Emerging market returns have been a cause for concern over recent weeks but by taking a broader perspective, investors may be able to take advantage of the volatility that is inherent in this sector.

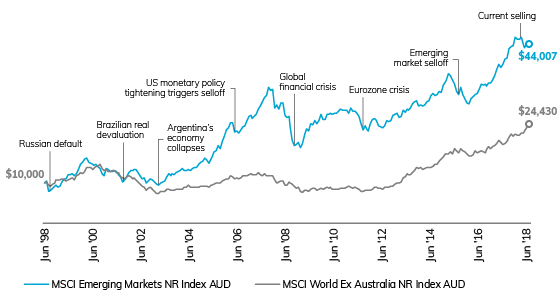

Recent analysis by research house Lonsec reveals that while emerging markets experience strong bouts of volatility they have also produced significant real returns over the long term. The below chart compares the MSCI Emerging Market Index, which tracks a basket of emerging market indices, with the standard MSCI World Ex Australia Index, which tracks developed market indices.

The chart reveals that while the emerging market index has experienced more volatility it has also produced higher returns over the past 20 years.

Emerging versus developed—growth of $10,000 over 20 years

Source: Lonsec, Bloomberg

Performance to 31 August 2018

It is important to remember that the phrase ‘emerging markets’ captures a large number of diverse countries. While Turkey and Argentina have suffered from trade related uncertainty, political risks and a rising US dollar, other emerging economies are powering ahead.

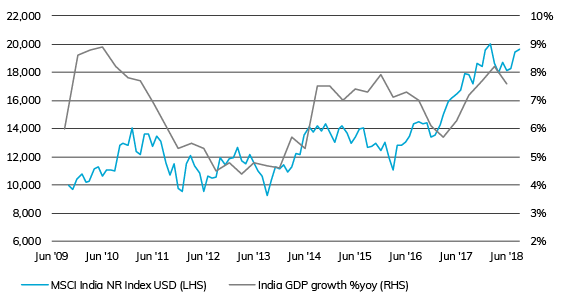

For example, India is still the fastest growing major economy in the world. The relationship between GDP growth and share market performance is imperfect with rising GDP not necessarily translating to strong investment returns. However, in India’s case share market performance has been reasonably correlated with GDP growth, indicating that it is relatively sustainable.

As a result, the broader emerging market index often has countries that are outperforming, and therefore balancing, laggards. This may produce more volatility but not necessarily lower returns.

Indian equities performance versus GDP growth

Source: Lonsec, Bloomberg

Release ends

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2018 Lonsec Research Pty Ltd, ABN 11 151 658 561 AFSL 421 445. All rights reserved. Read our Privacy Policy here.