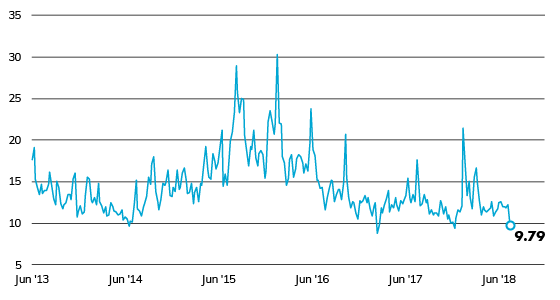

Volatility has died down since the dramatic spike witnessed in February 2018, but a return to near-historic lows should raise eyebrows among investors. The S&P/ASX 200 VIX Index, a measure of implied volatility in the Australian share market, closed last week at 9.79 points, falling back below double-digits and a far cry from February’s high of 22.16.

S&P/ASX 200 VIX Index

Source: Lonsec, Bloomberg

While fundamentals still provide some support for a low volatility environment, with interest rates at ultra-low levels and earnings growth generally living up to expectations, investors should be prepared for more heightened volatility in the second half of 2018.

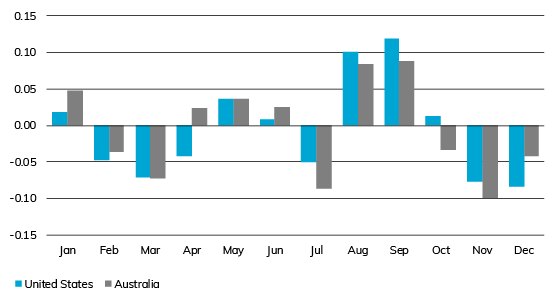

As the chart below shows, over the past 10 years the August and September period has seen the biggest average moves in the volatility index, and this is true of both the Australian and US markets.

Average daily change in volatility index, 2008-2018

Source: Lonsec, Bloomberg

While volatility is not always a bad thing, shares are particularly vulnerable when a low-volatility environment comes to a grinding halt.

With the US Fed due to hike rates again in September, and the UK grasping for a Brexit deal ahead of the October European Summit, there are reasons to be nervous. And the fears are not only confined to developed economies: Turkey’s currency has plunged to record lows and is having knock-on effects in other emerging markets.

On the trade front, while the US-China tariff war is yet to hit developed markets hard, the negative impact is starting to creep into measures of manufacturing activity and export volumes in the US and Asia.

In other words, this is no time to be ignoring history.

Release ends