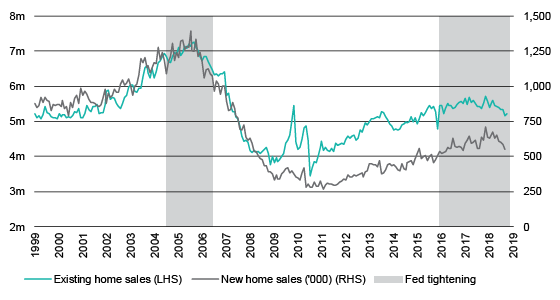

While consumer spending continues to propel the US economy, GDP growth slowed in the September quarter, with a conspicuous downturn in fixed investment. Recent signs of weakness in the housing sector have raised fears that this downturn could continue through the December quarter, but more importantly markets are concerned that Fed tightening could exacerbate the situation, triggering a further fall in housing activity and putting pressure on consumer spending.

Although housing starts have fallen only modestly from an annual pace of 1.3 to 1.2 million, sales of new homes have fallen 13% over the course of 2018, while the NAHB builder sentiment index has reached its lowest level in two years. Housing activity remained weak in October, with single-family housing starts falling by 1.8% and permits falling by 0.6%. As the chart below shows, both existing and new home sales appear to be coming off, coinciding with the most recent cycle of monetary policy tightening.

The US housing market is sounding concerns for the economy

Source: St Louis Fed, Lonsec

At a recent speech at the Dallas Fed, Jerome Powell listed three possible challenges to growth in 2019, including a weaker global economy, fading fiscal stimulus, and the lagged economic impact of the Fed’s past rate increases. More broadly, financial conditions have tightened, with credit spreads widening, equity prices declining, and the currency strengthening. There is now a distinct possibility that the Fed may pause during the course of 2019.

In the meantime, trade tensions continue to impact confidence. President Trump has threatened to impose tariffs on almost all Chinese exports to the US and to ramp up the rate to 25%. Whether reduced options for stimulus force the Trump administration into a deal on trade with China remains to be seen. The recent impasse between the US and China on trade at the APEC conference does not instill confidence, although talks between Donald Trump and Xi Jinping at the G20 summit in Argentina in late November could bear fruit.

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd (Lonsec), ACN 608 837 583, a corporate authorised representative (CAR number 1236821) of Lonsec Research Pty Ltd, ABN 11 151 658 561, AFSL 421 445.

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2018 Lonsec Investment Solutions Pty Ltd, ACN 608 837 583, a corporate authorised representative (CAR number 1236821) of Lonsec Research Pty Ltd, ABN 11 151 658 561, AFSL 421 445. All rights reserved.