Behavioural finance tells us that herd behaviour is hard wired into our brains. As investors we don’t want to miss out on opportunities, especially when we see others taking advantage of them. Herd behaviour and a fear of missing out is what drives asset bubbles, which means as investors we need to be on guard to ensure our emotions take a back seat when we make buy and sell decisions.

Investors are familiar with the FAANG stocks (for the uninitiated FAANG stands for Facebook, Apple, Amazon, Netflix and Google). Some of them are among the highest valued stocks in the world (Apple became the first company in the world to reach a market cap of $1 trillion but has since fallen below this level due to falling iPhone sales). In Australia we have our own acronymised technology cohort called the WAAAX stocks, which include WiseTech, Altium, Appen, Afterpay and Xero.

While hardly on par with the US tech giants in terms of size, these businesses have managed to capture people’s attention and imagination in a similar way. But like the FAANGs, the WAAAXs are certainly not a homogenous group. While each has seen eyewatering growth in recent years, they are essentially very different businesses with different growth drivers and risks.

WAAAXing fortunes

It’s sometimes easy to forget how parochial the Australian share market can be. The WAAAX phenomenon is undoubtedly a good thing, especially given that the ASX remains dominated by banks and miners. Australia’s tech sector may still be small, but its growth is helping to provide some much-needed diversification. While only 2.4% of the ASX 200’s total market cap, there are now 15 names in the tech sector with a combined market cap of over $75 billion.

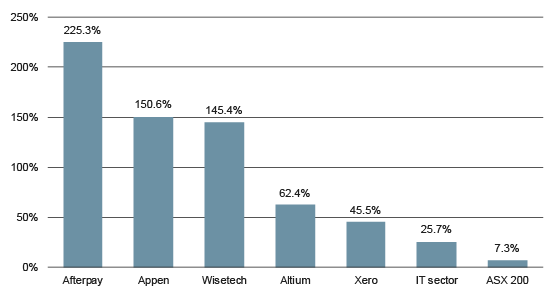

WAAAX share price returns (12 months to end March 2019)

Source: FE, Lonsec

When you look at the stellar growth of these shares, it’s easy to see why they’re considered the Australian FAANGs. But how useful is it to group shares together in this way? Certainly in the US, the FAANGs don’t always behave as a group. While the return of risk appetite contributed to their strong performance in the March quarter, most were unable to make up for earlier losses due to the ongoing impact of idiosyncratic issues plaguing each stock.

Facebook continues to be scrutinised for their lax privacy policies, Amazon is facing a challenging earnings outlook, Apple’s revenue and product launches have fallen short of expectations, Netflix faces increasing pressure from new competitors, and Alphabet (Google) received another fine from the European Union for violating antitrust laws.

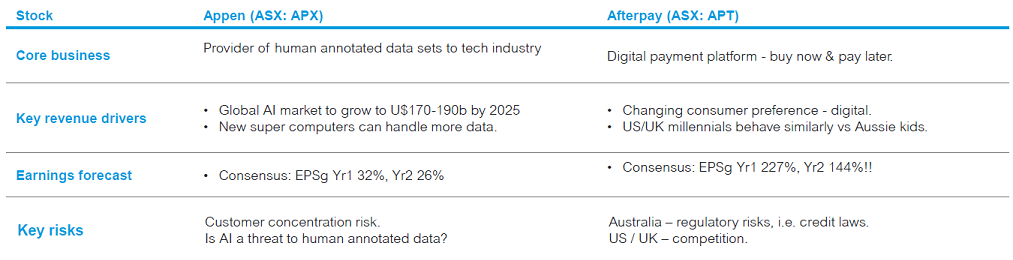

In Australia, the diversity of the WAAAX stocks poses a similar challenge for investors. To give a sense of how different these businesses are, let’s have a quick look at two of them: Appen and Afterpay. These are among the most popular shares over the past two years, but they have fundamentally different core businesses. For Appen, revenue is driven by the growth in AI and machine learning solutions, with Appen providing quality datasets that help make these products smarter. In contrast, Afterpay’s extraordinary growth has been due to the company’s ability to take advantage of a potential step change in consumer behaviour, with a younger generation of consumers favouring digital payments and more flexible spending.

Source: Lonsec

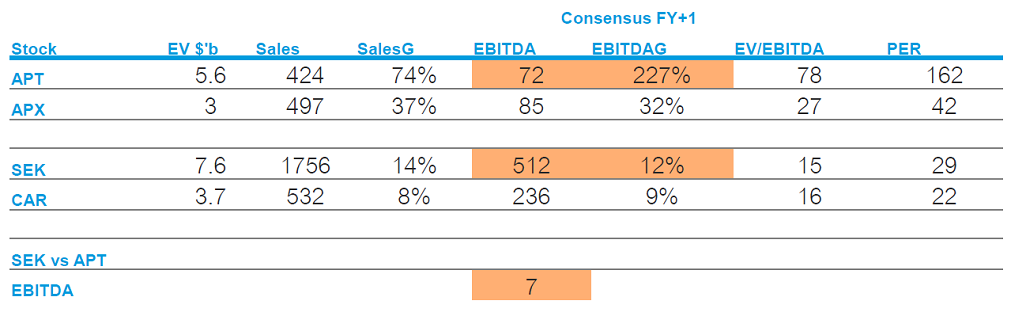

While these stocks are different, there is no denying the extraordinary growth of the WAAAX group, which is indicative of some of the disruptive trends taking place in the digital world. This is reflected in the sales and EBITDA growth of Afterpay and Appen, which becomes starker when compared to other popular sector peers Seek and Carsales. Clearly there are good reasons to be optimistic, but the question is how best to take advantage of these opportunities in your broader portfolio.

Source: FE, Lonsec

Using WAAAX shares in your portfolio – key things to note

When incorporating the WAAAX shares in your portfolio, the most important thing to remember is that they are not homogenous, which means you shouldn’t group them together. While these shares may grow together in a risk on environment, each face their own set of risks and opportunities which could see results diverge significantly.

The second thing to note is that these are capital hungry businesses with a mandate to grow, which means you should not expect a steady stream of hefty dividends. Because they are long duration assets, they will also be more sensitive to movements in interest rates.

Thirdly, while each of these stocks appears to enjoy significant upside, there are always risks around valuation and potential bubble-like behaviour. Valuing things like network effects can be difficult, while forecasting consumer trends and the role of AI require a host of assumptions to hold true. When it comes to technology, there is usually a significant degree of uncertainty involved, not to mention the regulatory risks faced by successful disruptors.

Our view of the WAAAX stocks is that you want to take advantage of the growth opportunities they represent, but don’t fall into the trap of bucketing them together. Understand the drivers of each business and let the winners run, but be sure to carefully monitor the market and regulatory risks of each business.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2019 Lonsec Research Pty Ltd, ABN 11 151 658 561, AFSL 421 445. All rights reserved. Read our Privacy Policy here.