Give financial advisers confidence in their recommendation

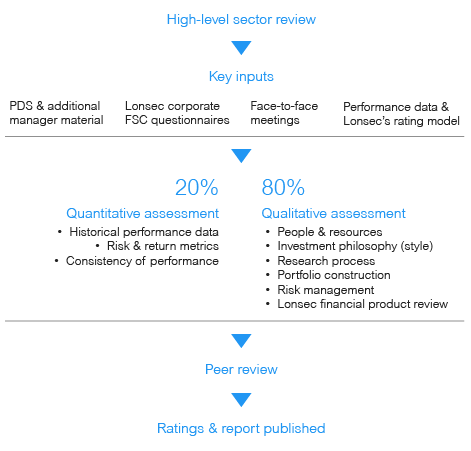

Lonsec’s ratings are trusted by the industry as a reliable indication of an investment product’s overall quality and ability to meet its stated objectives. Financial advisers use Lonsec’s ratings and fund reviews to construct Approved Product Lists (APLs), construct tailored investment solutions based on qualitative criteria, and to support their best interest obligations when recommending products.