Introduction

Listed Investment Vehicles such as Listed Investment Companies and Trusts were under much scrutiny prior to the eruption of the current crisis to engulf markets. Casting our minds back only two months, the issue dominating this corner of the investment world revolved around stamping fees. While Treasury has been tasked to formulate a response, it arguably has more pressing matters such as devising strategies to keep the Australian economy from imploding from the COVID-19 shutdown and direction may be some time coming.

The vehicles themselves have endured a torrid time during the market turmoil with planned capital raisings cancelled and the usual performance issues that inevitably crop up. The correction has, however, exposed other fundamental issues with LIVs ranging from underlying portfolio valuations to how these products themselves should be used in a client context.

From frying pan to the fire

Financial markets tend to resolve issues by themselves—for good or for bad. Stamping fees are otherwise known as commissions associated with a capital raising for a LIV. With the ASX having cratered 36% in short order (Feb. 20 to March 23), and investors nursing losses it seems likely that interest in new product would be severely curtailed for the medium term at least.

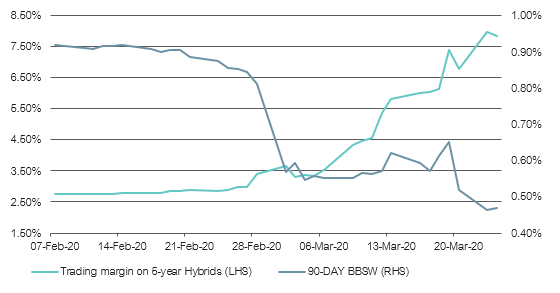

This is probably even more so for the yield orientated strategies which had been crowding the ASX boards of late. The thirst for yield, and the hitherto relative calmness in markets, had emboldened investors to reach out across the fixed income risk curve into highly sophisticated territory like private debt. While uncertainty surrounding stamping fees may have given issuers of new products cold feet, the ensuing COVID-19 induced market correction has more than likely forced a re-evaluation of timelines—from 2021 if at all.

These assets had been the preserve of institutional investors given the underlying risks and the need to have a genuine long-term view in order to prosper. The LIV closed-end structures are well suited to these types of assets protecting value from any investor panic and forced redemptions. However, while the assets themselves are sheltered (setting aside any potential issues relating to their prospective quality and resilience) the LIV trades daily on the market and concerns/reduced conviction will be impounded. There is always the ever-present issue of misuse although not dissimilar to illiquid or volatile micro and small cap equities.

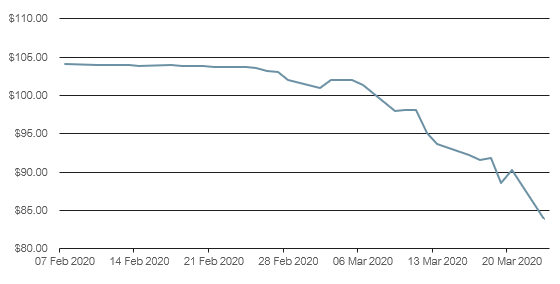

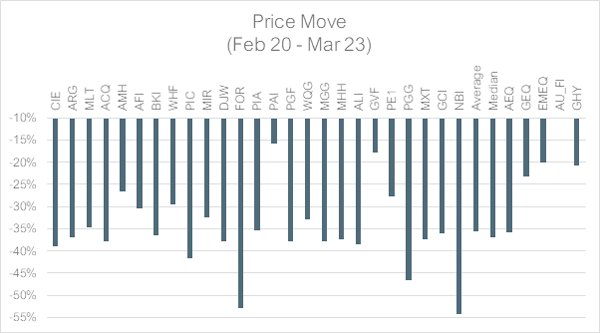

Lonsec researches 25 LIVs across Australian Equities, Global Equities, Fixed Income, Alternatives and Infrastructure (see Appendix 1 for the full list). All vehicles experienced steep drawdowns in traded value in excess of 10% during the window of February 20 to March 23 as seen in the following chart.

Source: Lonsec Research, Iress & Bloomberg | Stock Codes = See Appendix 1 | AEQ = S&P/ASX 200 TR Index AUD; GEQ = MSCI World ex Australia NR Index AUD; EMEQ = MSCI Emerging Markets NR Index AUD; AFI = Bloomberg AusBond Composite 0+ Year Index AUD; GHY = Bloomberg Barclays US Corporate High Yield (Unhedged)

Observations:

- Most LIV prices have fallen in line with the broader Australian share market rather than proxies which more closely match the underlying assets within their portfolios. For instance, the Magellan Global Trust (MGG) price fell 38% while the benchmark global equities index only fell 23%—this represents a significant 15 percentage point difference. A common criticism of listed infrastructure and property is that these assets will tend to trade more like stocks (Australian stocks at that) and this chart suggests that this criticism may be extended to non-AEQ LIVs. This can have serious consequences for client portfolio management and rebalancing decisions.

- Nine of the 25 LIVs fell less than the Australian market’s 36% of which six were Australian Equities focused vehicles.

- Platinum Asia Investments Limited (PAI) stands out with only a -16% fall. This would seem counterintuitive given its heavy China focus (net 42.9% as at 29 Feb. 2020 to China and related) and a healthy dollop of Korean exposure (net 9.4% as at 29 Feb. 2020). However, China’s stocks have so far proven resilient to the economic fallout with the CSI300 down only 12% for the same period (following an earlier period of volatility in January/February 2020).

- The only other LIV to have experienced such a cushioned fall (-18%) was Global Value Fund Limited (GVF). GVF uses a sophisticated strategy investing across a range of assets (including LIVs) as well as derivatives.

- The most eyebrow raising moves have been seen with the Fixed Income LIVs although this would seem reasonable after digging a bit deeper. Fixed Income more generally has a safe haven status during period of stress albeit with well understood limitations. Sovereign bonds tend to be the safest (hence their general risk-free asset status) followed by highly rated corporate bonds. All the Fixed Income products under coverage (including PGG) invest across a range of riskier debt with mixed liquidity and quality in order to generate their high yields.

- NB Global Corporate Income Trust (NBI) has the unenviable title of the worst price performer (-54%) of all listed products researched by Lonsec. Partners Group Global Income Fund (PGG) takes third spot (-47%) behind Forager Australian Shares Fund (-53%). NBI invests in global high yield bonds (GHY) which have been at the centre of concerns during this current crisis. GHY is also be considered as relatively more liquid than some of the other higher risk Fixed Income strategies in this space (e.g. private debt). NBI was also forced to cancel a c. A$340mn capital raising as a result of the market volatility. PE1 (withdrew ahead of close) and MXT (c. A$344mn) also cancelled capital raisings. Australian players MXT (-37%) and GCI (-36%) cannot escape the ignominy either.

- The investors need to be mindful of however is that unlike equities, bonds/loans (in Fixed Income products) have a finite period and strategies should receive a return of their capital barring any significant wave of defaults (then the recovery rate becomes another factor, generally higher than equities). Moreover, while traded prices may fluctuate as investors react to news affecting the underlying investments, the closed-end nature of these vehicles supports the integrity of the investment vehicle as these LIVs are immune from redemption pressure. Then again, they may simply trade at deep discounts to NTA for an extended period.

Stale NTAs Blight Sector

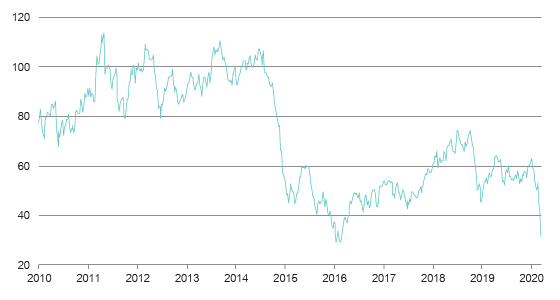

Listed markets are great for price transparency and particularly well suited to forming views on industrial companies. Maybe less so when it comes to LIVs judging by the propensity of these vehicles to trade away from their NTA—sometimes significantly.

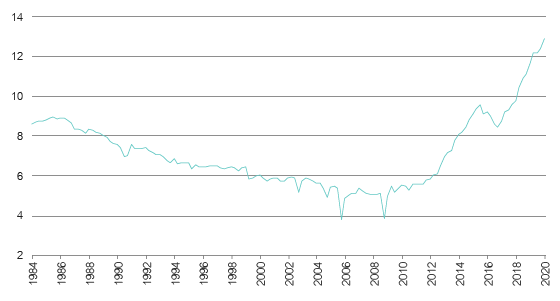

LIVs may have actively quoted prices but the frequency with which the value of their underlying investments is published can vary widely from daily, weekly, monthly or potentially longer. Clearly increased costs could be a limiting factor to increasing the frequency of audited values but producing daily estimates is not expected to be a material cost especially as this information should already be readily available within portfolio management systems.

Sadly, most Australian Equities LIVs report their NTA on a monthly basis and this stands in stark contrast to their Global Equities peers updating the market weekly. ARG has responded to the recent market turmoil by publishing weekly estimates. CIE, AMH, AFI, MIR and DJW have provided intra-month March updates. FOR and PIC meanwhile have been providing daily estimates for a long time and this should conceivably be the default model for all equities based LIVs.

Equity-based strategies are quite straightforward and typically uncomplicated with readily available asset prices. NTA updates on a monthly basis should no longer be accepted as general practice and these vehicles should improve their communications to investors. That vehicles with arguably less price transparent debt assets can confidently provide daily NTA estimates should give most of their peers cause for reflection on their own practices.

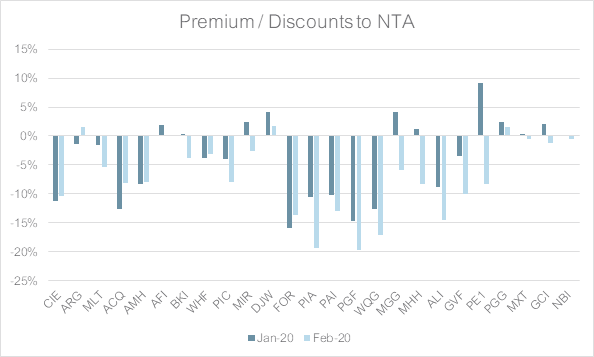

Source: Lonsec Research, Iress & Bloomberg | NTA = Pre-Tax NTA; Period = End of Month

The above chart highlights the premiums / discounts as at the end of January and February 2020. Clearly these values are very dated given the widespread price action post the 20th of February but nonetheless provide a useful discussion point. For instance, given the distress which has befallen credit markets globally and the significant price corrections experienced by the vehicles themselves, the very narrow discounts are expected to have noticeably widened. Using NBI as an example, this was trading at a 16% discount based on the March 26 NTA and March 27 closing price.

NBI observation also provides another lesson. Complicated strategies, or those with which the market has less familiarity or comfort, may nevertheless trade away materially from the underlying portfolio value. This is irrespective of the frequency with which NTA updates are provided. Moreover, not all assets can be valued more frequently either (e.g. direct property). Traded prices reflect future expectations and factors which impinge on an investor’s ability to derive these can weigh on market performance. In times of crisis, investors tend to flock not only to safety but simplicity too.

Conclusion

The treatment of stamping fees had been consuming the industry for many months before the Treasurer announced a review into the issue in January. This was before the world changed with COVID-19 and exposing some other deep-seated issues within the industry. For instance, why should a portfolio of liquid daily traded securities only provide NTA updates on a monthly basis? By comparison managed funds can strike prices daily on similar pools of assets. Moreover, debt focused LIVs are already confidently providing daily NTA estimates. Stale NTAs are expected to have a material impact on investor psychology and into the trading performance of these vehicles.

The other more pernicious issue relates to portfolio construction. A client portfolio built of non-equities based LIVs is likely to miss out on immediate and normally expected correlation benefits as many Lonsec researched ASX-listed LIVs traded in-line with the ASX and not with their underlying assets. Perhaps this issue should get at least equal attention than whether stamping fees should persist.