Federal government doubles down on expansionary budget

It’s been only seven months since the last federal budget in October 2020, which was delayed in order to give the government maximum flexibility to respond to the COVID-19 pandemic. This budget is the second pandemic budget, with the focus now shifting from temporary spending measures to keep the economy afloat to building a more sustainable post-COVID economy and beginning the long journey of budget repair.

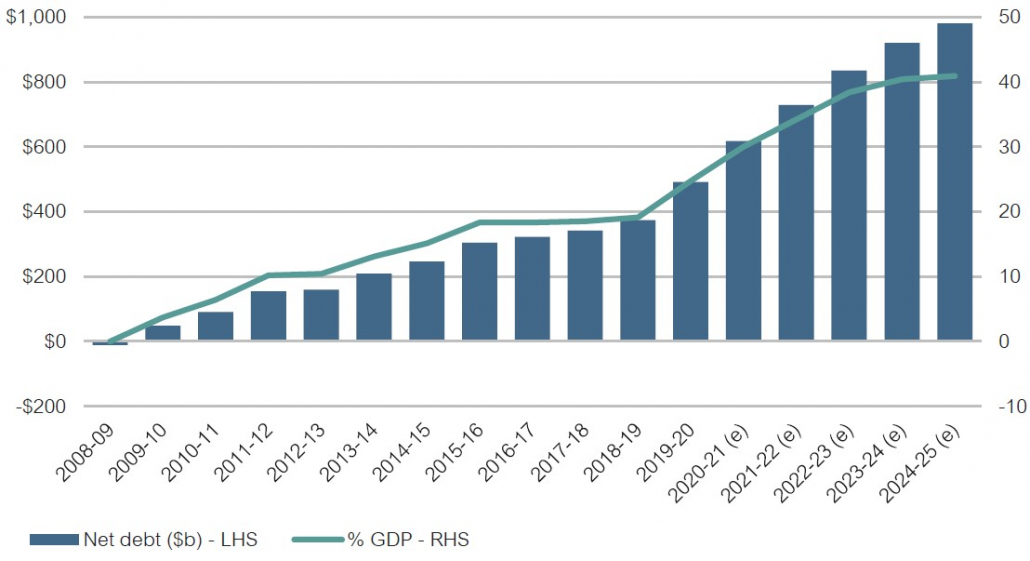

What’s clear is that—unlike many of the job saving initiatives employed during the pandemic—the impact on Australia’s fiscal position will be much less temporary, with mounting deficits through the forward estimates set to accumulate a net debt of just under $1 trillion by 2024-25. The consolation is that, with interest rates at record lows and the Reserve Bank of Australia intent on keeping them that way, there has never been a better time for the government to borrow to support households and add to Australia’s infrastructure pipeline.

The government has not taken any chances with this budget. While the economic recovery has been strong—reflected most notably in employment growth—and consumers have so far shrugged off the unwinding of the JobKeeper program, the pandemic is still with us and there are plenty of potential risks that could derail or forestall growth. Instead of taking the opportunity to go harder on budget repair, the government is keen to secure the recovery with a very expansionary budget that doubles down on the 2020-21 fiscal strategy.

Still fighting the virus

Australia’s management of the pandemic has been the envy of the world, but now the test of the Morrison government will be how effectively it can support the roll out of vaccines while providing the necessary fiscal support to businesses, households, and the healthcare system. To address the immediate challenge of the vaccine rollout, the government is providing $1.9 billion through the COVID-19 Vaccination Strategy plus an additional $1.5 billion to extend a range of COVID-19 health response measures.

While Australia is emerging from the COVID-19 shock with a strong recovery in activity and employment, the outlook for the global economy remains highly uncertain. With 800,000 COVID-19 cases diagnosed daily across the world, new strains of the virus emerging and international travel restrictions yet to be lifted, the effects of COVID-19 may not dissipate for some time yet.

Tax relief and targeted support for vulnerable sectors

Aside from the direct COVID-related measures, the real centrepiece of the budget is the tax relief measures, which will provide more dry powder for households, which are now more confident about the direction of the recovery and hopefully willing to spend down the savings they accumulated during the pandemic.

The government will retain the low and middle income tax offset (LMITO) in 2021-22 to provide $7.8 billion in targeted support to around 10.2 million low- and middle-income earners. This is on top of the $25.1 billion in tax cuts flowing to households in 2021-22 that have been announced in previous budgets.

The other key item is the extension of full expensing of depreciable assets for businesses with turnover below $5 billion, which was introduced as a temporary measure in the 2020-21 budget. This budget extends full expensing for another 12 months until 30 June 2023 to encourage additional investment and allow businesses embarking on projects with longer lead times to capture more of the benefits of this measure.

Other initiatives to provide more targeted support include an additional $1.2 billion for the aviation and tourism sectors, the Small and Medium Enterprise (SME) Recovery Loan Scheme, which builds on the SME Guarantee scheme, and an additional $500 million to expand the JobTrainer Fund, subject to matched funding by state and territory governments.

Another infrastructure budget

Infrastructure has become a budget staple regardless of who is in power, and the Morrison government has not missed their opportunity this time around. This budget provides an additional $15.2 billion over ten years for road, rail and community infrastructure projects, which the government claims will support over 30,000 direct and indirect jobs.

The highlights of the infrastructure spend include $2 billion to support delivery of the Melbourne Intermodal Terminal to increase national rail freight network capacity, $2.6 billion for the North-South Corridor (Darlington to Anzac Highway in South Australia) and $2.0 billion for the Great Western Highway Upgrade (Katoomba to Lithgow in New South Wales). This package also includes an additional $1 billion to extend the Local Roads and Community Infrastructure Program.

Improving aged care

Although it took a back seat through the pandemic, aged care reform has been the big issue on the government’s radar following the Royal Commission into Aged Care Quality and Safety. The government has committed an additional $17.7 billion over five years to improve the system, including $6.5 billion for the release of 80,000 additional Home Care Packages over the next two years. The Aged Care Quality and Safety Commission will also receive additional resources to manage compliance and ensure quality care services and the introduction of new star ratings.

An additional $13.2 billion has been provided for the National Disability Insurance Scheme, while a key political focus for the budget has been on the $3.4 billion to support women, including programs to improve women’s safety and economic security.

The elephant in the room: debt and deficits

None of the spending initiatives in this year’s budget would be possible without upending Australia’s fiscal norms. While debt-to-GDP remains low compared to Australia’s peers, the two pandemic budgets will test the political restraints that have traditionally governed the nation’s fiscal settings, even in the wake of the GFC. Government outlays are expected to hit 32.1% of GDP in 2020-21 and, while that is the peak, such a figure would have been unthinkable a decade ago.

Australia’s net debt will hit nearly $1 trillion by 2024-25

Source: Budget papers

Net debt is expected to be 34.2% cent of GDP in 2021-22 and peak at 40.9% of GDP in 2024-25. Net debt is then projected to fall over the medium term to 37.0% of GDP in 2031-32. In other words, Australia will be managing the fiscal impact of the pandemic for a decade or more.

While gross debt has increased significantly since the onset of the pandemic, the cost of servicing that debt is lower in 2021-22 than it was in 2018-19 as a result of historically low interest rates. The government’s management of the yield curve has helped reduce refinancing risk and has made repayments less sensitive to short-term yield moves. However, while low yields will be doing much of the heavy lifting, the government must still work to reduce the economy’s dependence on government spending and ensure there is enough room to move when the next crisis hits—hopefully far off down the road!

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd ACN: 608 837 583 (LIS), a Corporate Authorised Representative (CAR number: 1236821) of Lonsec Research Pty Ltd ABN: 11 151 658 561 AFSL: 421 445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Fiscal Holdings Pty Ltd ACN: 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure at the date of publication: Lonsec Research receives a fee from the relevant fund manager or product issuer(s) for researching financial products (using objective criteria) which may be referred to in this document. Lonsec Research may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec Research services. LIS receives a fee for providing the model portfolios to financial services organisations and professionals. LIS’ and Lonsec Research’s fees are not linked to the financial product rating(s) outcome or the inclusion of the financial product(s) in model portfolios. LIS and Lonsec Research may hold any financial product(s) referred to in this document. LIS and Lonsec Research’s representatives and/or their associates may hold any financial product(s) referred to in this document, but details of these holdings are not known to the Lonsec Research analyst(s).

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to “general advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. Before making an investment decision based on the rating or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If the financial advice relates to the acquisition or possible acquisition of a particular financial product, the reader should obtain and consider the Investment Statement or the Product Disclosure Statement for each financial product before making any decision about whether to acquire the financial product.

Disclaimer: This document is not intended for use by a retail client or a member of the public and should not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by LIS. Financial conclusions, ratings and advice are reasonably held at the time of completion (refer to the date of this document) but subject to change without notice. LIS assumes no obligation to update this document following publication.

Except for any liability which cannot be excluded, LIS and Lonsec Research, their directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2021 Lonsec Investment Solutions Pty Ltd ACN: 608 837 583