If you thought the coronavirus put an end to geopolitical maneuvering, you probably haven’t checked in on the oil market.

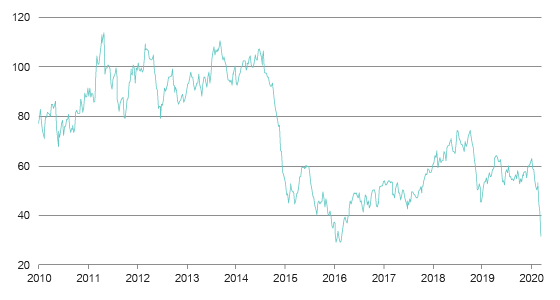

The WTI spot price has fallen from its most recent peak of around US$74 per barrel in late 2018 to around $32 as at the end of last week. The price was around $52 at the start of February, reminding us of the astonishing pace at which oil prices can move (especially on the downside).

The coronavirus has come along as a negative demand-driven catalyst to enforce this via sharply reduced prices, at least for the short term.

WTO crude oil spot price (US$)

Source: Bloomberg

With annual global supply and demand of around 99.5 million barrels of oil per day (MMBOPD), the movement of just 2 MMBOPD on either side, from historical observation, can have dramatic effects on the spot price. Some analysts are forecasting a 4 MMBOPD drop in demand in the February to April period – and potentially longer – due to the coronavirus and associated economic fallout.

OPEC have proposed an additional 1.5 MMBOPD cut if Russia joins in, but so far Russia has not agreed, in part causing a large drop in oil prices and leaving the market to ponder if the loose relationship between Russia and OPEC is over. There is an existing 2.1 MMBOPD cut to official supply levels already in place for OPEC+, which consists of the 14 OPEC members plus 10 non-OPEC producers (the so-called Vienna group led by Russia).

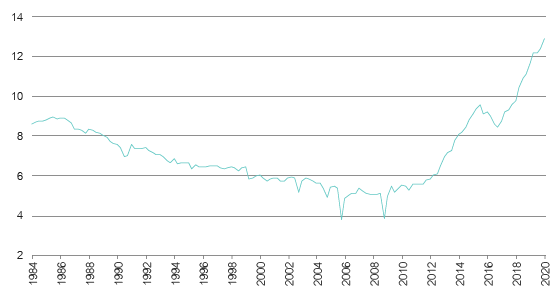

As the world’s attention is captured by the coronavirus, a repeat of 2015 is taking place in the background. On the back of the high oil prices that prevailed from 2010 to 2014, US shale producers increased their production to record levels, contributing to overall US oil output of 9.6 MMBOPD – up from approximately 5 million in 2009 – causing OPEC market share to fall from 34% to 31%.

US oil production (million barrels per day)

Source: Lonsec

When that level of supply started to weigh on inventories, prices started to fall. Previously, OPEC has stepped in to cut their output and stabilise prices, but this time it refused, arguing it was the US producers that caused the excess supply problem and they weren’t going to cut back voluntarily.

Lessons from 2015

This inaction from OPEC had a severe impact on Australian produces like Santos (STO) and Origin Energy (ORG), which had amassed large amounts of debt after investing in LNG plants, and were then forced to embark on dilutionary equity raisings and dividend cuts. BHP wrote off billions of dollars from its misguided acquisition of shale assets in 2012, back when oil prices were high, and only Beach Energy (BPT) and Woodside Petroleum (WPL) were able to take advantage of the situation and buy up assets at low values. Of course, WPL didn’t quite pull this off in the end and were forced to write down their Kitimat LNG acquisition.

As oil prices fell sharply from late 2014 and 2015, some US shale producers became uneconomic and exploration rig counts declined, leading to US production falling back to a low of 8.5 MMBOPD in September 2016. The cycle repeated itself with oil prices rising in response to this decline in output, combined with ongoing modest but positive global growth thanks to the Chinese economy.

As oil prices began their march back up to US $70 per barrel in 2018, US shale producers were once again encouraged to increase production, this time at an enforced cost base below that of the previous cycle. With the added support of a pro-business government, output rose to 13.1 MMBOPD by February 2020.

This time, however, Russia has had enough. After making some production cuts last year as part of the OPEC+ initiative, further cuts hand US producers an undeserved and unnecessary advantage. After Russia’s walkout, markets believe we could be entering a period of sustained low and volatile oil prices, as the world waits for US shale producers to be forced to cut back production once again.

Lonsec’s view

Lonsec has generally taken a cautious view on holding energy stocks in our model portfolios, partly due to the risks of the events described above, which tend to come in all-too-regular cycles. We avoided the trap in 2015 (although others were not so lucky) and have maintained a healthy degree of caution since.

Unless OPEC and Russia can come to some sort of agreement, oil markets are set for further pain. Given the magnitude of the price falls, opportunities may present themselves for those seeking to take advantage of the cyclical nature of energy businesses, but this must be done with an understanding of the history and inherent risks and volatility within the sector.

As Lonsec moves to hold more regular investment committee meetings as market volatility reaches intense levels, it’s important to consider both risk mitigation strategies as well as longer-term opportunities that could add value to portfolios as we move through the cycle.

At a security level, STO has gone from a semi-distressed situation, with multiple capital raisings and a dividend cut in 2016, to a much stronger company now under very good management. Still, after reaching a share price high of $9.00 on 15 January 2020, it has declined 25.5% over the last seven weeks to $6.70 per share, highlighting the potential volatility in the sector.

STO share price

Source: Lonsec

WPL appears to have good defensive characteristics compared to its peers, but its investment pipeline over the next five years includes large outlays on projects with a low internal rate of return. We decided to remove WPL from our core portfolio given the high level of volatility in both the stock and oil price, and we also questioned some of the projects the business has acquired recently.

OSH is in real trouble and is the most levered play – it has higher risk of capital management initiatives compared to its peers. Both STO and BPT have began cutting capex.

The coronavirus outbreak and the dramatic fall in oil prices were not predicable events, but Lonsec’s focus now is on diversifying our portfolios from a bottom-up perspective while looking for opportunities to take a more positive position in certain securities as valuations become more attractive. These conversations will take place on a regular basis, including as part of our formal investment committee meetings, which are now taking place monthly and as required as market volatility plays out.