Leading superannuation research house SuperRatings estimates that the median balanced option generated a return of 2.6% in November, maintaining the momentum from October.

While inflation remains elevated, some improvement in equity market sentiment helped funds to regain some of the losses from the beginning of the financial year. Uncertainty remains however, as people prepare for the Christmas purchasing season, and members should expect to continue to see their super balances bouncing up and down over the coming months.

The median growth option increased by an estimated 3.2% in November, while the median capital stable option which has less exposure to share markets delivered a smaller positive result, with a rise of 1.6%.

Accumulation returns to November 2022

| Monthly | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SR50 Balanced (60-76) Index | 2.6% | -1.3% | 4.6% | 5.9% | 6.7% | 8.0% |

| SR50 Capital Stable (20-40) Index | 1.6% | -1.4% | 2.1% | 3.2% | 3.9% | 4.7% |

| SR50 Growth (77-90) Index | 3.2% | -1.4% | 5.5% | 6.8% | 7.7% | 9.3% |

Source: SuperRatings estimates

Pension returns also rose in November, with the median balanced pension option up an estimated 3.0%. While an increase of 3.4% was estimated for the median growth option and 1.8% for the median capital stable pension option.

Pension returns to November 2022

| Monthly | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SRP50 Balanced (60-76) Index | 3.0% | -1.8% | 5.0% | 6.5% | 7.3% | 8.8% |

| SRP50 Capital Stable (20-40) Index | 1.8% | -1.5% | 2.3% | 3.4% | 4.2% | 5.1% |

| SRP50 Growth (77-90) Index | 3.4% | -2.1% | 5.9% | 7.6% | 8.5% | 10.1% |

Source: SuperRatings estimates

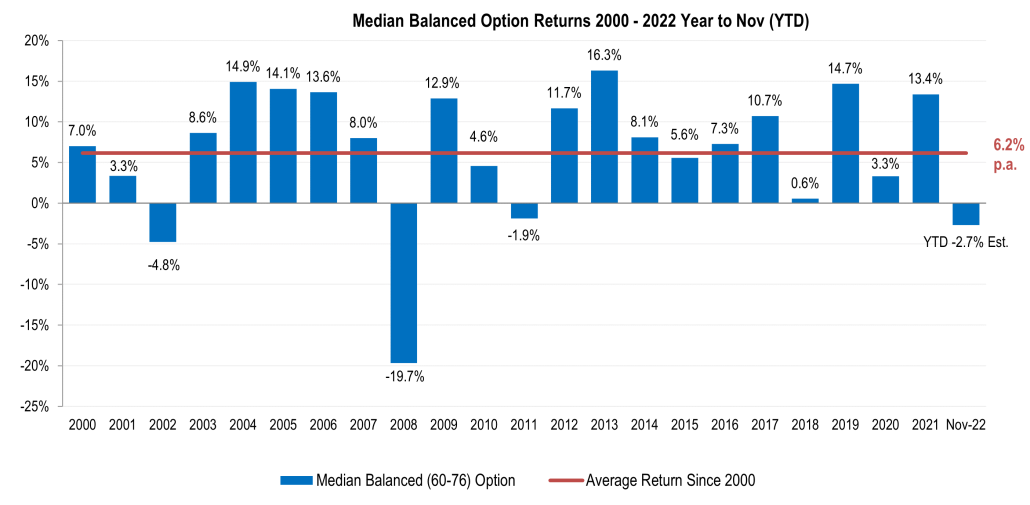

“Funds have faced a tough calendar year, though performance has improved over the last couple of months. If we see a small negative return or even a flat return for the typical balanced option for 2022, depending on how December plays out, this would be a better outcome than anticipated a couple of months ago”, commented Executive Director of SuperRatings, Kirby Rappell.

Despite the difficult calendar year to date, superannuation remains a well performing investment over the long term, with an average 6.2% p.a. return since 2000. Mr Rappell commented, “While we expect to see continued ups and downs over the coming year, the recent recovery is good news for members who focused on the long term and stuck to their investment strategy. As the end of the year approaches, we encourage members to review their superannuation with a focus on their long-term risk tolerance to ensure their super is set up for the year ahead. There are a variety of tools to help determine the level of ups and downs you’re comfortable with, as well as the ability to call your fund or adviser for support. Hopefully, this will allow people to better cope with the bumps along the way, as we see super providing improved outcomes for people in retirement over time.”

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au