Super Funds

Your trusted partner for superannuation data, insights and innovation

SuperRatings is Australia’s longest established superannuation research firm, specialising in delivering unparalleled research, ratings, and insights to the superannuation industry. Our mission is to provide super funds with the tools and intelligence they need to build value for their members and achieve their strategic goals, bridging the information gap between super funds and their members.

Our Research Advantage

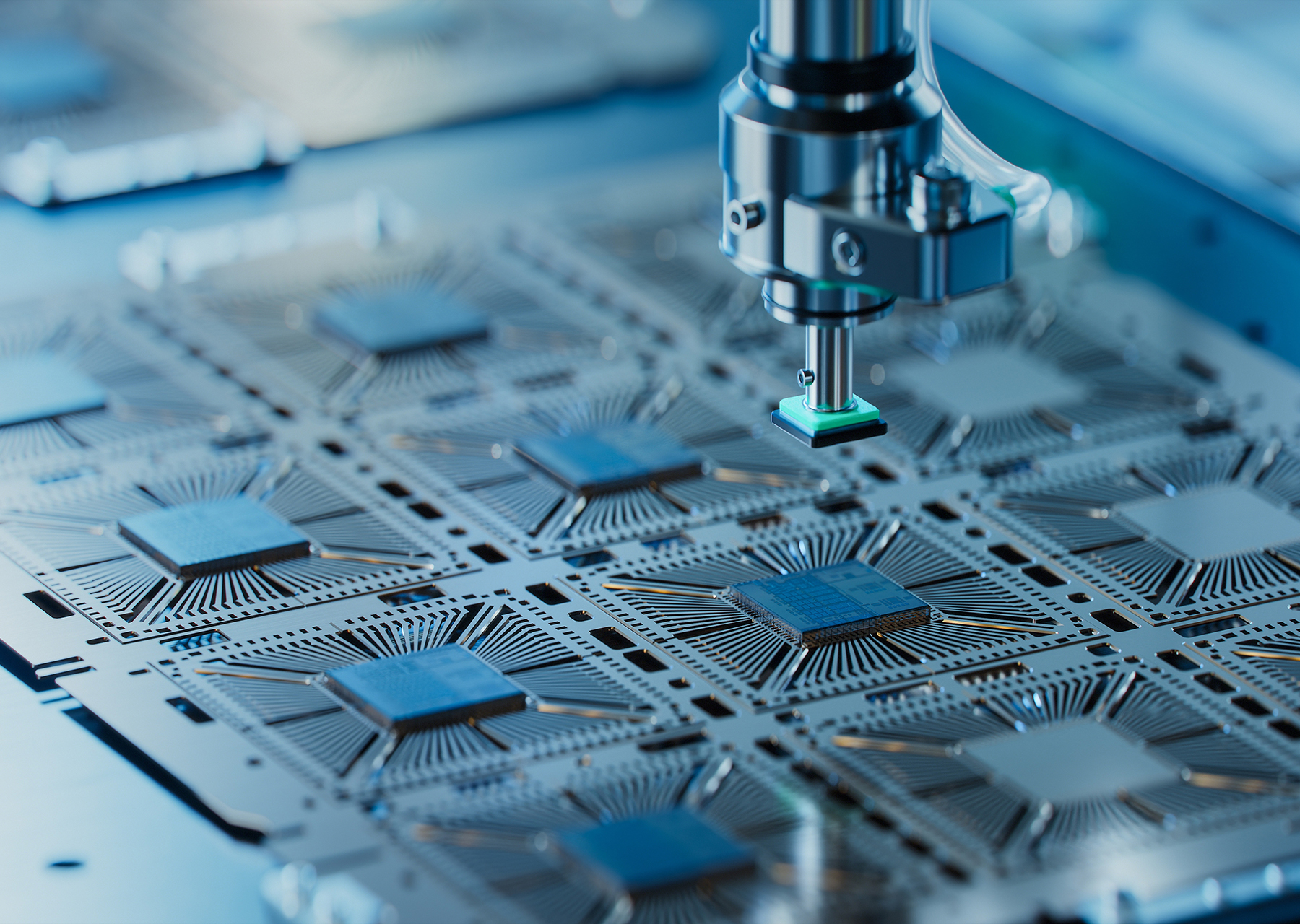

Comprehensive Data

Gain access to some of the most detailed superannuation product data available.

Market Comparison

Compare aspects of your fund’s offering as appropriate against the wider market to identify strengths and opportunities.

Member Engagement Tools

Utilise dynamic tools to demonstrate your super product’s advantages and engage your members effectively.

Discover how SuperRatings can empower your superannuation strategy with cutting-edge research and insights. Join us in shaping a more informed and efficient superannuation industry.

Let us know which solution you’re looking for:

I want to understand how my fund sits against the industry

I want to showcase my fund’s ratings and awards logos

I want to unlock value for my members through innovation and insights

I want financial advisers to recommend my fund with confidence

I want to understand how my fund sits against the industry

SuperRatings offers unparalleled research, ratings, data, tools and insights, providing the superannuation industry with the tools and intelligence required to build value for their members and reach their strategic goals.

Our mission is to close the information divide between super funds and their members and create a stronger superannuation industry that benefits all Australians.

I want to showcase my fund’s ratings and awards logos

SuperRatings’ ratings and awards logos provide crucial unbiased third-party validation of your fund’s capabilities to members and prospective members.

To maximise the impact of these accolades, clients also obtain a ratings and awards marketing guide to effectively leverage the logos. Consider utilising the logos throughout various marketing mediums such as your website and other multi-channel advertisements to increase awareness and engagement.

I want to unlock value for my members through innovation and market insights

We help clients understand what drives their value, which areas offer the best growth potential and how financial product offerings can be optimised across different segments. With superior analysis, supported by a vast array of industry data, we are well placed to help funds and employers navigate the complexities of our industry. Our market views are regularly sought by funds, service providers, key industry stakeholders and employers.

I want financial advisers to recommend my fund with confidence

In a compliance-heavy environment, financial advisers must justify their investment recommendations and demonstrate their best interest duty when providing investment advice. By having your investment options rated by Lonsec, you provide advisers with the essential tools to fully understand your investment process, match your products to their clients’ needs, and fulfill their best interest duty.

AdviserConnect streamlines engagement between super funds and advisers, fostering transparency and certainty in member outcomes. Integrated into Lonsec’s iRate® portal, it facilitates efficient collaboration and information sharing. This integration simplifies adviser challenges, providing valuable insights into fund offerings and exceptional services, essential for meeting best interest duties and recommending super funds confidently.

Latest News

Get in touch with us

Lonsec Sydney Level 39, 25 Martin Place, Sydney NSW 2000

Lonsec Melbourne Level 33, 120 Collins Street, Melbourne VIC 3000

Lonsec Adelaide Suite 3, Level 2, 12 Pirie Street, Adelaide SA 5000

Important information: Any express or implied rating or advice is limited to general advice, it doesn’t consider any personal needs, goals or objectives. Before making any decision about financial products, consider whether it is personally appropriate for you in light of your personal circumstances. Our business model is not structured to support direct clients who do not have a relationship with a financial adviser. We recommend you obtain and consider the Product Disclosure Statement for each financial product and seek professional personal advice before making any decisions regarding a financial product.

Copyright © 2024 Lonsec Group | Important Documents