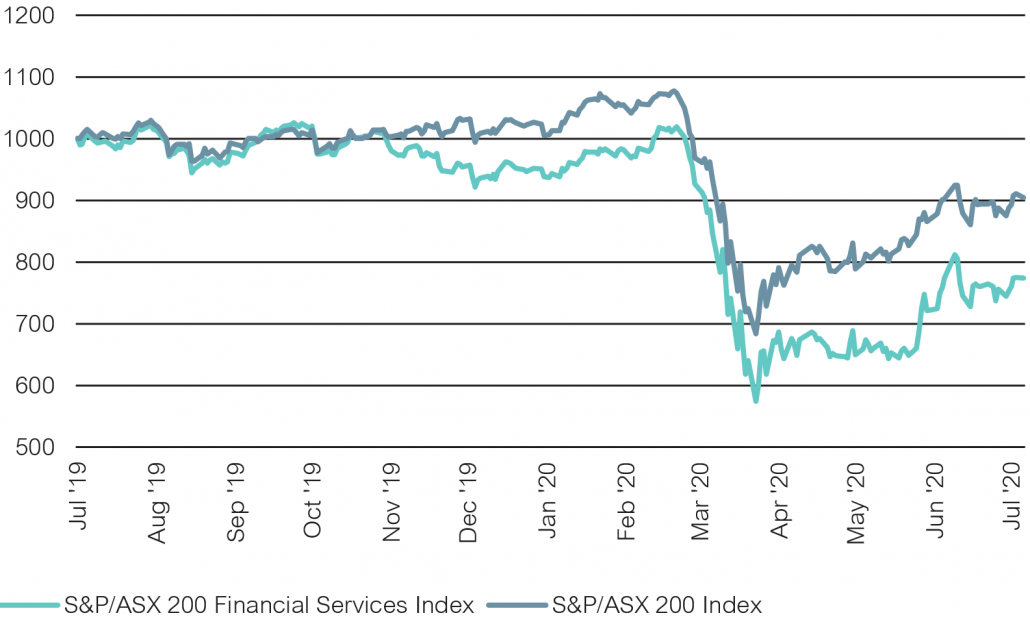

The Australian property securities market has seen most prices continue to recover during the September quarter 2020 as the reporting season was better than expected. However, the bifurcation between sub-sectors is similar to the global property securities markets. Industrial/Logistics, specialist, funds management, large format, and non-discretionary retail sectors have outperformed in calendar 2020. Discretionary retail and office sectors underperformed.

The Retail sector has had to deal with forced store closures (excluding supermarkets and essential provisions), with the Melbourne metropolitan region still under lockdown restrictions. The government mandated Leasing Code of Conduct has shared the pain of reduced revenues for eligible small-to-medium enterprises, although some larger retailers have been attempting to withhold rents and renegotiate based on a revenue-linked model.

Overall, rent collections in retail have been around 55% for the June 2020 quarter, with dividends cut or omitted by the likes of Scentre Group. Retail rents for discretionary stores are likely to continue to come under pressure. In contrast, non-discretionary retail centres anchored by supermarkets have traded strongly, as have large format centres with Bunnings Hardware, Officeworks, and JB Hi-Fi as tenants. Property valuations of the latter have remained firm, while discretionary mall valuations have fallen.

The Office sector has continued to collect a high level of rents and valuations have seen limited reductions given the level of local investor interest in high quality Australian property (albeit international interest is more subdued given that travel is not possible for inspections). Medical and tech-related space is also well sought after by smaller investors. However, rental incentives are rising and sub-lease space in Sydney and Melbourne has grown by 100,000 square metres.

The Industrial/Logistics sector has been led by Goodman Group, with a strong FY20 earnings result and reaffirmed positive outlook based on its global development pipeline and recurring funds management fees. In Australia, logistics developments are expanding to cater for the ongoing shift to online networks with some vacancy increase on the east coast.

The Residential sector has received significant government support from the JobKeeper and JobSeeker programs and other incentives by various state governments. Further easing of lending criteria by APRA, in addition to loan repayment deferrals by the major banks, has lent support during the pandemic period. However, these measures are scheduled to unwind over the next six months (excluding the $25,000 Homebuilder program and easier lending requirements), which is likely to expose the residential sector to high unemployment. While Australia’s international in-bound travel is severely limited, migration numbers will be down significantly relative to previous years and the outlook for new residential property sales from this source is likely to be subdued.

Several Australian REITs (A-REITs) had capital raisings during 2020, so balance sheets are well-positioned with average gearing around 27%. At the same time the cost of debt has reduced with interest costs for new debt down from around 3.0–3.5% to 2.0–2.5% over the last year.

Pricing in the A-REIT sector has Industrial/Logistics (+71%), Hardware (+33%), and Service Centres (+13%) at premiums to net asset values (NAV). Sectors at a discount to NAV are Office (-17%) and Retail, although discretionary malls are at -54%, but non-discretionary centres at a 1.0% premium. Capitalisation rates have reduced over recent years and have now started to ease (for retail discretionary) or steady out (for office) but remain firm for Industrial/Logistics and Specialties (including Hardware).

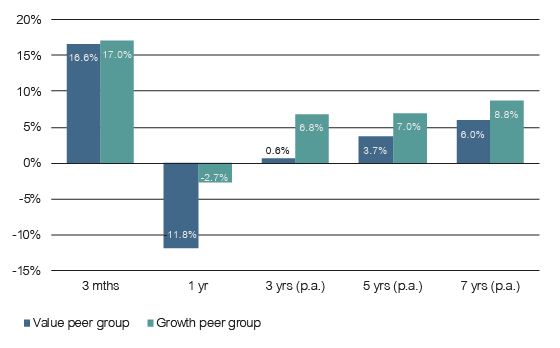

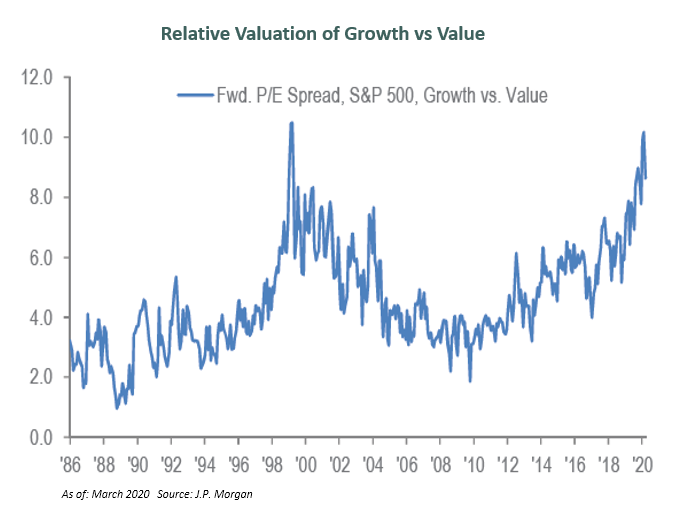

Lonsec believes the Australian real estate market, which was already late in the cycle pre-COVID, has extended its late-stage duration as a result of ‘lower-for-longer’ monetary policies. Despite deferrals and cancellations of dividends by some REITs, Australian property securities still offer attractive yields relative to both bonds and cash (holding at a 3.0–4.0% yield differential). Sectors with structural tailwinds (logistics, industrial, and specialised) are expected to enjoy more resilient cashflows and distributions, and as a result will continue to trade at a premium. Until the COVID-19 pandemic is brought under control, the way forward remains unclear. However, value investors will be tempted to look at heavily sold-off sectors at some stage.

Issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Warning: Past performance is not a reliable indicator of future performance. Any advice is General Advice without considering the objectives, financial situation and needs of any person. Before making a decision read the PDS and consider your financial circumstances or seek personal advice. Disclaimer: Lonsec gives no warranty of accuracy or completeness of information in this document, which is compiled from information from public and third-party sources. Opinions are reasonably held by Lonsec at compilation. Lonsec assumes no obligation to update this document after publication. Except for liability which can’t be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the document or any information. ©2020 Lonsec. All rights reserved. This report may also contain third party material that is subject to copyright. To the extent that copyright subsists in a third party it remains with the original owner and permission may be required to reuse the material. Any unauthorised reproduction of this information is prohibited.