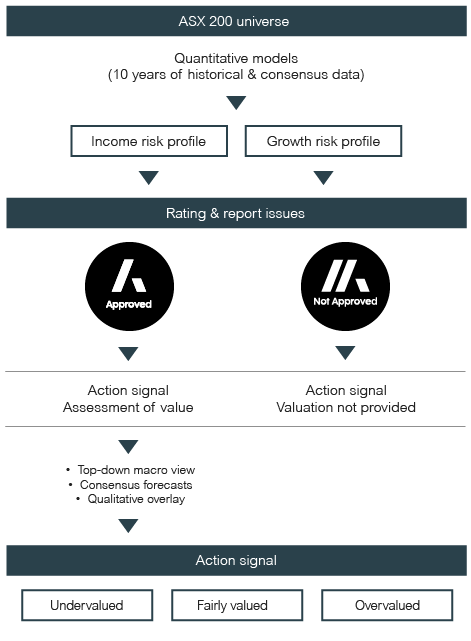

Actionable insights with analytical rigour

We understand that identifying future outperformance is an artform, not a science. Our analysts go beyond the pure numbers to understand the people and structures behind each investment product, giving you the tools to select high quality fund managers for individual investment needs.