8.2% |

| Rolling 20-year return to 31 March 2019 | 7.3% | – |

Interim results only. Median Balanced Option refers to ‘Balanced’ options with exposure to growth style assets of between 60% and 76%. Approximately 60% to 70% of Australians in our major funds are invested in their fund’s default investment option, which in most cases is the balanced investment option. Returns are net of investment fees, tax and implicit asset-based administration fees.

While funds have recovered from a horror December quarter, a weakening outlook will make it challenging for funds to make up further ground before 30 June. According to SuperRatings, the estimated financial year-to-date return for the median balanced option is 3.2%, which so far ranks as the seventh worst result since the introduction of the super guarantee in 1992.

Median balanced option financial year returns since the

introduction of the Superannuation Guarantee

*Financial year-to-date return

Source: SuperRatings

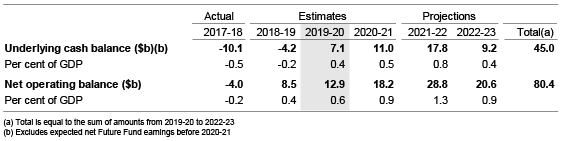

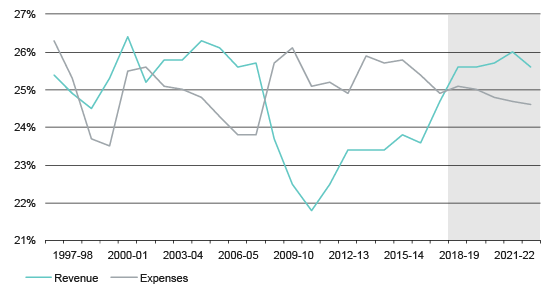

Meanwhile, the federal budget went largely unnoticed by markets, which had already anticipated many of the tax and infrastructure spending measures. Australians will head to the polls on 18 May, and while super is unlikely to be a defining election issue, there will be plenty of debate around Labor’s proposed changes.

“The federal budget delivered no surprises either for markets or for the super industry,” said SuperRatings Executive Director Kirby Rappell. “This is not a bad thing, because often the best thing a government can do is leave super alone.”

“The focus during the election will be on Labor’s proposed changes, which include reductions in contribution caps and the removal of imputation credit cash-outs, which will have a significant impact on SMSFs.”

Mr Rappell said falling home prices combined with weaker share market performance is the biggest challenge currently facing retirees.

“Falling house prices have a negative wealth effect that flows through to consumer spending, but they also throw a spanner in the works for many Australians approaching retirement who may have planned on downsizing and adding the windfall to their nest egg.”

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the merits of the superannuation or pension financial product(s) alone, without taking into account the objectives, financial situation or particular needs (‘financial circumstances’) of any particular person. Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness.

If SuperRatings advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Product Disclosure Statement for each superannuation or pension financial product before making any decision about whether to acquire a financial product. SuperRatings’ research process relies upon the participation of the superannuation fund or product issuer(s). Should the superannuation fund or product issuer(s) no longer be an active participant in SuperRatings research process, SuperRatings reserves the right to withdraw the rating and document at any time and discontinue future coverage of the superannuation and pension financial product(s).

Copyright © 2019 SuperRatings Pty Ltd (ABN 95 100 192 283 AFSL No. 311880 (SuperRatings)).

This media release is subject to the copyright of SuperRatings. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth.), no part of this media release may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of SuperRatings. This media release may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to SuperRatings copyrighted material, applies to such third party content.

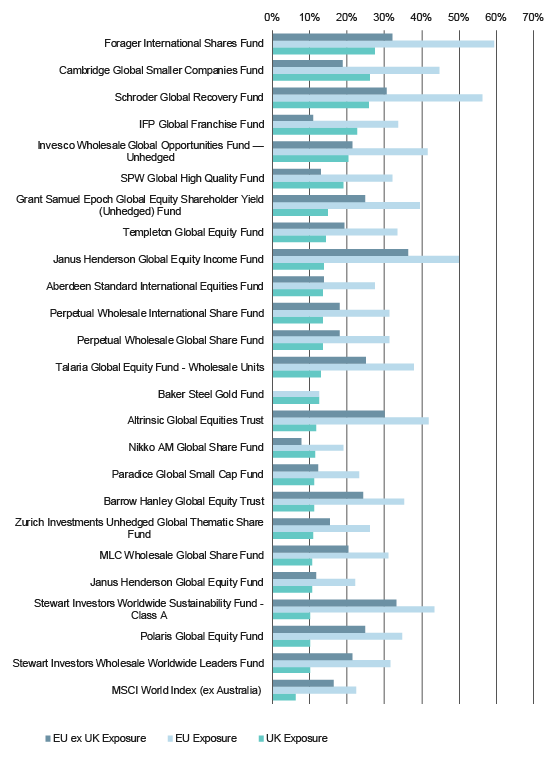

10% UK exposure” width=”561″ height=”301″ class=”alignnone size-full wp-image-5666″ style=”margin: 0;” />

10% UK exposure” width=”561″ height=”301″ class=”alignnone size-full wp-image-5666″ style=”margin: 0;” />