Investors have traditionally seen the largest 20 companies in the S&P/ASX 200 Index as the Australian champions that should form the backbone of an investment portfolio.

These names have become a staple for many investors if only because we don’t see a lot of rotation among them, even over relatively long periods of time. These companies have historically been banks, telcos, and even media conglomerates that sat at the centre of Australia’s news and entertainment industry.

In the Australian investing mindset, these companies are associated with industry leadership, proven business models, and high dividends. They are valued for the strength of their market position and the fact that they have been a feature of the corporate landscape for decades. Often, the longer investors hold these shares, the more reluctant they are to sell them.

However, given the market turmoil in the wake of COVID-19, investors are starting to ask themselves if they have become too reliant on these names. With companies forced to cut, delay, and even cancel dividends, the traditional view of blue-chip investing is starting to change.

Today, newcomers like Australian Healthcare giant CSL, major supermarkets in Woolworths and Coles, key Consumer Discretionary player Wesfarmers, and not to mention BHP are playing greater prominence within a balanced portfolio. While the banks still feature heavily, their dominance has dwindled post the GFC as regulation and lower interest rates limit their growth opportunities.

The role of large-cap shares in your portfolio

In Lonsec’s view, there is an important role for large-cap shares within a diversified portfolio. However, focusing too heavily on a handful of large companies and expecting them to do the heavy lifting can result in poor performance and likely will not be serving the investor’s needs and objectives.

The COVID-19 crisis has no doubt exposed a number of investors who believed they could rely on a company’s size and track record without considering their sources of risk or how exposed they were to certain sectors.

Diversification is critical when constructing a portfolio. This means having suitable exposures to different sectors, company sizes, and geographic regions. It also means understanding how your portfolio is positioned to manage various risks and opportunities as they emerge.

Heading into 2020, Lonsec’s portfolios were defensively positioned, with overweight exposures to the Health Care and Consumer Staples sectors. Following changes made in March, we increased our defensive exposure with companies we considered had a higher degree of earnings certainty, strong balance sheets, and a margin of safety that would help withstand the cashflow crunch.

At the other end of spectrum, the outlook for the Financials, Energy, and Consumer Discretionary sectors remains challenging, and Lonsec has remained underweight these sectors. Some companies like JB Hi-Fi and Harvey Norman reported surprisingly strong sales numbers, likely due to a switching of discretionary spend from food and leisure due to families being in ‘lockdown’, as such this is likely to be a short-term spike.

As short-term stimulus measures come to an end, these sectors may come under increasing pressure, and stock selection within these sectors will become critical.

Banking on the banks is not always wise

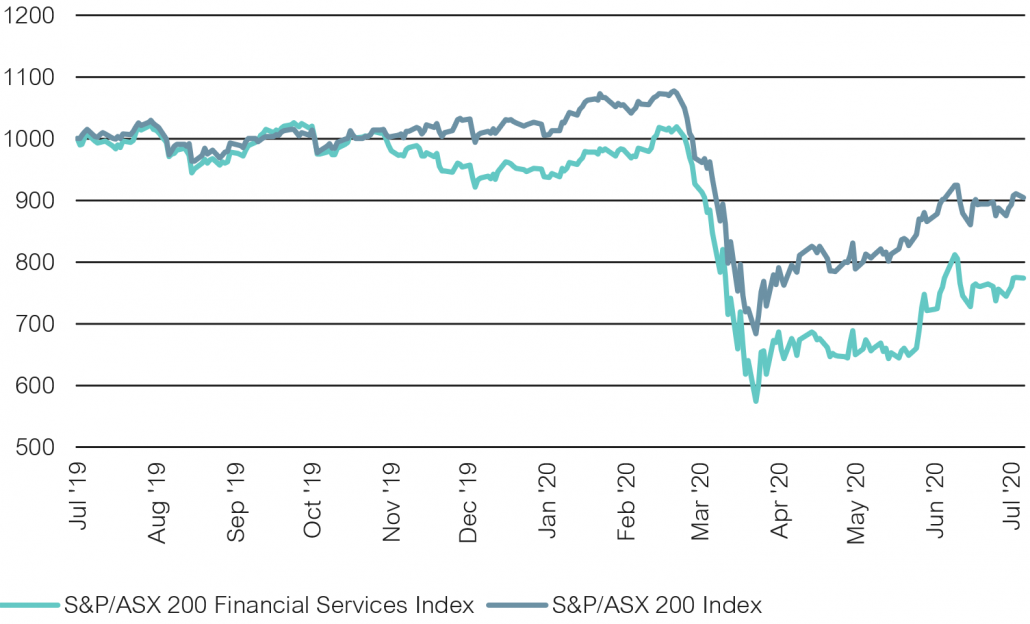

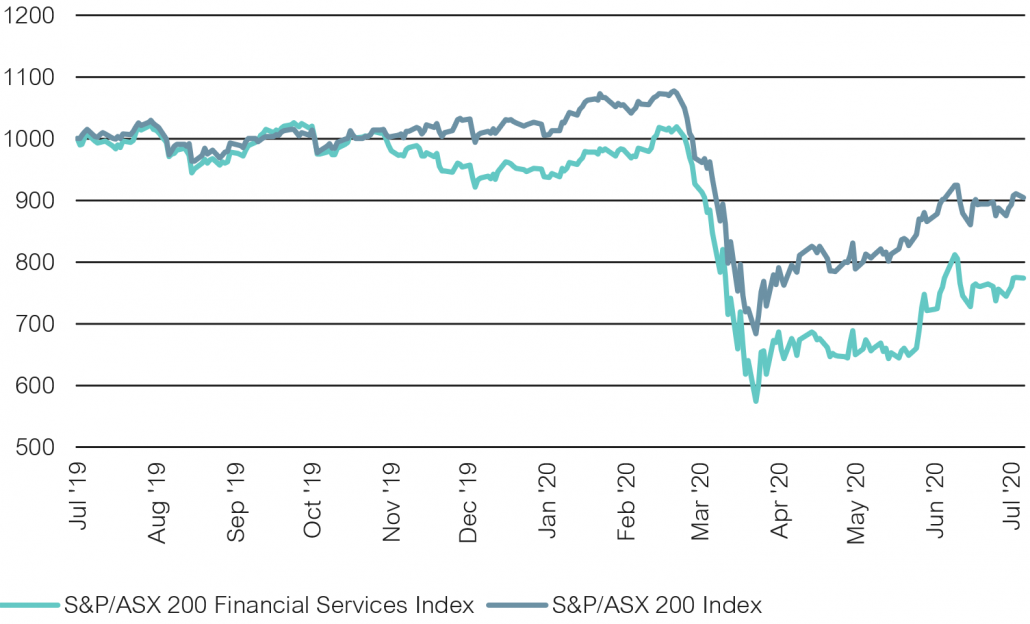

In terms of the banks, it’s very difficult to be positive. The Financials sector fell 20% over the first half of 2020, and while the banks are still generating a return on equity, the days of shareholders enjoying ROEs of around 15% are likely a thing of the past. Regulators have been working with the banks to help absorb the shock, but valuations remain low.

The key headwinds are the ultra-low interest rate environment, which has eaten into lending margins, and whilst mortgage deferrals have the potential to increase bank earnings (by inadvertently increasing their mortgage books), although the risk is that these actually turn into impairments. The banks may need monitor dividends or raise capital should this eventuate.

The financial services sector has underperformed the broader index

Source: Bloomberg

While ANZ and WBC looked to suspend their interim dividends, NAB cut their dividend by more than 50%, but sought to raise $3.5 billion from shareholders, which has been highly dilutive. Given APRA’s written guidance to the banks that they should be limiting discretionary dividend payments, boards are likely to be conservative with payout ratios until there’s further clarity. While the full impact is difficult to gauge at this time, the bottom line is that we should not expect the sort of dividends we have seen in the past, at least for the foreseeable future.

The effects of COVID-19 on the market has prompted investors to reconsider their understanding of blue-chip investing and the strategies that rely heavily on them. For many investors, expanding their horizon has helped put things in perspective. Asian markets are a good example of how dynamic things can be even at the high end of the market cap, which has seen the rise of different blue chips compared to Australia.

Asia certainly is showing strong growth in the tech sector, but the market is also benefiting from the rise of the middle class. When you look at the Financials and Consumer Discretionary sectors there, they have a higher EPS growth trajectory compared to Australia, simply because of those demographic factors that are driving earnings.

Looking further afield can also help investors identify a wider set of opportunities, even during the COVID-19 pandemic. Suddenly we’re working online, and many have been surprised at how seamlessly this happened. This has been facilitated by the rise in a host of digital services, which have allowed consumers and businesses to continue operating even during lockdown.

In Asia, the so-called fourth industrial revolution—new developments in automation, AI, and machine learning—combined with the demographic headwinds, is creating a lot of new growth potential. These could become the new blue-chip shares of the future, if they aren’t already. Alibaba and Baidu are prime examples of this. If Australian investors want to benefit from the growth in these companies, they need to expand their definition of blue-chip.

Including international blue chips in your portfolio is an important way of diversifying your risk and gaining exposure to different sources of growth. There are a range of products that help investors target these sectors, but the key is how these products are used within a broader risk-managed portfolio. Taking an active approach to managing these exposures is also key, especially given market dynamics can change incredibly quickly in the current environment.

Blue-chip shares have served Australians well, but the days of using the likes of BHP or Telstra to form the nucleus of an Australia-centric portfolio are over. If investors want to capture the new growth opportunities in world driven by technological change, while avoiding the potential dividend trap of traditional blue-chip shares, it’s time to start thinking differently.

Issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Warning: Past performance is not a reliable indicator of future performance. Any advice is General Advice without considering the objectives, financial situation and needs of any person. Before making a decision read the PDS and consider your financial circumstances or seek personal advice. Disclaimer: Lonsec gives no warranty of accuracy or completeness of information in this document, which is compiled from information from public and third-party sources. Opinions are reasonably held by Lonsec at compilation. Lonsec assumes no obligation to update this document after publication. Except for liability which can’t be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the document or any information. ©2020 Lonsec. All rights reserved. This report may also contain third party material that is subject to copyright. To the extent that copyright subsists in a third party it remains with the original owner and permission may be required to reuse the material. Any unauthorised reproduction of this information is prohibited.