This year has been challenging for fixed income investors across all sectors, but the extraordinary developments in emerging market currencies and yields spelled significant pain for Lonsec’s fixed income fund managers. Volatility had long been anticipated by investors but it finally reared its head in 2018 with February’s selloff, followed by a similar bout of volatility and drawdowns in October. That, along with rising yields in the US led to many moving out of credit markets in favour of more defensive assets.

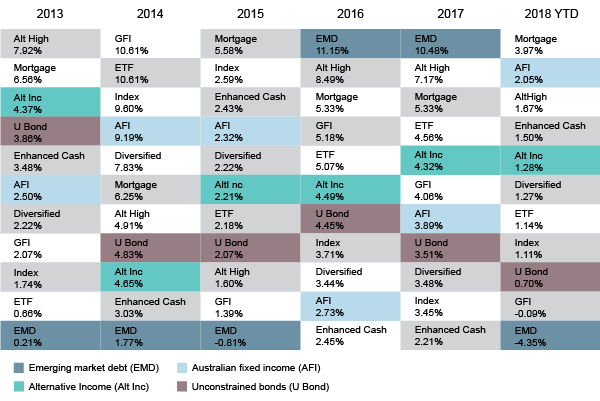

As the chart below shows, emerging market debt experienced a significant reversal in fortunes, going from the top performing peer group in 2016 and 2017 to the worst performing in 2018 (to the end of September). This was driven by a variety of events, including a strengthening US dollar, rising geopolitical risks—especially in Turkey—and investors moving back into the perceived safety of global bonds.

Australian fixed income manager returns were weaker than last year with only seven out of 13 managers outperforming the benchmark over the year ending September 2018. Over the three-year period returns were much weaker, with only one manager outperforming out of nine, although mostly with lower levels of volatility than the benchmark.

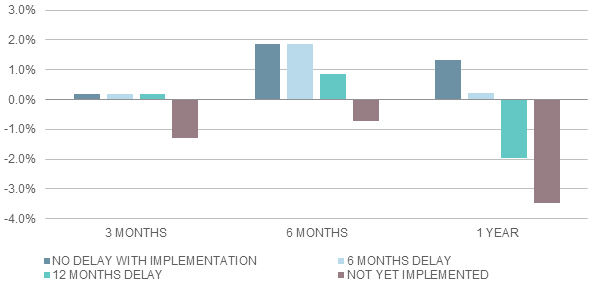

Average peer group returns by calendar year

Source: Lonsec

Average returns in the alternative income groups have been lower than last year, reflecting the challenging credit conditions across the board. Overall, eight managers outperformed the Lonsec sector benchmark while five underperformed. The strongest performing manager returned 3.3% while the worst returned -0.1%, demonstrating further compression in results from the previous year. Over three years, performance is stronger with ten out of eleven managers having outperformed the benchmark.

Within the unconstrained bond universe, results have been underwhelming, with 10 of 23 managers outperforming the Bloomberg AusBond Bank Bill Index. The unconstrained sector is highly diverse, and returns can vary greatly given that mandates are very flexible and implicitly seek to outperform cash at a minimum. However, compared to last year the dispersion of results was narrower with the best performing fund returning 2.9% and the worst returning -3.8%. Over the past few years, unconstrained bond managers as a peer group have delivered modest returns and have generally underperformed Australian fixed income funds year to year.

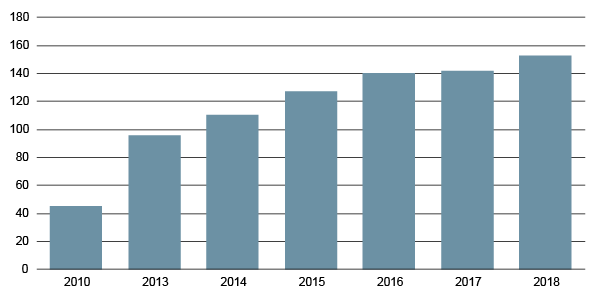

Growth in fixed income products covered by Lonsec

Source: Lonsec

Unconstrained bond products remain one of the drivers of product growth, along with post-retirement income-focused solutions. For investors willing to take on additional credit risk, there has been growth across both high yield and investment grade products, while at the other end of the spectrum Exchange Traded Funds (ETFs) and passive products have also experienced steady growth. There has also been notable growth in the number of funds offering responsible investment strategies. Investors should remain mindful of the role fixed income plays in an overall portfolio and how riskier assets may be impacted during adverse market events.

To find out more about Lonsec’s fixed income product research, sign up for a free research trial or get in touch with our client services team.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2018 Lonsec Research Pty Ltd, ABN 11 151 658 561, AFSL 421 445. All rights reserved. Read our Privacy Policy here.

Listed Fund Award

Listed Fund Award