Lonsec Multi-Asset Managed Portfolios

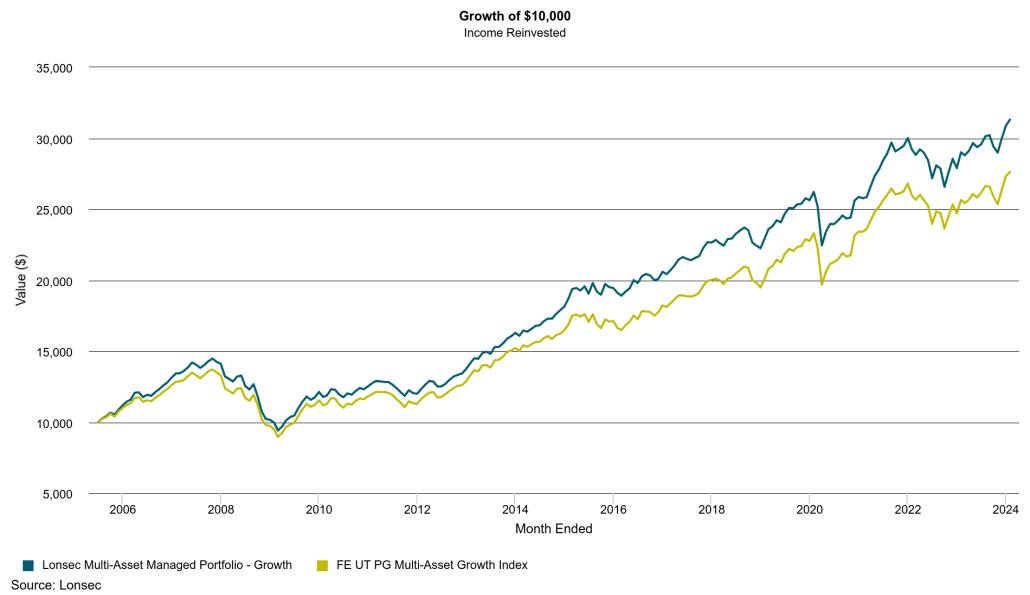

The Multi-Asset Managed Portfolios provide investors with capital growth and income over the medium to long term through exposure to a range of asset classes and investment vehicles. The portfolios are designed to reduce overall portfolio risk by spreading investments across a number of specialist managers with complementary investment styles.