Superannuation funds are under increasing pressure to drive down fees. While investment fees and costs are a key driver of the amount members pay for their superannuation, demonstrating the relationship between cost and value remains challenging.

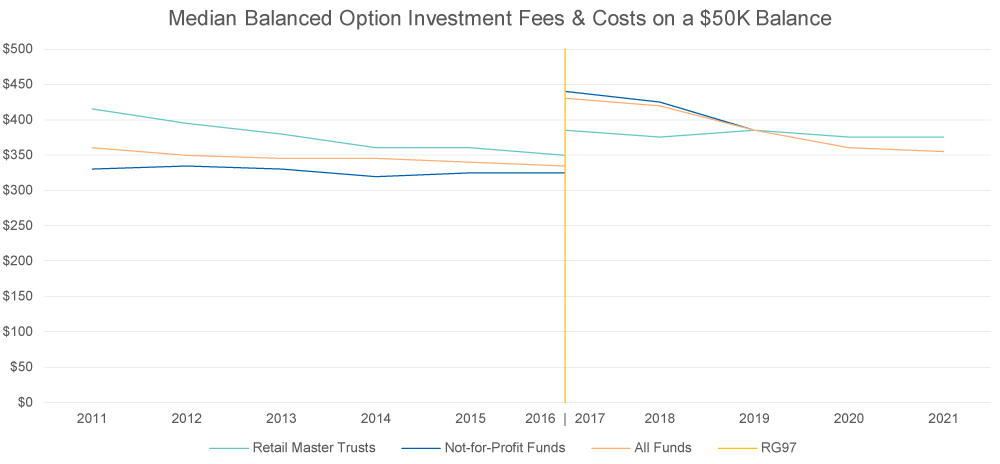

SuperRatings has analysed how investment fees have changed since 2011. The chart below shows the median annual cost for investment based on a member with a $50,000 account balance invested in a balanced (60-76) investment option.

From 2011 to 2016, investment fees declined overall as not-for-profit funds maintained their investment costs and the retail master trust sector steadily reduced their fees. However, in 2017, the new fee disclosure requirements introduced under ASIC’s Regulatory Guide 97 resulted in a reset of funds’ disclosed fees and costs. This resulted in fee positioning by sector flipping, with not-for-profit funds reporting higher investment costs than their retail master trust counterparts. This was driven by greater look-through of costs impacting many unlisted and alternative asset classes. This clearly highlighted the disconnect we often observe between fees and value, with many higher cost providers outperforming over the longer term. After the initial change in disclosures, investment fees again converged until 30 June 2019 when the median investment fee across sectors sat at 0.77%.

However, this fall has been hastened by an increase in the number of funds offering passive investment options aimed specifically at members looking for low-cost investment options, as well as a regulatory landscape strongly focused on fees.

2021 has seen investment fees and costs remain flat. Although final costs including potentially higher performance fees as a result of the strong rebound in equity markets are not likely to be fully disclosed until after the end of the financial year. We may also see greater volatility here in coming years depending on market performance. We also expect further disruption to the accepted level of investment fees, with funds closely monitoring performance tests, as well as the risk that a focus on fees emerges over net benefit delivered to member accounts.

Changes to fee disclosures are ongoing, with revised requirements under RG97 required to be implemented by 30 September 2022. Funds have the option to adopt the new standards from 30 September 2020 and it is pleasing to see some early movement.

Despite ten years of declining investment fees, the change in disclosure requirements in 2017 means a member looking at their statement today would see a very similar investment cost on their 2011 statement. This underlines the challenge and opportunity facing funds as they seek to demonstrate relevance to members.

As funds seek to grow and drive scale, we will continue to monitor the fee outcomes delivered to members. We note the increased regulatory environment and consumer pressures, yet believe funds must ensure a clear focus remains on the value delivered to members’ accounts. While leveraging scale to drive down fees is crucial, lower costs do not always mean better value, with a holistic view on all aspects of member outcomes vital in any assessment of success.

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the merits of the superannuation or pension financial product(s) alone, without taking into account the objectives, financial situation or particular needs (‘financial circumstances’) of any particular person. Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If SuperRatings advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Product Disclosure Statement for each superannuation or pension financial product before making any decision about whether to acquire a financial product. SuperRatings research process relies upon the participation of the superannuation fund or product issuer(s). Should the superannuation fund or product issuer(s) no longer be an active participant in SuperRatings research process, SuperRatings reserves the right to withdraw the rating and document at any time and discontinue future coverage of the superannuation and pension financial product(s).

Copyright © 2021 SuperRatings Pty Ltd (ABN 95 100 192 283 AFSL No. 311880 (SuperRatings)). This media release is subject to the copyright of SuperRatings. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth.), no part of this media release may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of SuperRatings. This media release may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to SuperRatings copyrighted material, applies to such third party content.