Diversification worked well in the last week of February 2020 as equity markets sold off in response to the rapidly escalating COVID-19 pandemic. Bond markets, notably the highest quality and safest bonds (government bonds and high-quality investment grade credit) rose in price, providing a cushioning impact to multi-asset portfolios. Bonds, as expected, provided good diversification benefits in what was a typical ‘flight to quality’ episode.

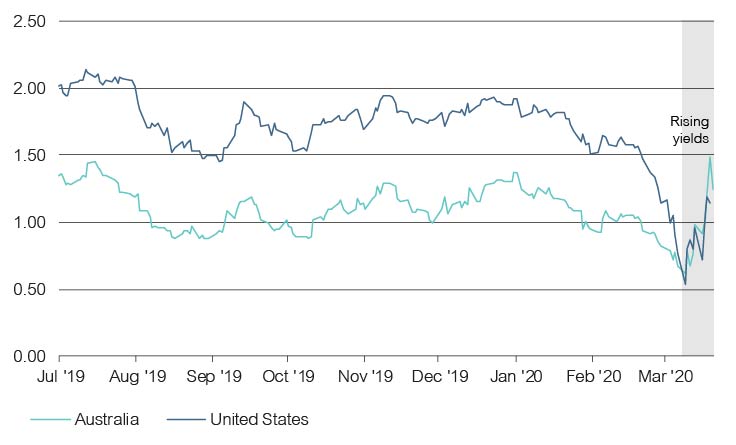

Roll forward to March and we are now seeing a very different market – one that is evolving rapidly. Most notably, bond yields have been rising, meaning prices have been falling. What’s going on? Are bond markets looking through the current bad news and pricing in an economic recovery? Usually yields rally in response to positive economic news, don’t they? Unfortunately, this is not the case. Rising yields and falling equity markets are not a good combination for multi asset investors because it means correlations have risen.

10-year government bonds yields began rising rapidly in March

Source: Bloomberg, Lonsec

What we are seeing and hearing from our fund managers is that there are severe liquidity issues in bond markets. Our fixed income managers are reporting limited liquidity in what are usually the most liquid securities: government bonds. There are simply very few buyers of these assets and many sellers. Adding to the problem is the widening pipeline of bonds, with more supply on the way courtesy of government fiscal stimulus plans, which will be funded via new bond issuance. The impact of increased supply is, of course, to lower prices.

General deleveraging by investors is clearly taking place. Investors are selling any liquid assets they can – including bonds – to fund redemptions, margin calls, or simply to move into cash. Some of our fixed income managers have been taking profit, trimming their positions after building in additional duration to their portfolios in the second half of last year. Parts of the market are blaming hedge fund sellers (always the first and easiest to blame) and some are blaming social distancing, which is making it more difficult for bond traders to execute their trades working from home.

At the same time, we’ve seen companies drawing down their entire credit lines at banks in efforts to shore up their balance sheets and make it through the next few weeks, months, or quarters with little to no revenue coming in. Access to cash (or credit) is essential to keeping these businesses alive and through to the other side of this shutdown. Bills, interest payments and fixed costs still need to be serviced. Companies are hording cash, and those that held government bonds as part of their liquidity reserves are selling. The demand for liquidity has been great, and cash – or ‘cashflow’ – is certainly king in this environment.

In efforts to avoid a repeat of the global financial crisis, central banks are throwing everything they’ve got at this, flooding markets with liquidity to ensure credit markets continue to function and companies have access to funding. Stabilizing the government bond curve (off which all credit securities are priced) is a critical first step for a functioning credit market.

Here in Australia, the RBA announced a number of measures, including dropping the cash rate to 0.25%, providing strong forward guidance, introducing a term funding facility, and announcing its intention to buy government bonds across the curve to ensure the 3-year yield remains low at 0.25%. We expect a large buyer (with deep pockets) entering the market could go some way towards stabilizing bond yields. On the back of the RBA announcement, yields on the 3-year bond dropped from 0.62% to 0.35%. This is a good first step, however we will be monitoring markets closely to see if it is enough. Thankfully, we think the RBA still has more left in its arsenal if required.